Answered step by step

Verified Expert Solution

Question

1 Approved Answer

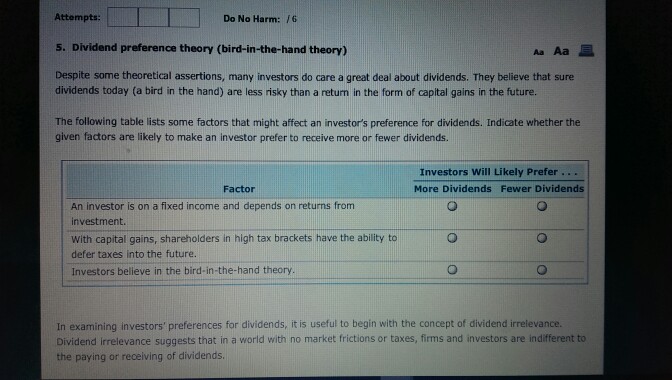

Attempts: Do No Harm: /6 s. Dividend preference theory (bird-in-the-hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They

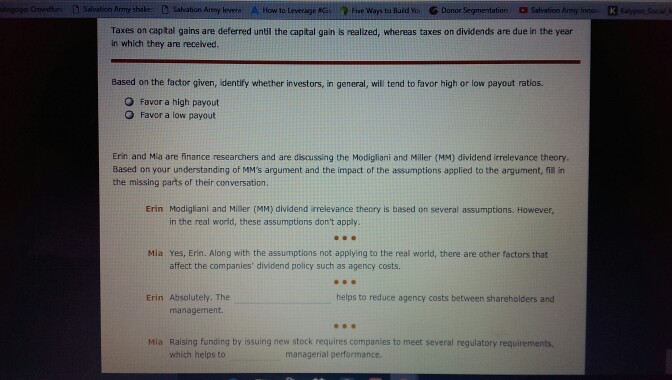

Attempts: Do No Harm: /6 s. Dividend preference theory (bird-in-the-hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They believe that sure dividends today (a bird in the hand) are less risky than a retum in the form of capital gains in the future. The following table lists some factors that might affect an investor's preference for dividends. Indicate whether the given factors are likely to make an investor prefer to receive more or fewer dividends. Investors Will Likely Prefer More Dividends Fewer Dividends Factor An investor is on a fxed income and depends on returns from investment With capital gains, shareholders in high tax brackets have the ability to defer taxes into the future. Investors believe in the bird-in-the-hand theory. ng investors preferences for dividends, itis sefu to begin with the concept of dividend irrelevance In examining investors' preferences for dividends, it is useful to begin with the concept of dividend irrelevance. Dividend irrelevance suggests that in a world with no market frictions or taxes, firms and investors are indifferent to the paying or receiving of dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started