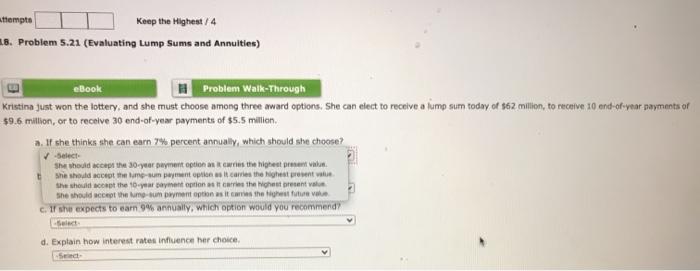

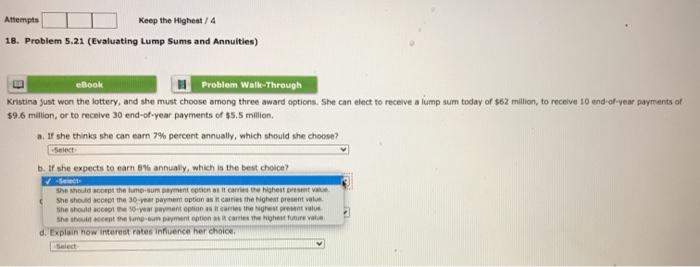

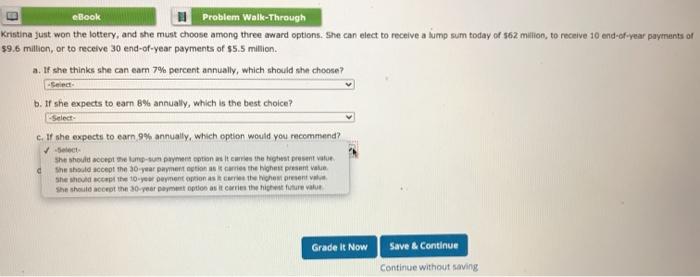

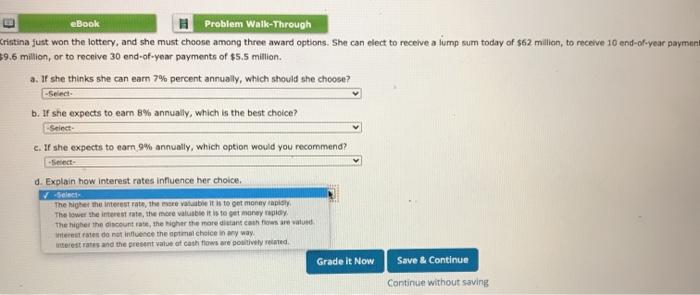

attempto Keep the Highest/4 3.8. Problem 5.21 (Evaluating Lump Sums and Annulties) eBook Problem Walk-Through Kristina just won the lottery, and she must choose among three award options. She can elect to receive a lump sum today of 862 million, to receive 10 end-of-year payments of $9.6 million, or to receive 30 end-of-year payments of $5.5 million a. It she thinks she can earn 7% percent annually, which should she choose? Select She should accept the 30-year payment options are the highest She should themesum payment options carries the highest presente She should at the tear payment options to the present She should accept the m-sum Dayment option as it was the highest future C. If she expects to earn 9% annually, which option would you recommend? d. Explain how interest rates influence her choice Attempts Keep the Highest/4 18. Problem 5.21 (Evaluating Lump Sums and Annuities) eBook Problem Walk-Through Kristina just won the lottery, and she must choose among three award options. She can elect to receive a lump sum today of $62 million, to receive 10 end-of-year payments of $9.6 million, or to receive 30 end-of-year payments of $5.5 milion. a. If she thinks she can earn 7% perennt annually, which should she choose? Select b. If she expect to earn by annually, which is the best cholen? Set the tumours Bayment on as I came highest She should the 30-year pant option as it carries the highest present valus She shoulder mentors came the destprent value She shetheme payment option carries the highest une vale d. Explain how interest rates influence her choice eBook Problem Walk-Through Kristina just won the lottery, and she must choose among three award options. She can elect to receive a lump sum today of 562 million, to receive 10 end-of-year payments or $9,6 million, or to receive 30 end-of-year payments of $5.5 million. a. If she thinks she can earn 7% percent annually, which should she choose? b. If she expects to earn 8% annually, which is the best choice? Select c. If she expects to earn 9% annually, which option would you recommand? She should come up son premio sit ames the highest presente d She should accept the 30-year payment in carries the highest present She shoe to your en options are the present She short the 30-year payment option as it carries the higher value Grade it Now Save & Continue Continue without saving eBook Problem Walk-Through Cristina just won the lottery, and she must choose among three award options. She can clect to receive a lump sum today of $62 million, to receive 10 end-of-year paymeni 19.6 million, or to receive 30 end-of-year payments of $5.5 million. a. If she thinks she can earn 7% percent annually, which should she choose? b. If she expects to earn 8% annually, which is the best choice? Select c. If she expects to earn 9% annually, which option would you recommend? . Explain how interest rates influence her choice. Select- The Night me interest rate, the more valuable it is to get money fairy The lower the interest rate, the more valuable it is to get money play The higher the discount rate, the higher the more distant chwarele trotes do not influence the spinal choice in any way. interest rates and the present value of cash flows are positively related Grade it Now Save & Continue Continue without saving