Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempts: Keep the Highest: 12 13. Present value You just found out that you had a very eccentric uncle who lived quietly in the Bronx.

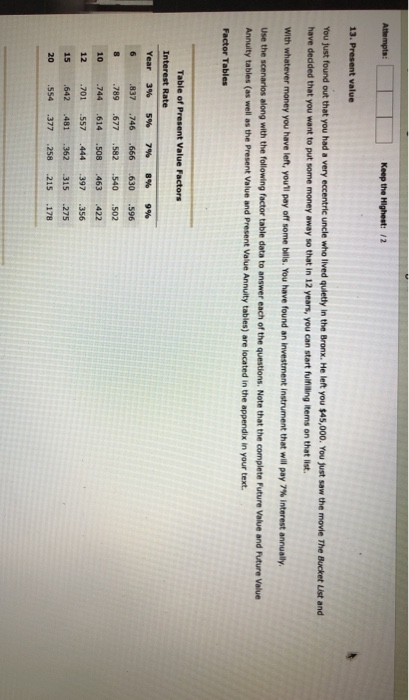

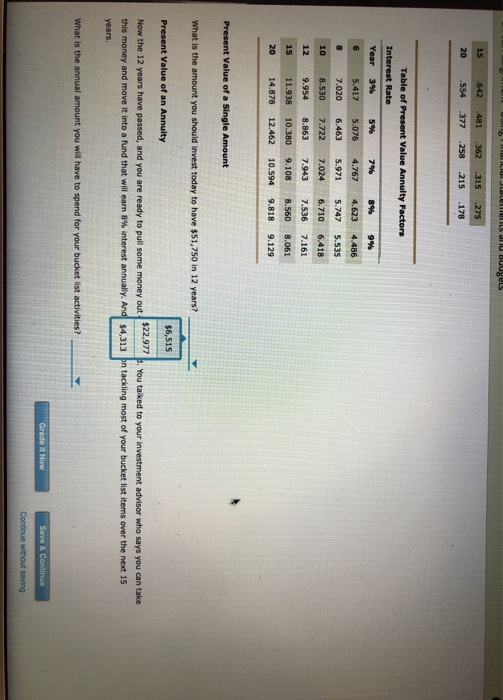

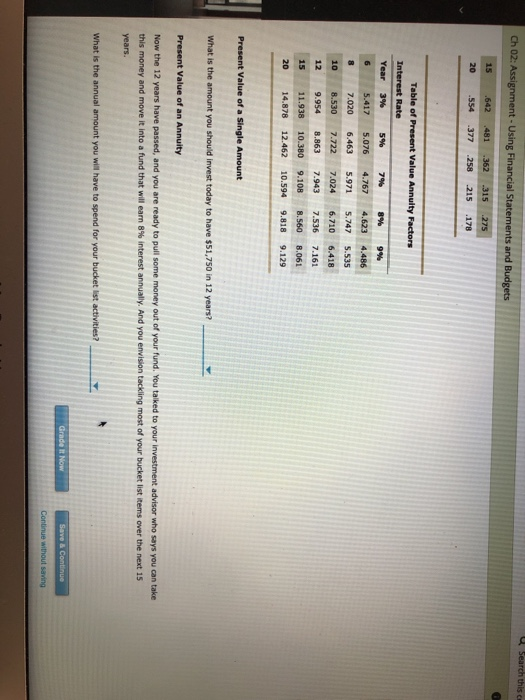

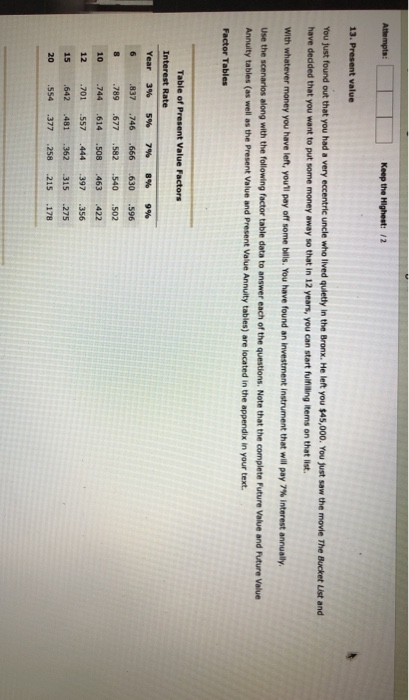

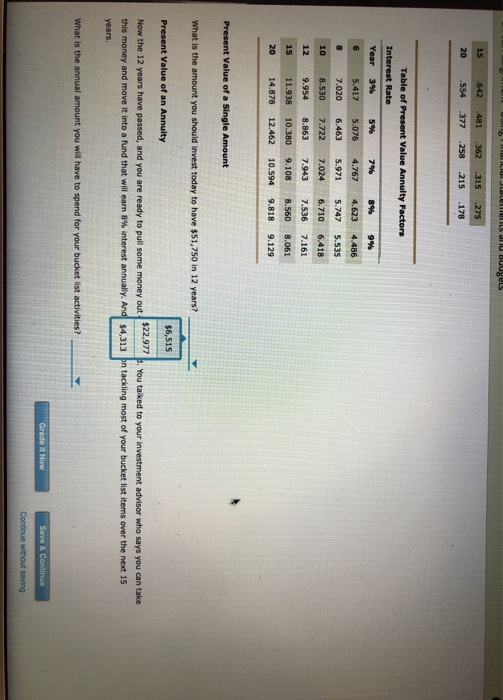

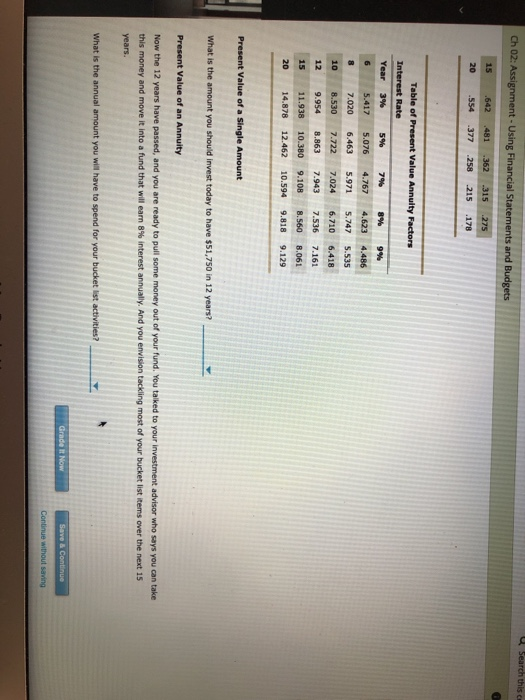

Attempts: Keep the Highest: 12 13. Present value You just found out that you had a very eccentric uncle who lived quietly in the Bronx. He left you $45,000. You just saw the movie The Bucket List and have decided that you want to put some money away so that in 12 years, you can start fulfilling items on that list. with whatever money you have left, you'll pay off some bills. You have found an investment instrument that will pay 7% interest annually Use the scenarios along with the following factor table data to answer each of the questions. Note that the complete Future Value and Future Value Annuity tables (as well as the Present Value and Present Value Annuity tables) are located in the appendix in your text. Factor Tables Table of Present Value Factors Interest Rate Year 9% .596 3W .837 .789 .744 .701 5% 7% 746 666 .677 .582 614 508 557.444 .481 362 377 258 8% 630 .540 463 -397 -502 215 B aba Sates budgets 15 20 642 554 481 .377 362 258 315 215 275 .178 Table of Present Value Annuity Factors Interest Rate Year 3% 5% 7% 8% 9% 6 5.417 5.076 4.767 4.623 4.486 8 7.020 6.463 5.971 5.747 5.535 10 8.530 7.722 7.024 6.710 6.418 129.954 8.863 7.9437.536 7.161 15 11.938 10.380 9.108 8.560 8.061 20 14.878 12.462 10.594 9.818 9.129 Present Value of a Single Amount What is the amount you should invest today to have $51,750 in 12 years? Present Value of an Annuity $6,515 Now the 12 years have passed, and you are ready to pull some money out . You talked to your investment advisor who says you can take this money and move it into a fund that will earn 8% interest annually. And $4,313 bn tackling most of your bucket list items over the next 15 years. What is the annual amount you will have to spend for your bucket list activities? Grade It Now Save & Continue Continue without saving Search this c Ch 02: Assignment - Using Financial Statements and Budgets 15 20 642 5 54 481 377 362 258 315 215 275 178 Table of Present Value Annuity Factors Interest Rate Year 3% 5% 7% 8% 6 5.417 5.076 4.767 4.623 4.486 7.020 6.463 5.971 5.747 5.535 8.530 7.722 7.024 6.418 12 9.954 8.863 7.943 7.161 15 11.938 10.380 9.108 3.560 8.061 14.878 12.462 10.594 9.818 9.129 10 6.710 7.536 Present Value of a Single Amount What is the amount you should invest today to have $51,750 in 12 years? Present Value of an Annuity Now the 12 years have passed, and you are ready to pull some money out of your fund. You talked to your investment advisor who says you can take this money and move it into a fund that will earn 8% interest annually. And you envision tackling most of your bucket list items over the next 15 years. What is the annual amount you will have to spend for your bucket list activities? Grade it Now Save & Continue Continue without saving

Attempts: Keep the Highest: 12 13. Present value You just found out that you had a very eccentric uncle who lived quietly in the Bronx. He left you $45,000. You just saw the movie The Bucket List and have decided that you want to put some money away so that in 12 years, you can start fulfilling items on that list. with whatever money you have left, you'll pay off some bills. You have found an investment instrument that will pay 7% interest annually Use the scenarios along with the following factor table data to answer each of the questions. Note that the complete Future Value and Future Value Annuity tables (as well as the Present Value and Present Value Annuity tables) are located in the appendix in your text. Factor Tables Table of Present Value Factors Interest Rate Year 9% .596 3W .837 .789 .744 .701 5% 7% 746 666 .677 .582 614 508 557.444 .481 362 377 258 8% 630 .540 463 -397 -502 215 B aba Sates budgets 15 20 642 554 481 .377 362 258 315 215 275 .178 Table of Present Value Annuity Factors Interest Rate Year 3% 5% 7% 8% 9% 6 5.417 5.076 4.767 4.623 4.486 8 7.020 6.463 5.971 5.747 5.535 10 8.530 7.722 7.024 6.710 6.418 129.954 8.863 7.9437.536 7.161 15 11.938 10.380 9.108 8.560 8.061 20 14.878 12.462 10.594 9.818 9.129 Present Value of a Single Amount What is the amount you should invest today to have $51,750 in 12 years? Present Value of an Annuity $6,515 Now the 12 years have passed, and you are ready to pull some money out . You talked to your investment advisor who says you can take this money and move it into a fund that will earn 8% interest annually. And $4,313 bn tackling most of your bucket list items over the next 15 years. What is the annual amount you will have to spend for your bucket list activities? Grade It Now Save & Continue Continue without saving Search this c Ch 02: Assignment - Using Financial Statements and Budgets 15 20 642 5 54 481 377 362 258 315 215 275 178 Table of Present Value Annuity Factors Interest Rate Year 3% 5% 7% 8% 6 5.417 5.076 4.767 4.623 4.486 7.020 6.463 5.971 5.747 5.535 8.530 7.722 7.024 6.418 12 9.954 8.863 7.943 7.161 15 11.938 10.380 9.108 3.560 8.061 14.878 12.462 10.594 9.818 9.129 10 6.710 7.536 Present Value of a Single Amount What is the amount you should invest today to have $51,750 in 12 years? Present Value of an Annuity Now the 12 years have passed, and you are ready to pull some money out of your fund. You talked to your investment advisor who says you can take this money and move it into a fund that will earn 8% interest annually. And you envision tackling most of your bucket list items over the next 15 years. What is the annual amount you will have to spend for your bucket list activities? Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started