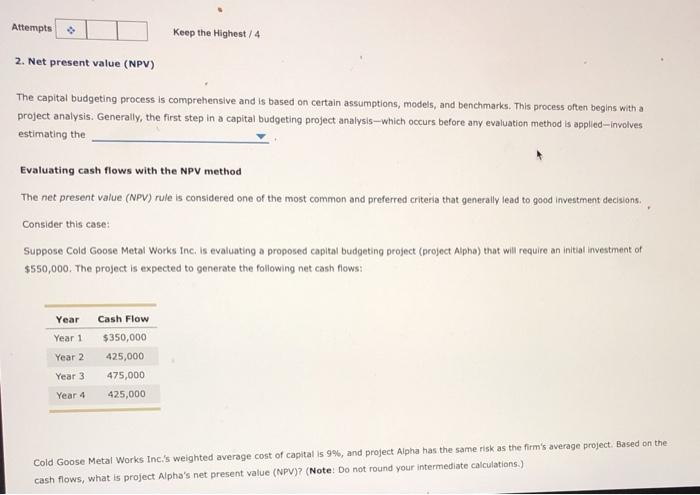

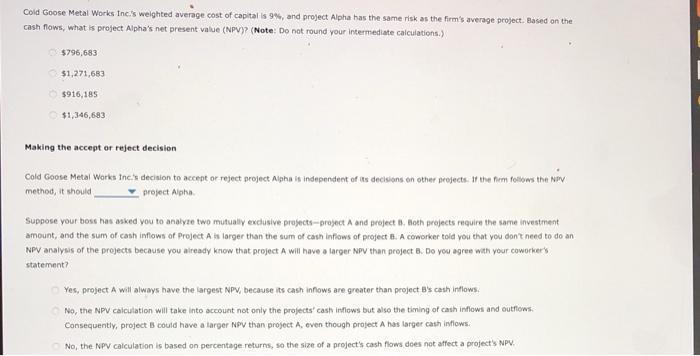

Attempts Keep the Highest / 4 2. Net present value (NPV) The capital budgeting process is comprehensive and is based on certain assumptions, models, and benchmarks. This process often begins with a project analysis. Generally, the first step in a capital budgeting project analysis, which occurs before any evaluation method is applied-involves estimating the Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good Investment decisions. Consider this case: Suppose Cold Goose Metal Works Inc. is evaluating a proposed capital budgeting project (project Alpha) that will require an initiat investment of $550,000. The project is expected to generate the following net cash flows: Year Year 1 Year 2 Cash Flow $350,000 425,000 475,000 425,000 Year 3 Year 4 Cold Goose Metal Works Inc.'s weighted average cost of capital is 9%, and project Alpha has the same risk as the firm's average project. Based on the cash flows, what is project Alpha's net present value (NPV)? (Note: Do not round your intermediate calculations.) Cold Goose Metal Works Inc.'s weighted average cost of capital is 9%, and project Alpha has the same risk as the firm's average project. Based on the cash flows, what is project Alpha's net present value (NPV)? (Note: Do not round your Intermediate calculations.) $796,683 $1,271,683 $916,185 $1,346,683 Making the accept or reject decision Cold Goose Metal Works Ines decision to accept or reject project Alpho is independent of its decisions on other projects. If the fem follows the New method, it should project Alpha Suppose your boss has asked you to analyze two mutually exclusive projects-project and projects. Both projects require the same investment amount, and the sum of cash inflows of Project A is larger than the sum of cash Infows of project B. A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project will have a larger NPV than projects. Do you agree with your coworkers statement Yes, project will always have the largest Npy, because its cash inflows are greater than project B's cath inflows. No, the NPV calculation will take into account not only the projects' cash Intiows but also the timing of cash inflows and cuttios Consequently, project could have a larger NPV than project A, even though project A has larger cash inflows. No, the NPV calculation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPV