Answered step by step

Verified Expert Solution

Question

1 Approved Answer

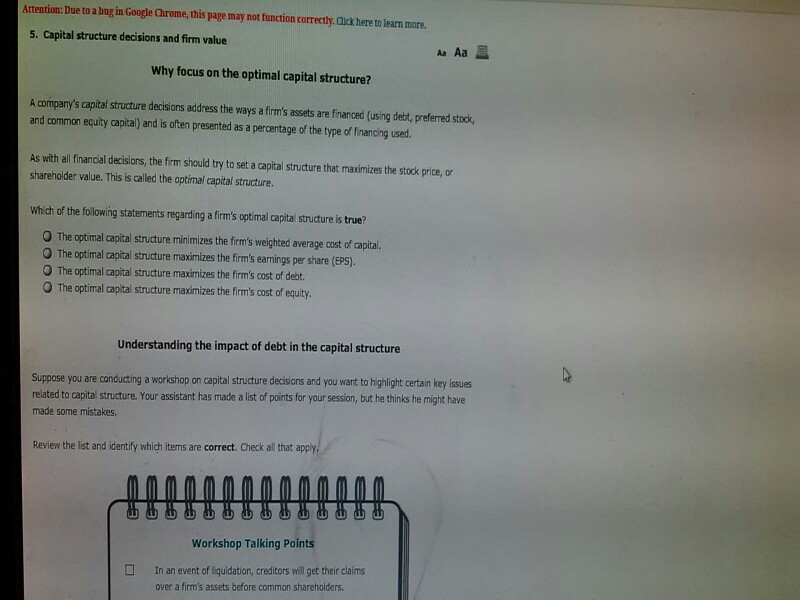

Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. 5. Capital structure decisions and firm

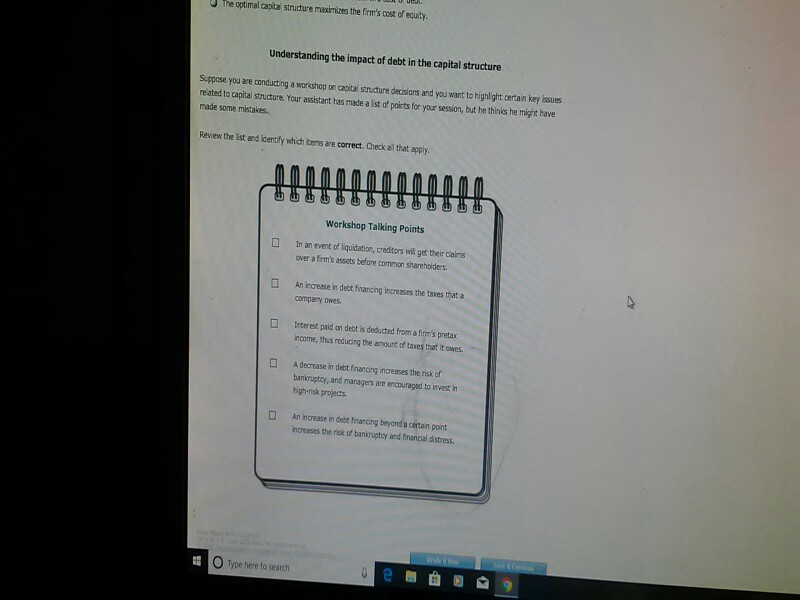

Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. 5. Capital structure decisions and firm value Why focus on the optimal capital structure? A company's capital structure decisions address the ways a firm's assets are financed (using debt, preferred stock, and common equity capital) and is ofen presented as a percentage of the type of financing used. As with all financial decisions, the firm should try to set a capital structure that maximizes the stock price, or shareholder value. This is called the optimal capital structure. Which of the following statements regarding a firm's optimal capital structure is true? O The optimal capital structure minimizes the firm's weighted average cost of capital. O The optimal capital structure maximizes the firm's earnings per share (EPS) 0 The optimal capital structure maximizes the firm's cost of debt. O The optimal capital structure maximizes the firm's cost of equity. Understanding the impact of debt in the capital structure Suppase you are conducting a workshop on capital structure decisions and you want to highlight certain key issues related to capital structure, Your assistant has made a list of points for your session, but he thinks he might have made some mistakes, Review the list and identify which items are correct. Check all that apply Workshop Talking Points In an event of liquidation, creditors will get their claims over a firm's assets before common shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started