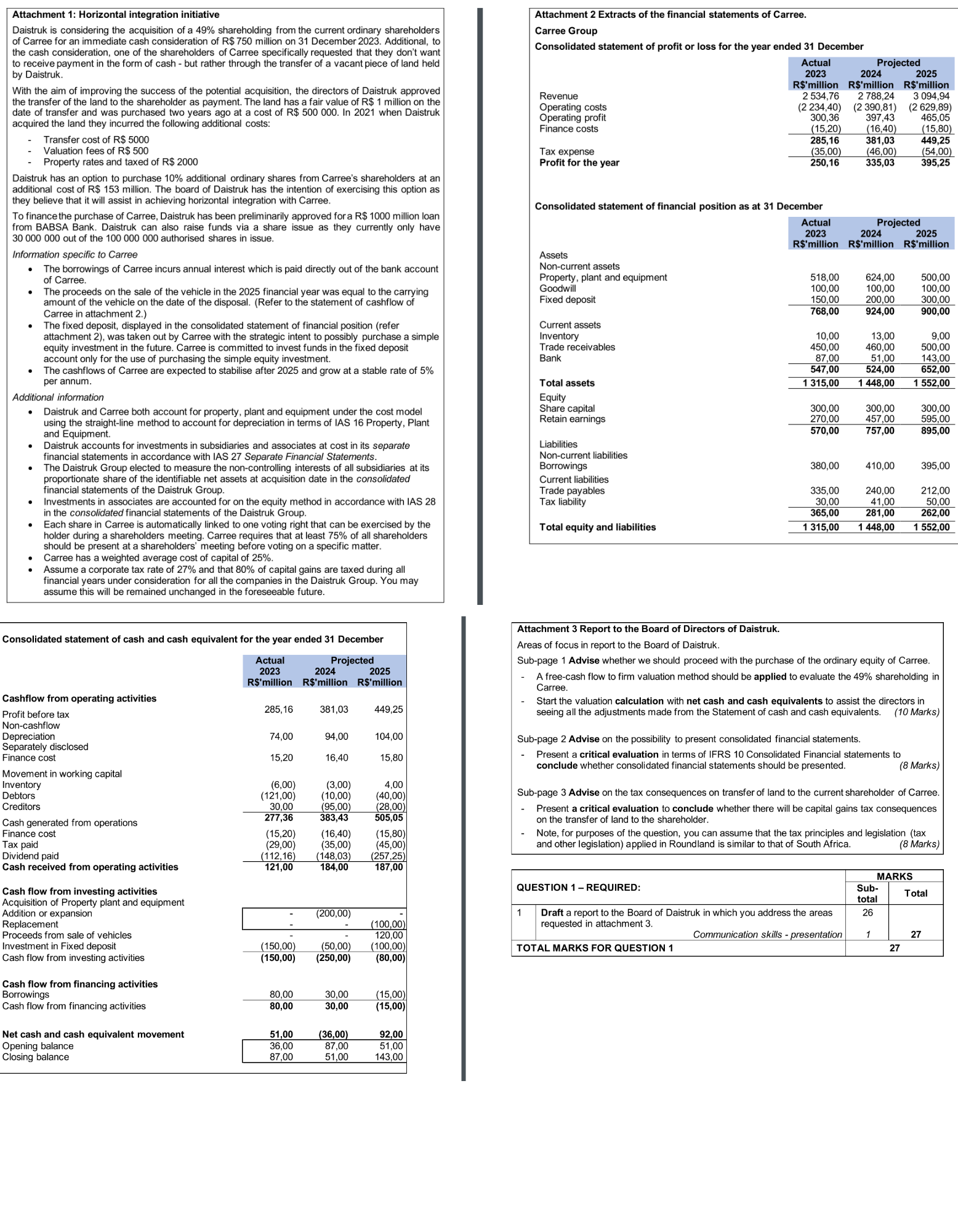

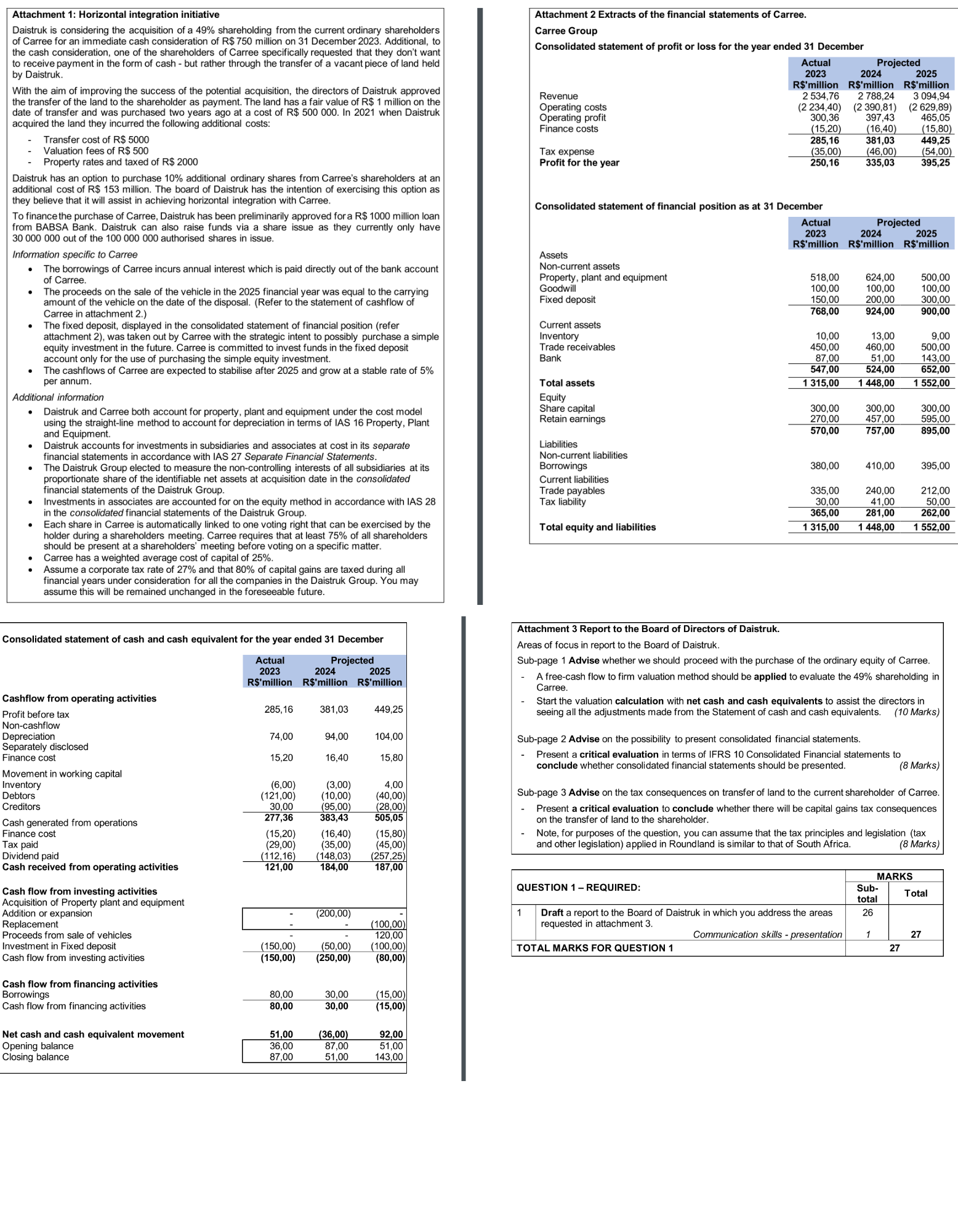

Attachment 1: Horizontal integration initiative Daistruk is considering the acquisition of a 49% shareholding from the current ordinary shareholders of Carree for an immediate cash consideration of R$750 million on 31 December 2023. Additional, to the cash consideration, one of the shareholders of Carree specifically requested that they don't want to receive payment in the form of cash - but rather through the transfer of a vacant piece of land held by Daistruk. With the aim of improving the success of the potential acquisition, the directors of Daistruk approved the transfer of the land to the shareholder as payment. The land has a fair value of R$1 million on the date of transfer and was purchased two years ago at a cost of R$500000. In 2021 when Daistruk acquired the land they incurred the following additional costs: - Transfer cost of R$5000 - Valuation fees of R$500 - Property rates and taxed of R$2000 Daistruk has an option to purchase 10% additional ordinary shares from Carree's shareholders at an additional cost of R$153 million. The board of Daistruk has the intention of exercising this option as they believe that it will assist in achieving horizontal integration with Carree. To finance the purchase of Carree, Daistruk has been preliminarily approved for a R$1000 million loan from BABSA Bank. Daistruk can also raise funds via a share issue as they currently only have 30000000 out of the 100000000 authorised shares in issue. Information specific to Carree - The borrowings of Carree incurs annual interest which is paid directly out of the bank account of Carree. - The proceeds on the sale of the vehicle in the 2025 financial year was equal to the carrying amount of the vehicle on the date of the disposal. (Refer to the statement of cashflow of Carree in attachment 2.) - The fixed deposit, displayed in the consolidated statement of financial position (refer attachment 2), was taken out by Carree with the strategic intent to possibly purchase a simple equity investment in the future. Carree is committed to invest funds in the fixed deposit account only for the use of purchasing the simple equity investment. - The cashflows of Carree are expected to stabilise after 2025 and grow at a stable rate of 5% per annum. Additional information - Daistruk and Carree both account for property, plant and equipment under the cost model using the straight-line method to account for depreciation in terms of IAS 16 Property, Plant and Equipment. - Daistruk accounts for investments in subsidiaries and associates at cost in its separate financial statements in accordance with IAS 27 Separate Financial Statements. - The Daistruk Group elected to measure the non-controlling interests of all subsidiaries at its proportionate share of the identifiable net assets at acquisition date in the consolidated financial statements of the Daistruk Group. - Investments in associates are accounted for on the equity method in accordance with IAS 28 in the consolidated financial statements of the Daistruk Group. - Each share in Carree is automatically linked to one voting right that can be exercised by the holder during a shareholders meeting. Carree requires that at least 75% of all shareholders should be present at a shareholders' meeting before voting on a specific matter. - Carree has a weighted average cost of capital of 25%. - Assume a corporate tax rate of 27% and that 80% of capital gains are taxed during all financial years under consideration for all the companies in the Daistruk Group. You may assume this will be remained unchanged in the foreseeable future. Attachment 2 Extracts of the financial statements of Carree. Carree Group Consolidated statement of profit or loss for the year ended 31 December Revenue Operating costs Operating profit Finance costs Tax expense Profit for the year Attachment 3 Report to the Board of Directors of Daistruk. Areas of focus in report to the Board of Daistruk. Sub-page 1 Advise whether we should proceed with the purchase of the ordinary equity of Carree. - A free-cash flow to firm valuation method should be applied to evaluate the 49% shareholding in Carree. - Start the valuation calculation with net cash and cash equivalents to assist the directors in seeing all the adjustments made from the Statement of cash and cash equivalents. (10 Marks) Sub-page 2 Advise on the possibility to present consolidated financial statements. - Present a critical evaluation in terms of IFRS 10 Consolidated Financial statements to conclude whether consolidated financial statements should be presented. (8 Marks) Sub-page 3 Advise on the tax consequences on transfer of land to the current shareholder of Carree. - Present a critical evaluation to conclude whether there will be capital gains tax consequences on the transfer of land to the shareholder. - Note, for purposes of the question, you can assume that the tax principles and legislation (tax and other legislation) applied in Roundland is similar to that of South Africa. (8 Marks)