Answered step by step

Verified Expert Solution

Question

1 Approved Answer

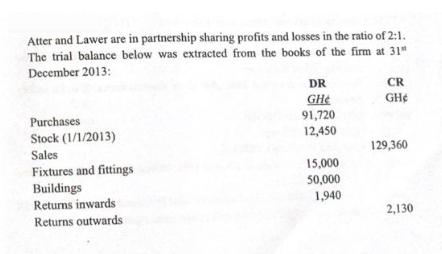

Atter and Lawer are in partnership sharing profits and losses in the ratio of 2:1. The trial balance below was extracted from the books

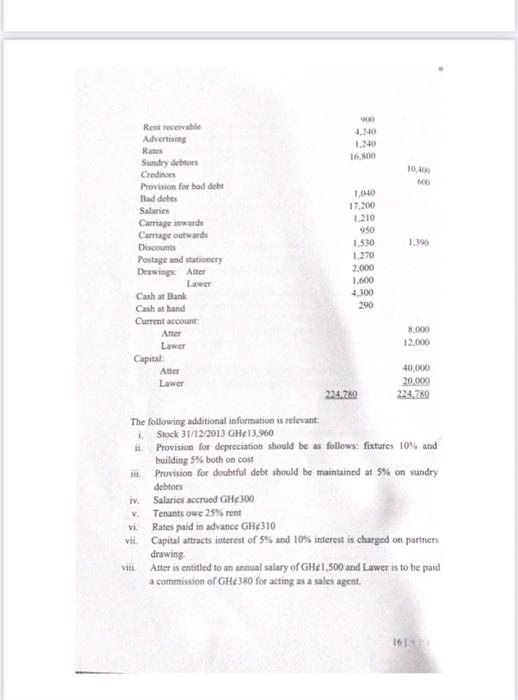

Atter and Lawer are in partnership sharing profits and losses in the ratio of 2:1. The trial balance below was extracted from the books of the firm at 31" December 2013: DR CR GH GHe 91,720 12,450 Purchases Stock (1/1/2013) 129,360 Sales Fixtures and fittings Buildings Returns inwards 15,000 50,000 1,940 2,130 Returns outwards 900 Rent recervable 4,240 Advertising Rates 1,240 16.800 Sundry debtors 10,400 Creditors 600 Provision for bad debt 1,040 Bad debts Salaries Carriage inwards Carriage outwards 17,200 1,210 950 1.530 1,390 Discounts Postage and stationery Drawings Ater 1.270 2,000 1,600 Lawer Cash at Bank 4300 290 Cash at hand Current account: 8,000 12.000 Atter Lawer Capital: Atter Lawer 40,000 20.000 224.780 224.780 The following additional information is relevant: i Stock 31/12/2013 GHE13,960 Provision for depreciation should be as follows: fixtures 10% and building 5% both on cost Provision for doubtful debt should be maintained at 5% on sundry debtors Salaries accrued GHE300 Tenants owe 25% rent V. vi. Rates paid in advance GH310 iv. vii. Capital attracts interest of 5% and 10% interest is charged on partners drawing. Atter is entitled to an annual salary of GHe 1,500 and Lawer is to be paid vii. a commission of GHE380 for acting as a sales agent. 161A Prepare the Income Statement, Profit and Loss Appropriation Account, Partners Current Account and Statement of Financial Position. Required:

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

INCOME STATEMENT Profit and Loss Account for the year e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started