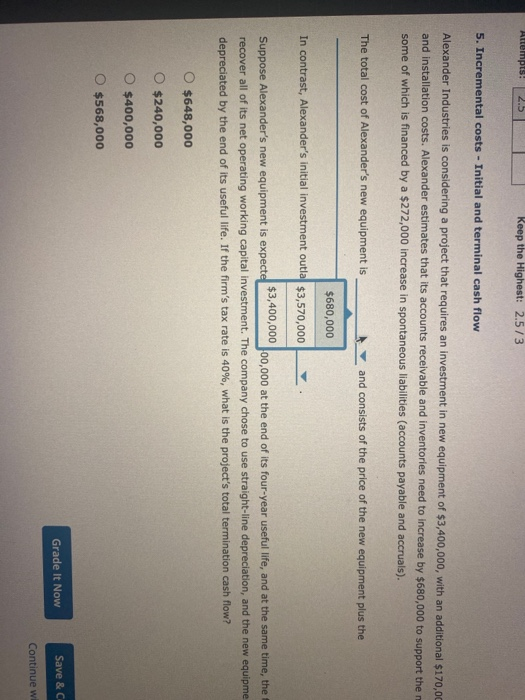

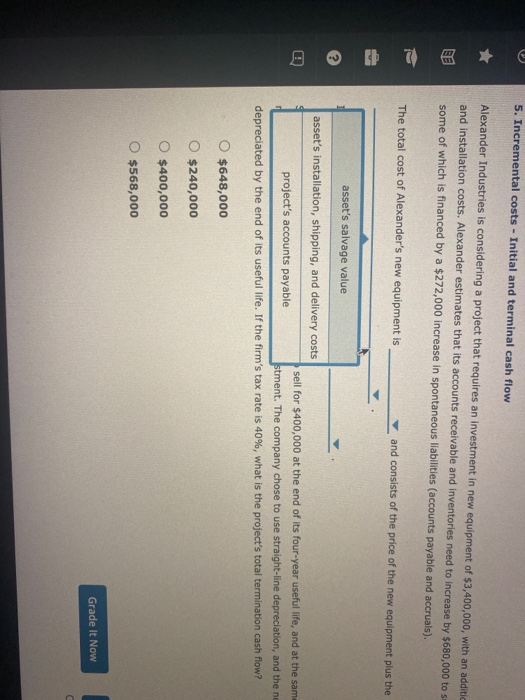

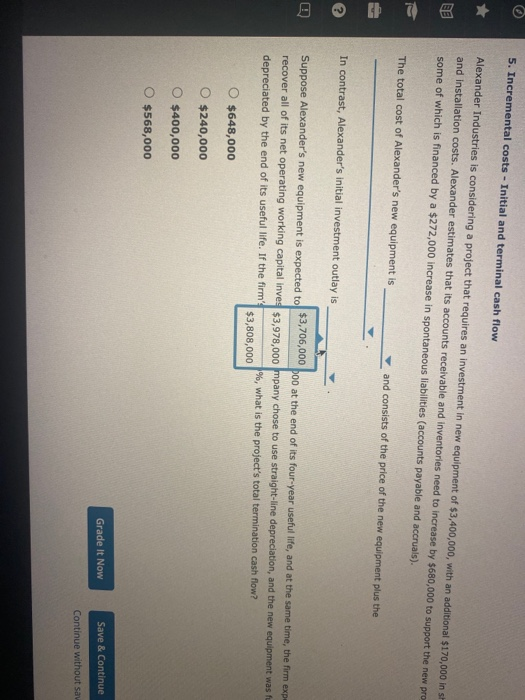

Attempts: 25 Keep the Highest: 2.5/3 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in shipping and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the In contrast, Alexander's initial investment outlay is Suppose Alexander's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital investment. The company chose to use straight-line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 O $240,000 O $400,000 O $568,000 Grade It Now Save & Continue Continue without saving Attempts! 2.5 Keep the Highest: 2.5/3 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,00 and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the $680,000 In contrast, Alexander's initial investment outla $3,570,000 Suppose Alexander's new equipment is expecte $3,400,000 400,000 at the end of its four-year useful life, and at the same time, the recover all of its net operating working capital investment. The company chose to use straight-line depreciation, and the new equipme depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 $240,000 O $400,000 O $568,000 Grade It Now Save & C Continue w 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additi and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to s some of which is financed by a $272,000 increase spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the asset's salvage value asset's installation, shipping, and delivery costs sell for $400,000 at the end of its four-year useful life, and at the same project's accounts payable stment. The company chose to use straight-line depreciation, and the ne depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 O $240,000 O $400,000 O $568,000 Grade It Now 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in st and Installation costs. Alexander estimates that its accounts receivable and Inventories need to increase by $680,000 to support the new pro some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the In contrast, Alexander's initial investment outlay is Suppose Alexander's new equipment is expected to $3,706,000 poo at the end of its four-year useful life, and at the same time, the firm expe recover all of its net operating working capital inves $3,978,000 mpany chose to use straight-line depreciation, and the new equipment was fu depreciated by the end of its useful life. If the firm' %, what is the project's total termination cash flow? $3,808,000 $648,000 $240,000 $400,000 $568,000 Grade It Now Save & Continue Continue without sav. Attempts: 25 Keep the Highest: 2.5/3 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in shipping and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the In contrast, Alexander's initial investment outlay is Suppose Alexander's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital investment. The company chose to use straight-line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 O $240,000 O $400,000 O $568,000 Grade It Now Save & Continue Continue without saving Attempts! 2.5 Keep the Highest: 2.5/3 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,00 and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the $680,000 In contrast, Alexander's initial investment outla $3,570,000 Suppose Alexander's new equipment is expecte $3,400,000 400,000 at the end of its four-year useful life, and at the same time, the recover all of its net operating working capital investment. The company chose to use straight-line depreciation, and the new equipme depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 $240,000 O $400,000 O $568,000 Grade It Now Save & C Continue w 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additi and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to s some of which is financed by a $272,000 increase spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the asset's salvage value asset's installation, shipping, and delivery costs sell for $400,000 at the end of its four-year useful life, and at the same project's accounts payable stment. The company chose to use straight-line depreciation, and the ne depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? O $648,000 O $240,000 O $400,000 O $568,000 Grade It Now 5. Incremental costs - Initial and terminal cash flow Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in st and Installation costs. Alexander estimates that its accounts receivable and Inventories need to increase by $680,000 to support the new pro some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Alexander's new equipment is and consists of the price of the new equipment plus the In contrast, Alexander's initial investment outlay is Suppose Alexander's new equipment is expected to $3,706,000 poo at the end of its four-year useful life, and at the same time, the firm expe recover all of its net operating working capital inves $3,978,000 mpany chose to use straight-line depreciation, and the new equipment was fu depreciated by the end of its useful life. If the firm' %, what is the project's total termination cash flow? $3,808,000 $648,000 $240,000 $400,000 $568,000 Grade It Now Save & Continue Continue without sav