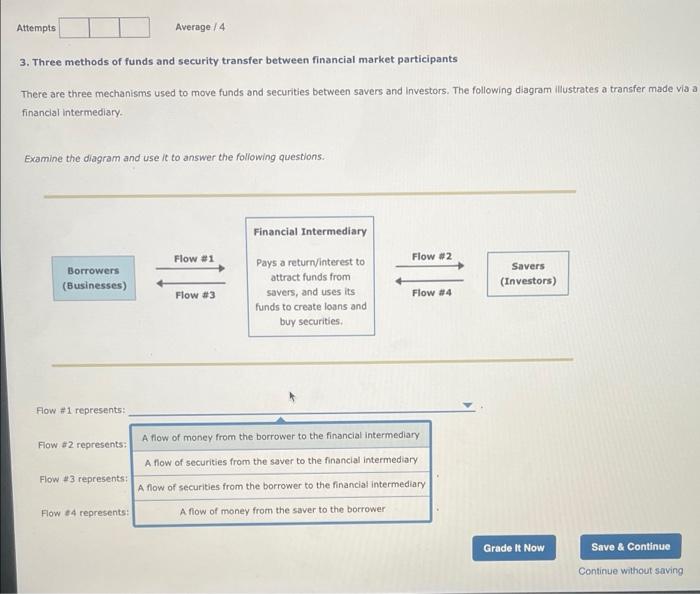

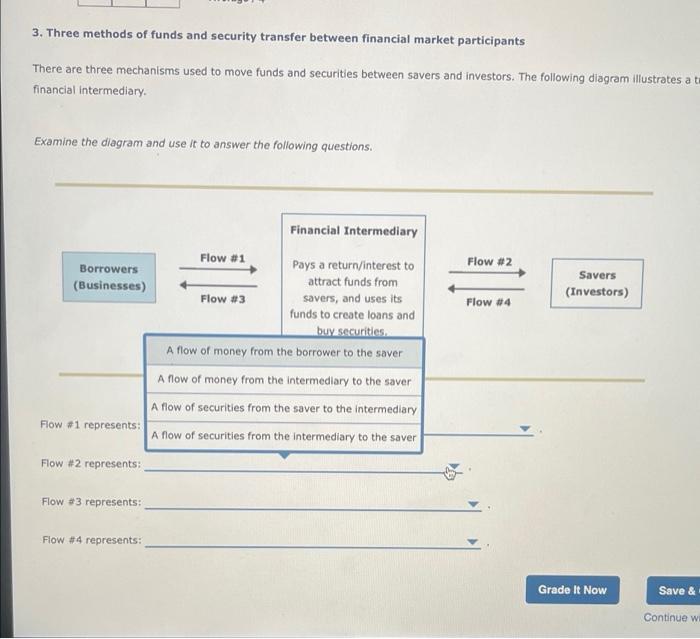

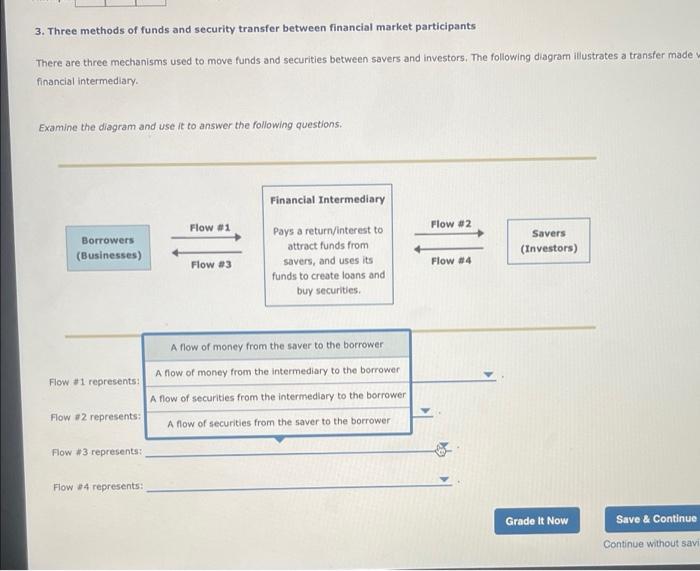

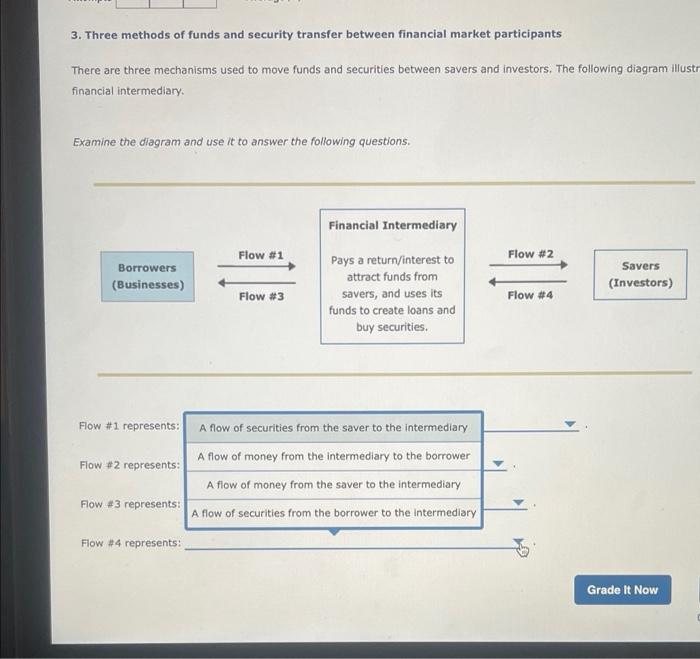

Attempts Average / 4 3. Three methods of funds and security transfer between financial market participants There are three mechanisms used to move funds and securities between savers and investors. The following diagram illustrates a transfer made via a financial intermediary. Examine the diagram and use it to answer the following questions. Financial Intermediary Flow #1 Flow #2 Borrowers (Businesses) Savers (Investors) Flow #3 Pays a return/interest to attract funds from savers, and uses its funds to create loans and buy securities. Flow #4 Flow #1 represents: A flow of money the borrower to the financial intermediary Flow #2 represents: A flow of securities from the saver to the financial intermediary Flow #3 represents: A flow of securities from the borrower to the financial intermediary Flow #4 represents: A flow of money from the saver to the borrower Grade It Now Save & Continue Continue without saving 3. Three methods of funds and security transfer between financial market participants There are three mechanisms used to move funds and securities between savers and investors. The following diagram illustrates a ta financial intermediary. Examine the diagram and use it to answer the following questions. Financial Intermediary Flow #1 Flow #2 Borrowers (Businesses) Savers (Investors) Flow #3 Pays a return/interest to attract funds from savers, and uses its funds to create loans and buy securities. Flow #4 A flow of money from the borrower to the saver A flow of money from the intermediary to the saver A flow of securities from the saver to the intermediary Flow #1 represents: A flow of securities from the intermediary to the saver Flow #2 represents: Flow #3 represents: Flow #4 represents: Grade It Now Save & Continue wi 3. Three methods of funds and security transfer between financial market participants There are three mechanisms used to move funds and securities between savers and investors. The following diagram illustrates a transfer made w financial intermediary. Examine the diagram and use it to answer the following questions. Financial Intermediary Flow #1 Flow #2 Pays a return/interest to Borrowers (Businesses) Savers (Investors) Flow #3 attract funds from savers, and uses its funds to create loans and i Flow #4 buy securities. A flow of money from the saver to the borrower A flow of money from the intermediary to the borrower Flow #1 represents: A flow of securities from the intermediary to the borrower A flow of securities from the saver to the borrower Flow #2 represents: Flow #3 represents: Flow #4 represents: Grade It Now Save & Continue Continue without savi 3. Three methods of funds and security transfer between financial market participants There are three mechanisms used to move funds and securities between savers and investors. The following diagram illustr financial intermediary. Examine the diagram and use it to answer the following questions. Financial Intermediary Flow #1 Flow #2 Pays a return/interest to Borrowers Savers (Investors) (Businesses) Flow #3 attract funds from savers, and uses its funds to create loans and Flow #4 buy securities. Flow #1 represents: A flow of securities from the saver to the intermediary A flow of money from the intermediary to the borrower Flow #2 represents: A flow of money from the saver to the intermediary Flow #3 represents: A flow of securities from the borrower to the intermediary Flow #4 represents: Grade It Now