Answered step by step

Verified Expert Solution

Question

1 Approved Answer

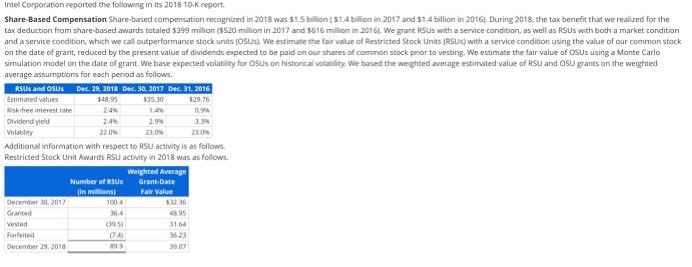

Intel Corporation reported the following in its 2018 10-K report. Share-Based Compensation Share-based campensation recognized in 2018 was 51.5 billon (S14 bilion in 2017

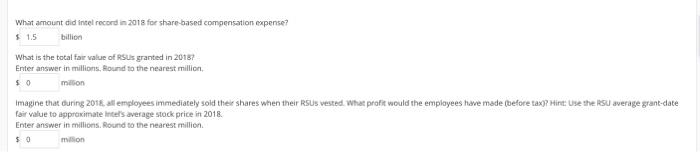

Intel Corporation reported the following in its 2018 10-K report. Share-Based Compensation Share-based campensation recognized in 2018 was 51.5 billon (S14 bilion in 2017 and $1.4 billion in 2016). During 2018, the tax benefit that we realized for the tax deduction from share-based awards totaled $399 million (5520 million in 2017 and $616 million in 2016 We grant RSUS with a service condition, as well as RSUS with both a market condition and a service condition, which we call outperformance stock units (OSus) We estimate the fair value of Restricted Stock Units (RSUs) with a service condition using the value of our common stock on the date of grant, reduced by the present value of dividends expected to be paid on our shares of common stock prior to vesting. We estimate the fair value of OSUS using a Monte Carlo simulation madel on the date of grant. We base expected volatility for OSus an historical volatility. We based the weighted average estimated value af RSU and OSu grants on the weighted average assumptions for each period as follows. RSUS and OSUS Dec. 29, 2018 Dec. 30, 2017 Dec. 31, 2016 Estimated values $48.95 $35.30 $29.76 Risk-free interest rate 24% 1.4% Dividend yield 2.4% 2.9% 3.3% Volability 22.0% 23.0% Additional information with respect to RSU activity is as follows. Restricted Stock Unit Awards RSU activity in 2018 was as follows. weighted Average Number of RSUS Grant Date in milions) 100 4 Fair Value $3236 December 30, 2017 Granted 364 48.95 Vested 31.64 Forfeited 36.23 December 29, 20s8 39.07 What amount did intel record in 2018 for share-based compensation expense? $ 1.5 billion What is the total fair value of RSUs granted in 20187 Enter answer in millions, Round to the nearest million, milion Imagine that during 2018, all employees immediately sold their shares when their RSUS vested. What profit would the emplayees have made (before tax)? Hint: Use the RSU average grant-date fair value to approximate intel's average stock price in 2018. Enter answer in millions. Round to the nearest million. million

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is 15Bn Sharebased compensation was recognized at 15B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started