Answered step by step

Verified Expert Solution

Question

1 Approved Answer

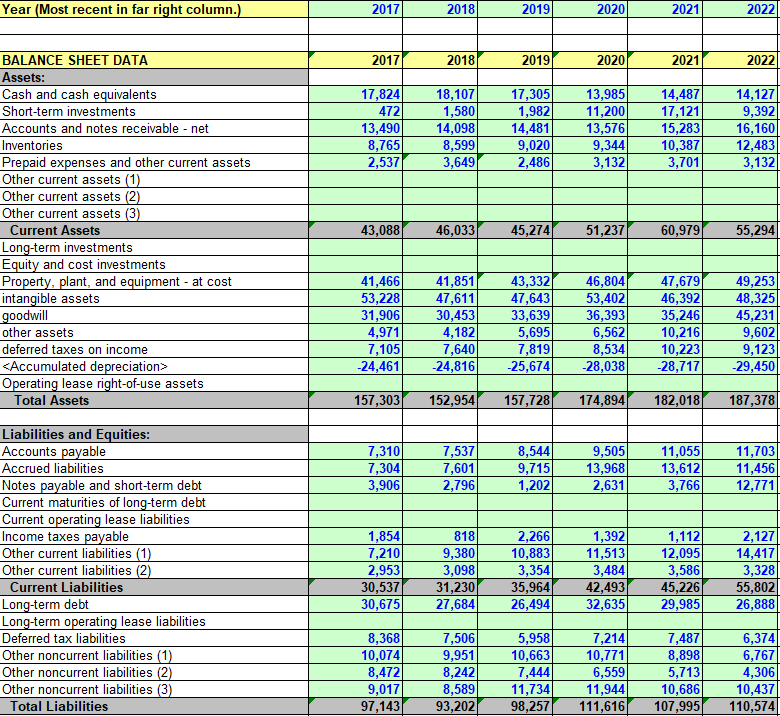

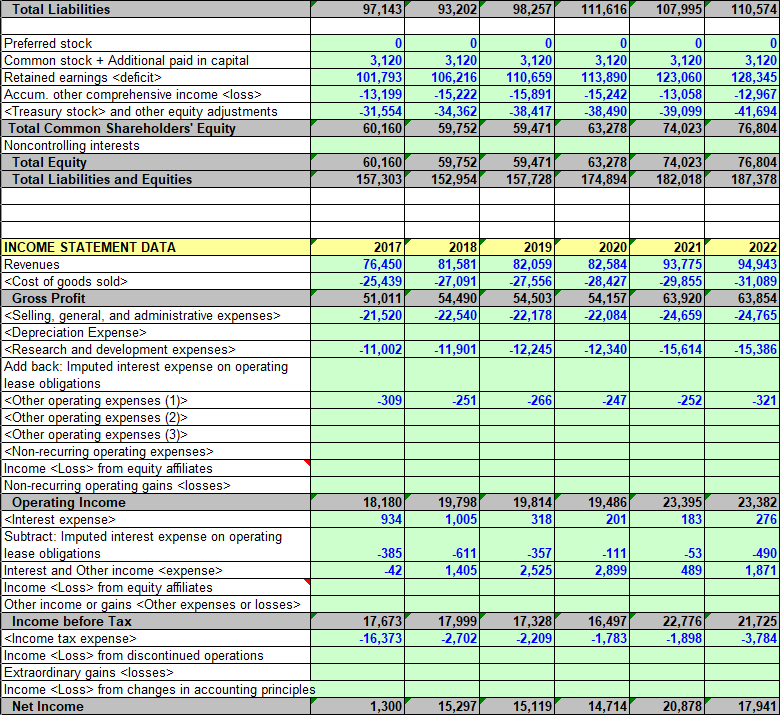

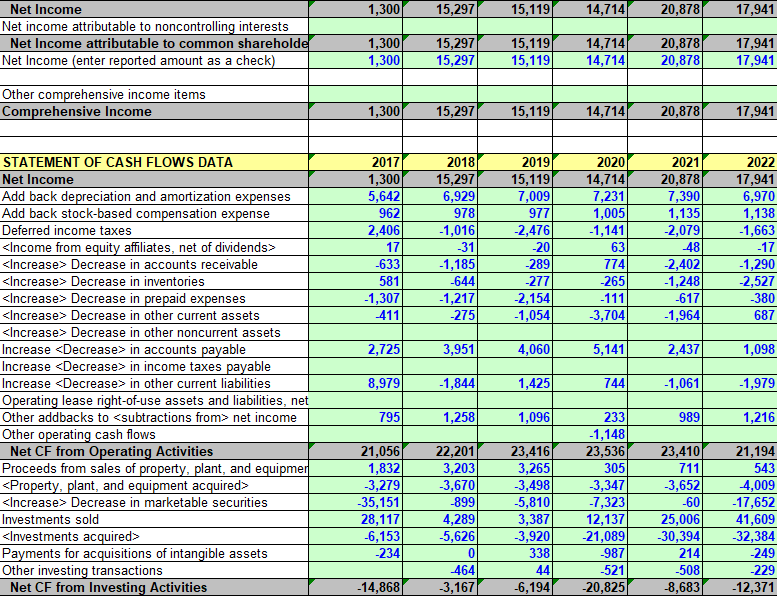

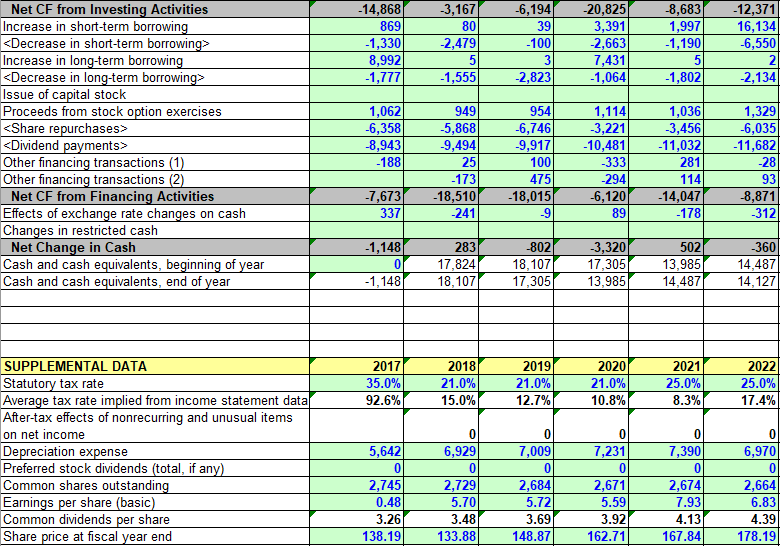

Attatched is financial information, and I just need some risk ratios for the years 2020, 2021, and 2022 computed, with the formulas preferably so I

Attatched is financial information, and I just need some risk ratios for the years 2020, 2021, and 2022 computed, with the formulas preferably so I can understand how do do it, as well as an interpretation.

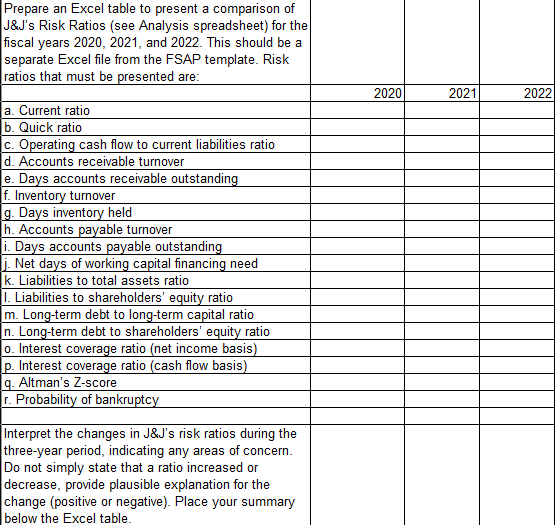

Prepare an Excel table to present a comparison of J\&J's Risk Ratios (see Analysis spreadsheet) for the fiscal years 2020, 2021, and 2022. This should be a separate Excel file from the FSAP template. Risk ratios that must be presented are: a. Current ratio b. Quick ratio c. Operating cash flow to current liabilities ratio d. Accounts receivable turnover e. Days accounts receivable outstanding f. Inventory turnover g. Days inventory held h. Accounts payable turnover i. Days accounts payable outstanding j. Net days of working capital financing need k. Liabilities to total assets ratio I. Liabilities to shareholders' equity ratio m. Long-term debt to long-term capital ratio n. Long-term debt to shareholders' equity ratio o. Interest coverage ratio (net income basis) p. Interest coverage ratio (cash flow basis) q. Altman's Z-score r. Probability of bankruptcy Interpret the changes in J\&J's risk ratios during the three-year period, indicating any areas of concern. Do not simply state that a ratio increased or decrease, provide plausible explanation for the change (positive or negative). Place your summary below the Excel table. Prepare an Excel table to present a comparison of J\&J's Risk Ratios (see Analysis spreadsheet) for the fiscal years 2020, 2021, and 2022. This should be a separate Excel file from the FSAP template. Risk ratios that must be presented are: a. Current ratio b. Quick ratio c. Operating cash flow to current liabilities ratio d. Accounts receivable turnover e. Days accounts receivable outstanding f. Inventory turnover g. Days inventory held h. Accounts payable turnover i. Days accounts payable outstanding j. Net days of working capital financing need k. Liabilities to total assets ratio I. Liabilities to shareholders' equity ratio m. Long-term debt to long-term capital ratio n. Long-term debt to shareholders' equity ratio o. Interest coverage ratio (net income basis) p. Interest coverage ratio (cash flow basis) q. Altman's Z-score r. Probability of bankruptcy Interpret the changes in J\&J's risk ratios during the three-year period, indicating any areas of concern. Do not simply state that a ratio increased or decrease, provide plausible explanation for the change (positive or negative). Place your summary below the Excel table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started