attempt this question only when you can solve all parts

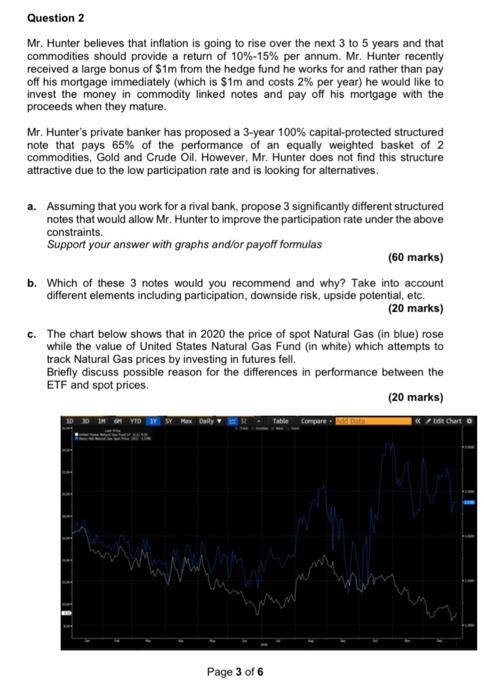

Question 2 Mr. Hunter believes that inflation is going to rise over the next 3 to 5 years and that commodities should provide a return of 10%-15% per annum. Mr. Hunter recently received a large bonus of $1m from the hedge fund he works for and rather than pay off his mortgage immediately (which is $1m and costs 2% per year) he would like to invest the money in commodity linked notes and pay off his mortgage with the proceeds when they mature. Mr. Hunter's private banker has proposed a 3-year 100% capital-protected structured note that pays 65% of the performance of an equally weighted basket of 2 commodities, Gold and Crude Oil. However, Mr. Hunter does not find this structure attractive due to the low participation rate and is looking for alternatives. a. Assuming that you work for a rival bank, propose 3 significantly different structured notes that would allow Mr. Hunter to improve the participation rate under the above constraints. Support your answer with graphs and/or payoff formulas (60 marks) b. Which of these 3 notes would you recommend and why? Take into account different elements including participation, downside risk, upside potential, etc. (20 marks) C. The chart below shows that in 2020 the price of spot Natural Gas (in blue) rose while the value of United States Natural Gas Fund (in white) which attempts to track Natural Gas prices by investing in futures fell Briefly discuss possible reason for the differences in performance between the ETF and spot prices (20 marks) Compare ide Chart Page 3 of 6 Question 2 Mr. Hunter believes that inflation is going to rise over the next 3 to 5 years and that commodities should provide a return of 10%-15% per annum. Mr. Hunter recently received a large bonus of $1m from the hedge fund he works for and rather than pay off his mortgage immediately (which is $1m and costs 2% per year) he would like to invest the money in commodity linked notes and pay off his mortgage with the proceeds when they mature. Mr. Hunter's private banker has proposed a 3-year 100% capital-protected structured note that pays 65% of the performance of an equally weighted basket of 2 commodities, Gold and Crude Oil. However, Mr. Hunter does not find this structure attractive due to the low participation rate and is looking for alternatives. a. Assuming that you work for a rival bank, propose 3 significantly different structured notes that would allow Mr. Hunter to improve the participation rate under the above constraints. Support your answer with graphs and/or payoff formulas (60 marks) b. Which of these 3 notes would you recommend and why? Take into account different elements including participation, downside risk, upside potential, etc. (20 marks) C. The chart below shows that in 2020 the price of spot Natural Gas (in blue) rose while the value of United States Natural Gas Fund (in white) which attempts to track Natural Gas prices by investing in futures fell Briefly discuss possible reason for the differences in performance between the ETF and spot prices (20 marks) Compare ide Chart Page 3 of 6