Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attention. - In step 2, No.3 Choices A. 10, B. 13, C.8, D. 3 (there is no 7 years) - Please correct me if I

Attention.

- In step 2, No.3 Choices A. 10, B. 13, C.8, D. 3 (there is no 7 years)

- Please correct me if I am wrong.

- I will give you "Like" as long as you answer my question.

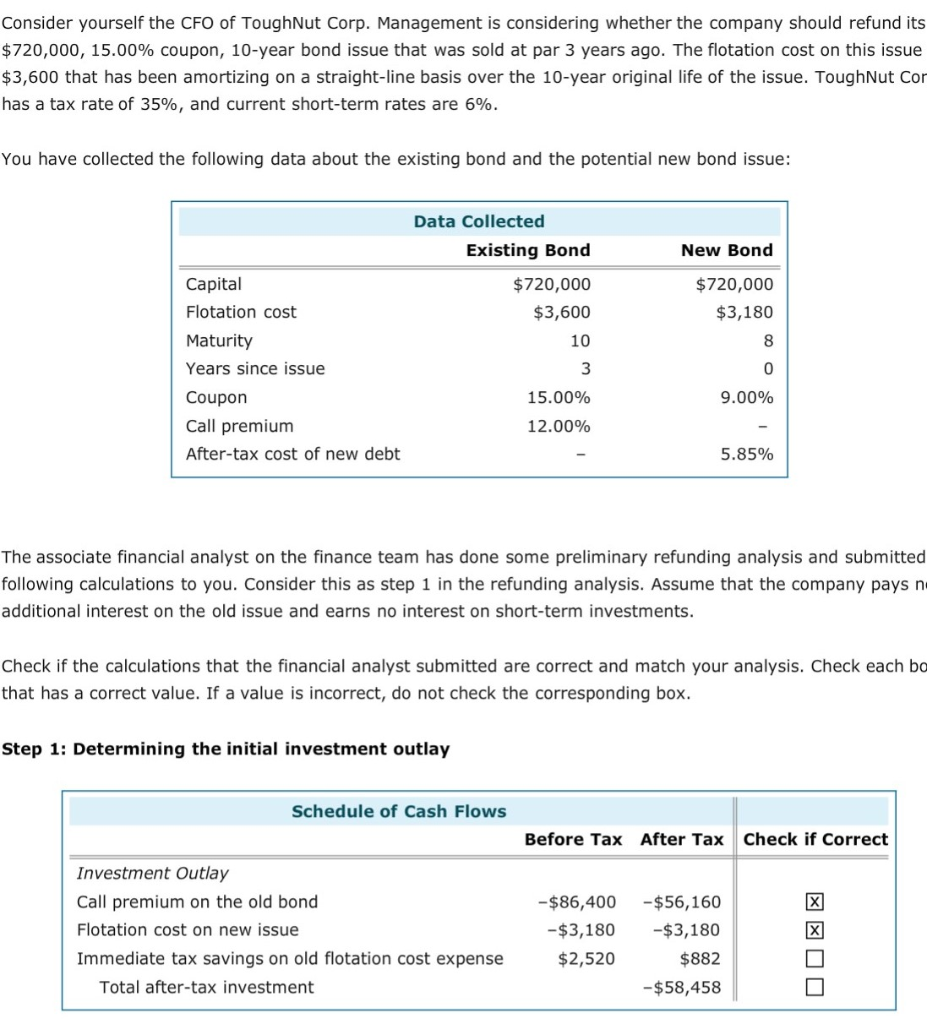

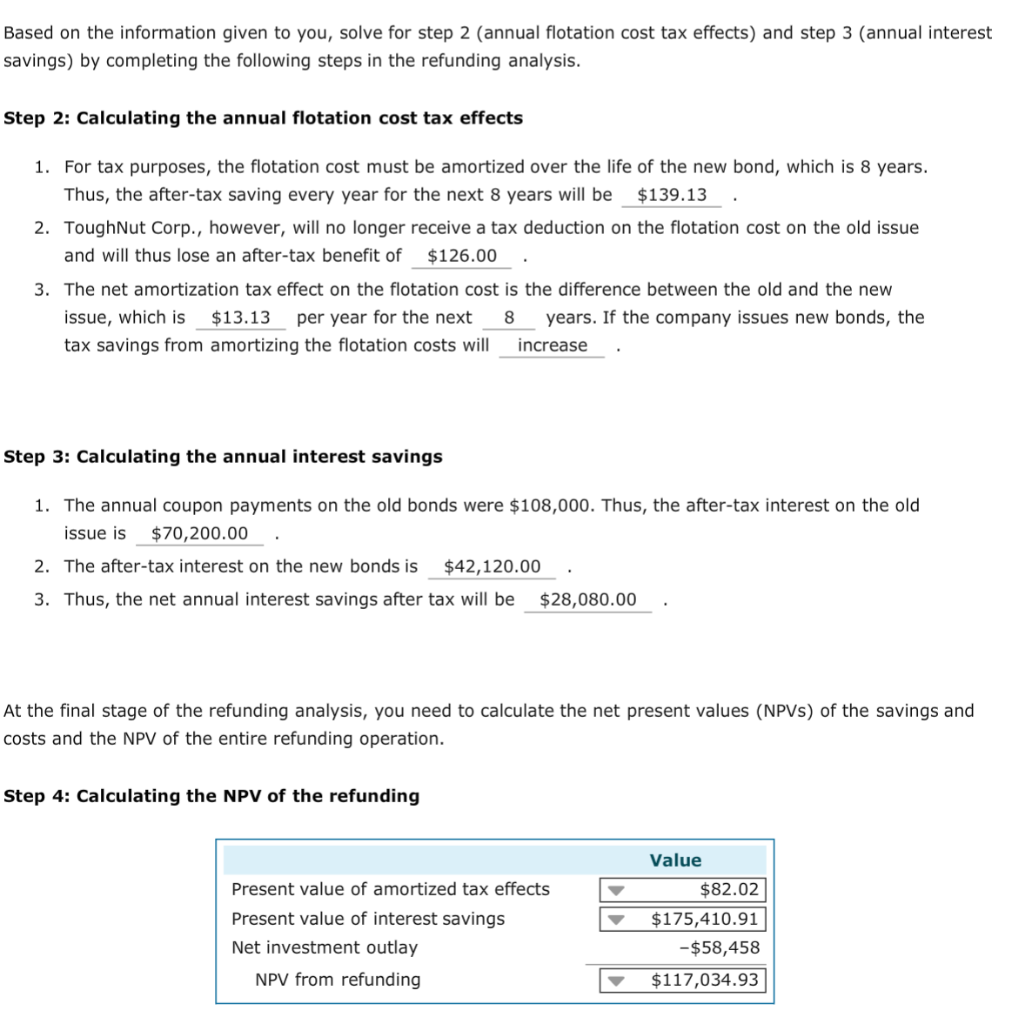

Consider yourself the CFO of ToughNut Corp. Management is considering whether the company should refund its $720,000, 15.00% coupon, 10-year bond issue that was sold at par 3 years ago. The flotation cost on this issue $3,600 that has been amortizing on a straight-line basis over the 10-year original life of the issue. ToughNut Con has a tax rate of 35%, and current short-term rates are 6%. You have collected the following data about the existing bond and the potential new bond issue: Data Collected Existing Bond New Bond Capital $720,000 $720,000 Flotation cost $3,600 $3,180 Maturity 10 Years since issue 0 Coupon 15.00% 9.00% Call premium 12.00% After-tax cost of new debt 5.85% The associate financial analyst on the finance team has done some preliminary refunding analysis and submitted following calculations to you. Consider this as step 1 in the refunding analysis. Assume that the company pays n additional interest on the old issue and earns no interest on short-term investments. Check if the calculations that the financial analyst submitted are correct and match your analysis. Check each bo that has a correct value. If a value is incorrect, do not check the corresponding box. Step 1: Determining the initial investment outlay Schedule of Cash Flows Before Tax After Tax Check if Correct Investment Outlay Call premium on the old bond -$86,400 -$56,160 X Flotation cost on new issue -$3,180 -$3,180 Immediate tax savings on old flotation cost expense $2,520 $882 Total after-tax investment -$58,458 Based on the information given to you, solve for step 2 (annual flotation cost tax effects) and step 3 (annual interest savings) by completing the following steps in the refunding analysis. Step 2: Calculating the annual flotation cost tax effects 1. For tax purposes, the flotation cost must be amortized over the life of the new bond, which is 8 years. Thus, the after-tax saving every year for the next 8 years will be $139.13 2. ToughNut Corp., however, will no longer receive a tax deduction on the flotation cost on the old issue and will thus lose an after-tax benefit of $126.00 3. The net amortization tax effect on the flotation cost is the difference between the old and the new per year for the next issue, which is $13.13 years. If the company issues new bonds, the tax savings from amortizing the flotation costs will increase Step 3: Calculating the annual interest savings 1. The annual coupon payments on the old bonds were $108,000. Thus, the after-tax interest on the old issue is $70,200.00 2. The after-tax interest on the new bonds is $42,120.00 3. Thus, the net annual interest savings after tax will be $28,080.00 At the final stage of the refunding analysis, you need to calculate the net present values (NPVS) of the savings and costs and the NPV of the entire refunding operation Step 4: Calculating the NPv of the refunding Value Present value of amortized tax effects $82.02 Present value of interest savings $175,410.91 Net investment outlay -$58,458 NPV from refunding $117,034.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started