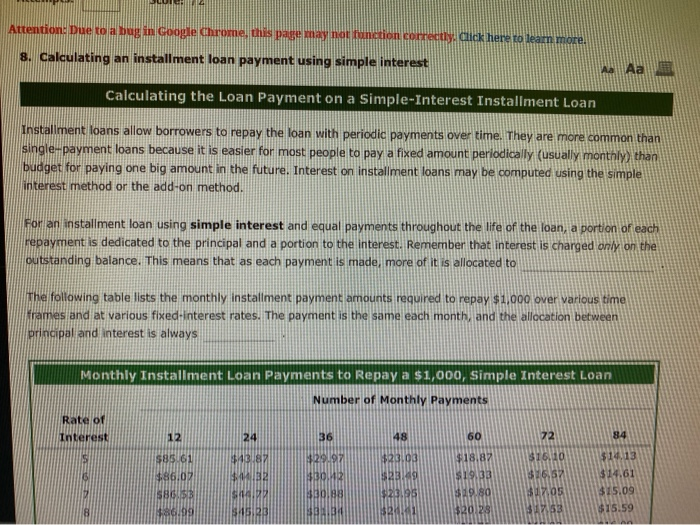

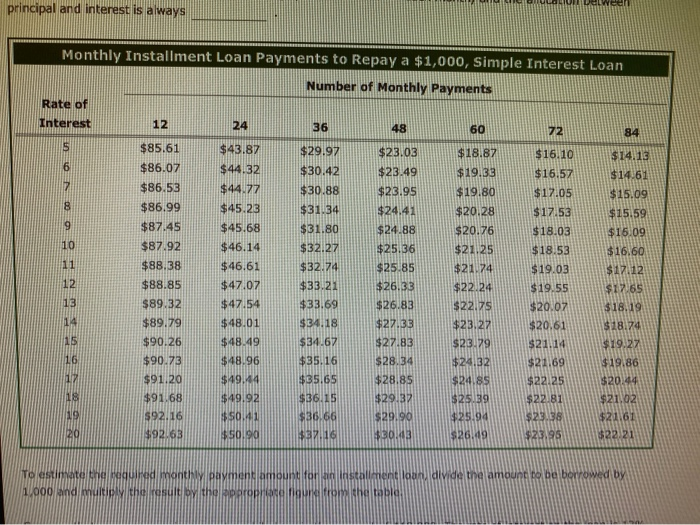

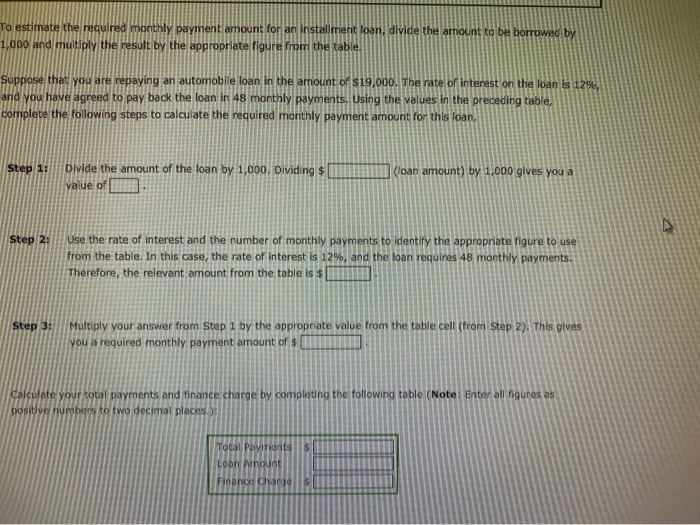

Attention: Due to a bug in Google Chrome, this page may function correctly. Click here to learn more Calculating an installment loan payment using simple interest Calculating the Loan Payment on a simple Interest Installment Loan Installment loans allow borrowers to repay the loan with periodic payments over time. They are more common than single-payment loans because it is easier for most people to pay a fixed amount periodically (usually monthly) than budget for paying one big amount in the future. Interest on installment loans may be computed using the simple interest method or the add-on method. For an installment loan using simple interest and equal payments throughout the life of the loan, a portion of each repayment is dedicated to the principal and a portion to the interest. Remember that interest is charged only on the outstanding balance. This means that as each payment is made, more of it is allocated to il the following table lists the monthly installment payment amounts required to repay $1.900 over various time rames and at various fixed-interest rates. The payment is the same each month, and the allocation between principal and interest is always Monthly Installment Loan Payments to Repay a $1,000, Simple Interest Loan per of Monthly Payments sos $15.59 principal and interest is always Monthly Installment Loan Payments to Repay a $1,000, Simple Interest Loan Number of Monthly Payments Rate $23.03 $16.10 $14 13 $43.87 $44.32 $18.87 $19.33 $19.80 $14.61 $44.77 $20.28 $20.76 $21.25 $29.97 $30.42 $30.88 $31.34 $31.80 $32.27 $32.74 $33.21 $33.69 $34.18 $34.67 $35.16 $15.09 $15.59 $16.09 $16.60 $17:12 $17.65 $85.61 $86.07 $86.53 $86.99 $87.45 $87.92 $88.38 $88.85 $89.32 $89.79 $90.26 $90.73 $91.20 $91.68 $92.16 392.63 $16.57 $12.05 $17.53 $18.03 $18.53 $19.03 $19.55 $20.07 . $45.23 $45.68 $46.14 $46.61 $47.07 $47.54 $48.01 $48.49 $48.96 $49.414 $26.33 $22.24 $18.19 $22.33 $20.61 $18.74 $23.27 $23.79 $21.14 $21,69 $19.86 $2044 $24.85 $22 25 UNEA HIBURed man divide the amount to be 1,000 and m To estimate the required monthly payment amount for an installment loan, divide the amount to be borrowed by 1,000 and multiply the result by the appropriate figure from the table. Suppose that you are repaying an automobile loan in the amount of $19,000. The rate of interest or the loan is 12% and you have agreed to pay back the loan in 48 monthly payments. Using the values in the preceding table complete the following steps to calculate the required monthly payment amount for this loan. Step 1: Divide the amount of the loan by 1,000. Dividing $ CT value of (loan amount) by 1,000 gives you a Step 2: Use the rate of interest and the number of monthly payments to identify the appropriate figure to use from the table. In this case, the rate of interest is 12%, and the loan requires 48 monthly payments. Therefore, the relevant amount from the table is $ Step 3: Multiply your answer from Step 1 by the appropriate value from the table cell (from Step 2). This gives you a required monthly payment amount of $ Calculate your total payments and finance charge by completing the following table (Note: Enter all figures os positive numbers to two decimal places Loph Amount