Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempts Keep the Highest / 1 8. 8: Time Value of Money: Uneven Cash Flows Many financial decisions require the analysis of uneven, or nonconstant,

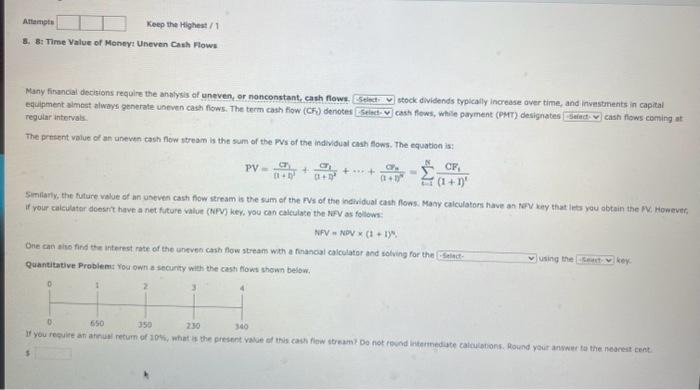

Attempts Keep the Highest / 1 8. 8: Time Value of Money: Uneven Cash Flows Many financial decisions require the analysis of uneven, or nonconstant, cash flows. -Select- equipment almost always generate uneven cash flows. The term cash flow (CF) denotes -Select- regular intervals. The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: 0 $ 1 2 3 PV = 4 CF (1+1) Similarly, the future value of an uneven cash flow stream is the sum of the FVs of the individual cash flows. Many calculators have an NFV key that lets you obtain the FV. However, f your calculator doesn't have a net future value (NFV) key, you can calculate the NFV as follows: if NFV = NPV x (1 + I). One can also find the interest rate of the uneven cash flow stream with a financial calculator and solving for the -Select- Quantitative Problem: You own a security with the cash flows shown below. CF + (1 + 1) 340 stock dividends typically increase over time, and investments in capital cash flows, while payment (PMT) designates -Select-cash flows coming at + + CFN (1+1)N N CF 1(1+1)* 0 650 350 230 If you require an annual return of 10%, what is the present value of this cash flow stream? Do not round intermediate calculations. Round your answer to the nearest cent. using the -Select-key.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started