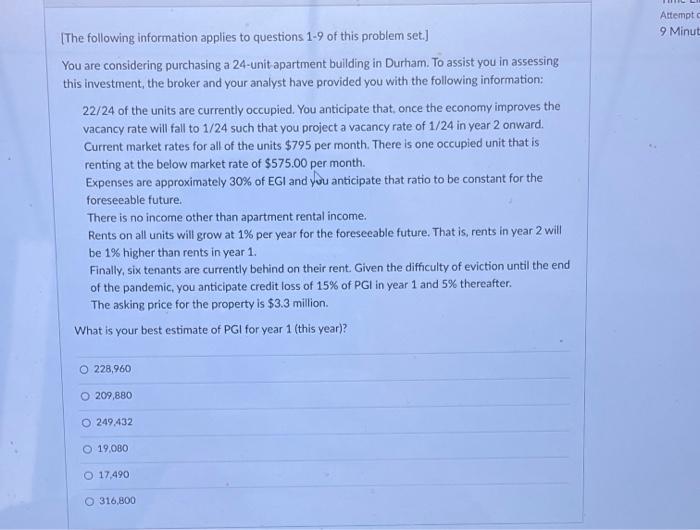

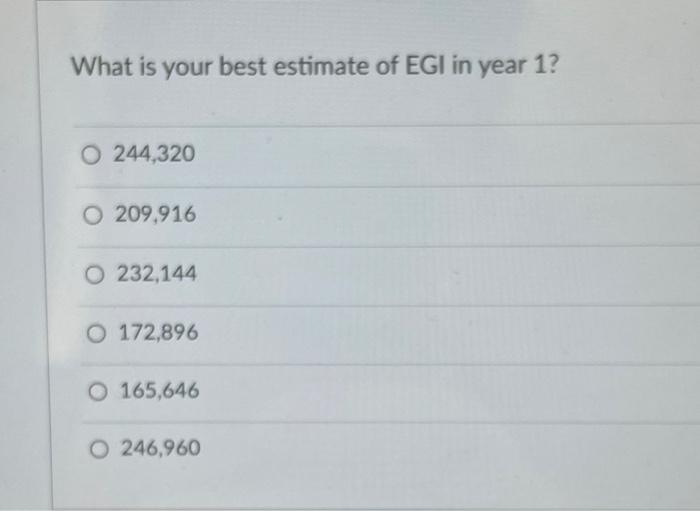

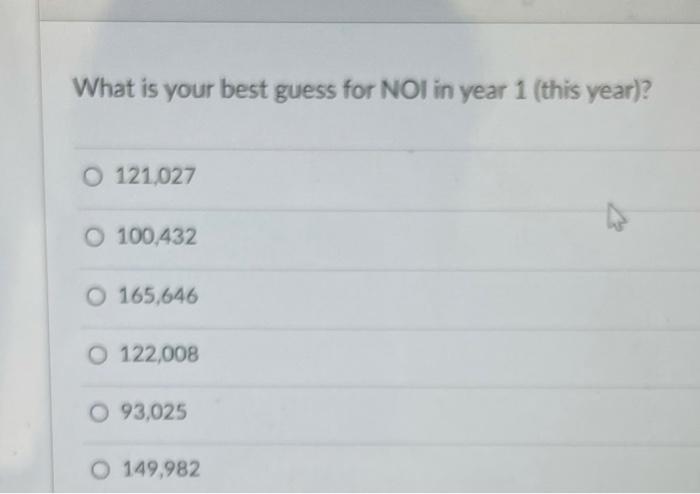

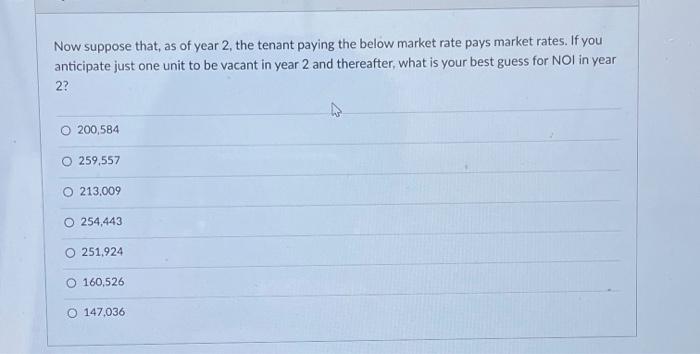

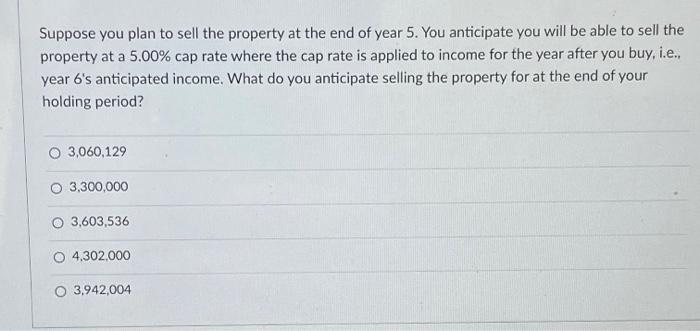

Attempt 9 Minut The following information applies to questions 1-9 of this problem set.] You are considering purchasing a 24-unit apartment building in Durham. To assist you in assessing this investment, the broker and your analyst have provided you with the following information: 22/24 of the units are currently occupied. You anticipate that once the economy improves the vacancy rate will fall to 1/24 such that you project a vacancy rate of 1/24 in year 2 onward. Current market rates for all of the units $795 per month. There is one occupied unit that is renting at the below market rate of $575.00 per month. Expenses are approximately 30% of EGI and you anticipate that ratio to be constant for the foreseeable future There is no income other than apartment rental income. Rents on all units will grow at 1% per year for the foreseeable future. That is,rents in year 2 will be 1% higher than rents in year 1. Finally, six tenants are currently behind on their rent. Given the difficulty of eviction until the end of the pandemic, you anticipate credit loss of 15% of PGI in year 1 and 5% thereafter. The asking price for the property is $3.3 million. What is your best estimate of PGI for year 1 (this year)? O 228,960 209,880 249.432 O 19.080 O 17.490 O 316,800 What is your best estimate of EGI in year 1? 0 244,320 O 209,916 O 232,144 O 172,896 O 165,646 O 246,960 What is your best guess for NOI in year 1 (this year)? O 121,027 100.432 O 165,646 0 122,008 093,025 O 149,982 Now suppose that, as of year 2, the tenant paying the below market rate pays market rates. If you anticipate just one unit to be vacant in year 2 and thereafter, what is your best guess for NOI in year 2? O 200,584 O 259,557 213,009 O 254,443 0 251.924 O 160,526 O 147.036 Suppose you plan to sell the property at the end of year 5. You anticipate you will be able to sell the property at a 5.00% cap rate where the cap rate is applied to income for the year after you buy, i.e.. year 6's anticipated income. What do you anticipate selling the property for at the end of your holding period? O 3,060,129 3,300,000 O 3,603,536 0 4,302,000 O 3,942,004