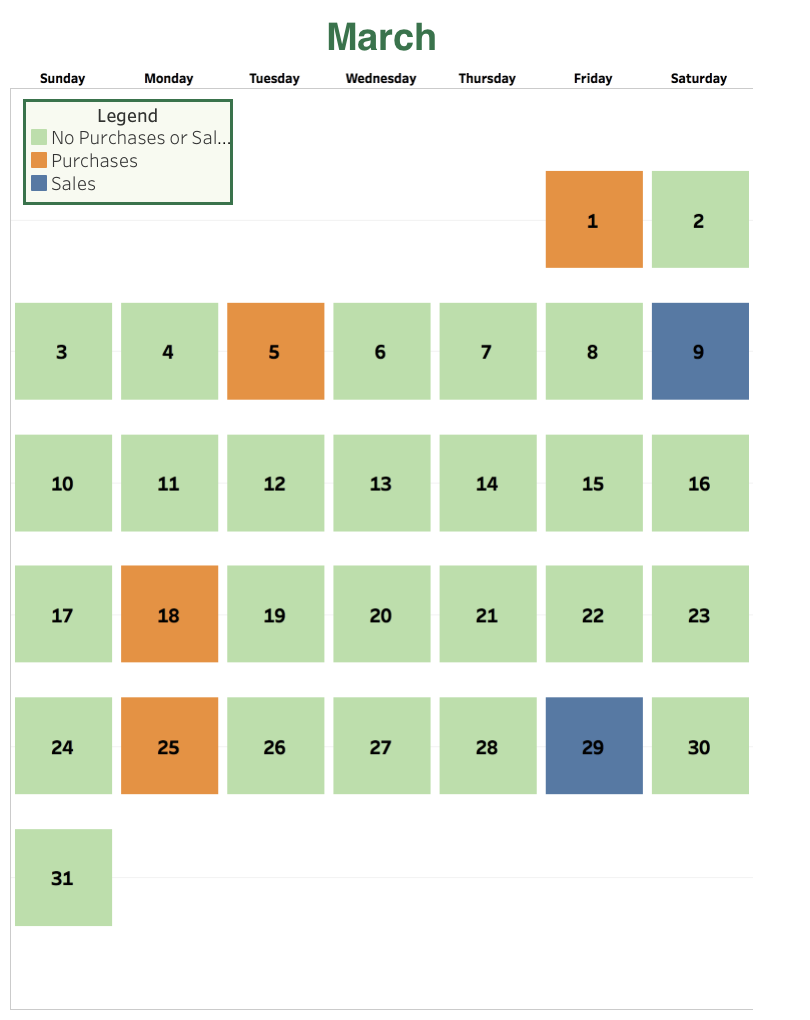

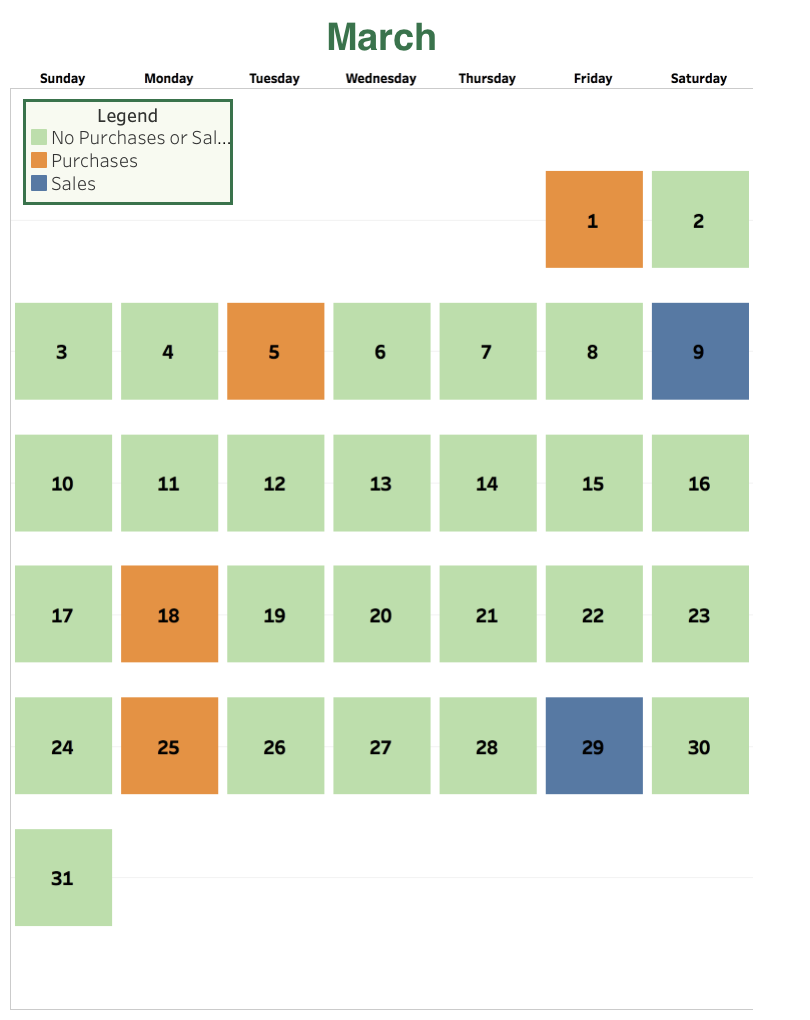

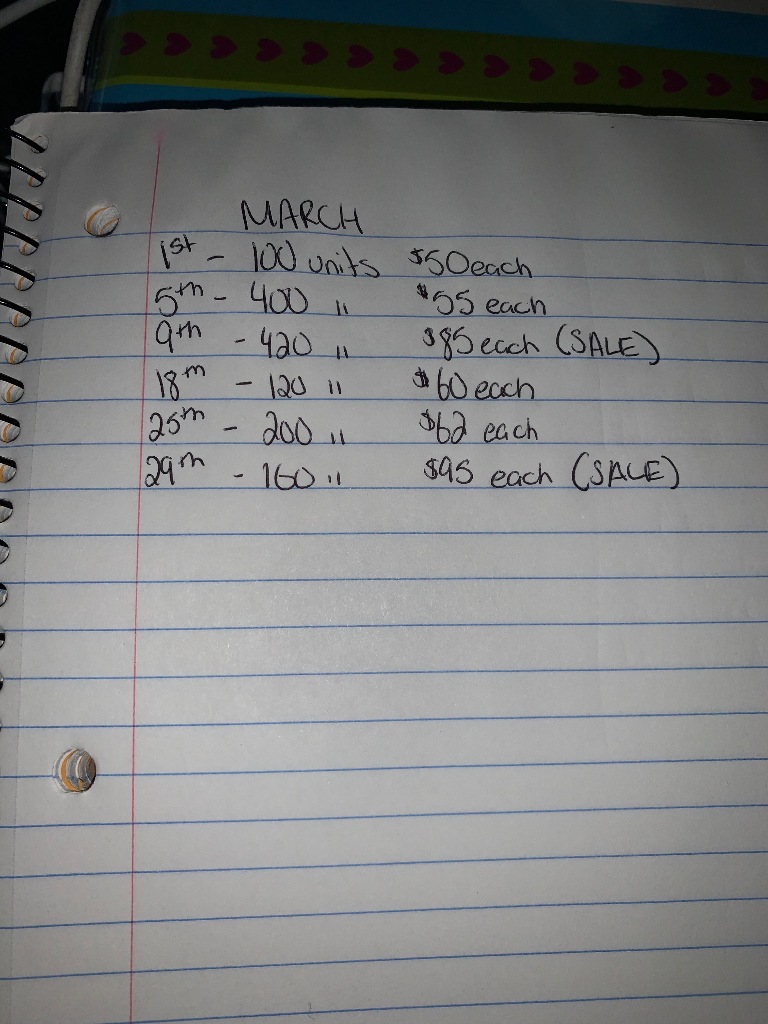

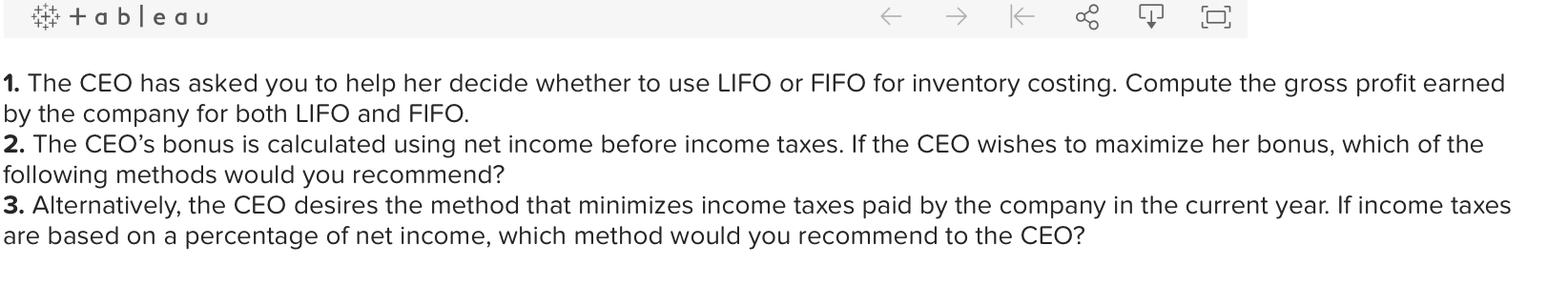

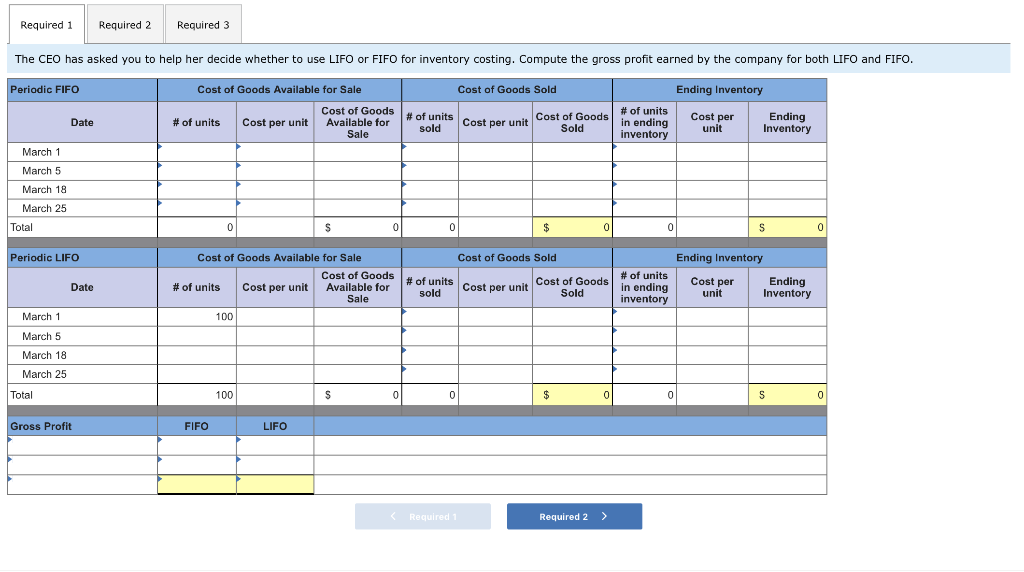

ATV Co. began operations on March 1 and uses a periodic inventory system. It entered into purchases and sales for March as shown in the Tableau Dashboard.

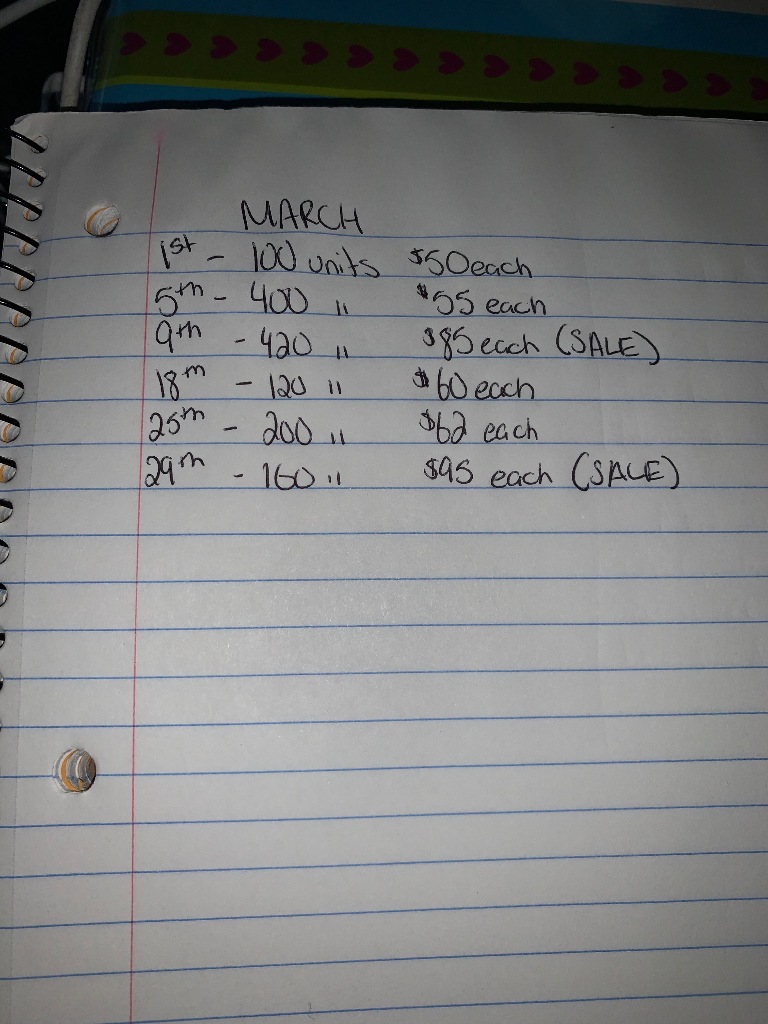

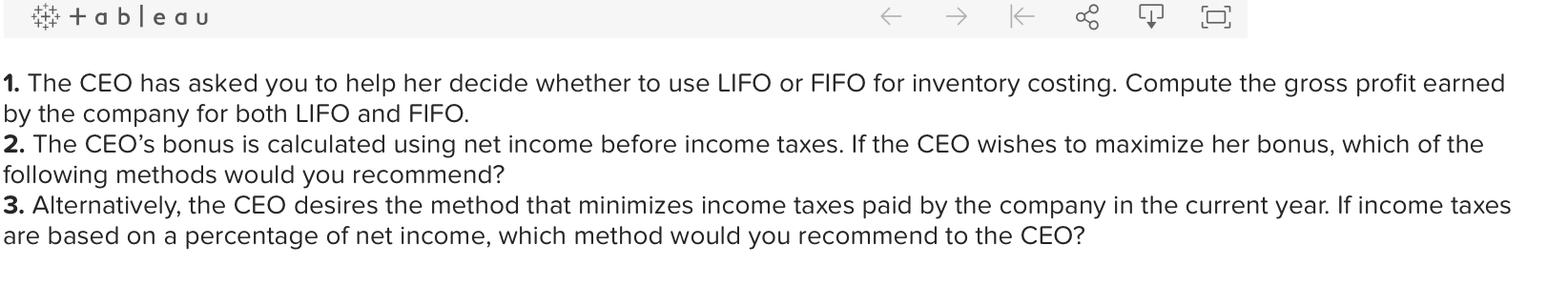

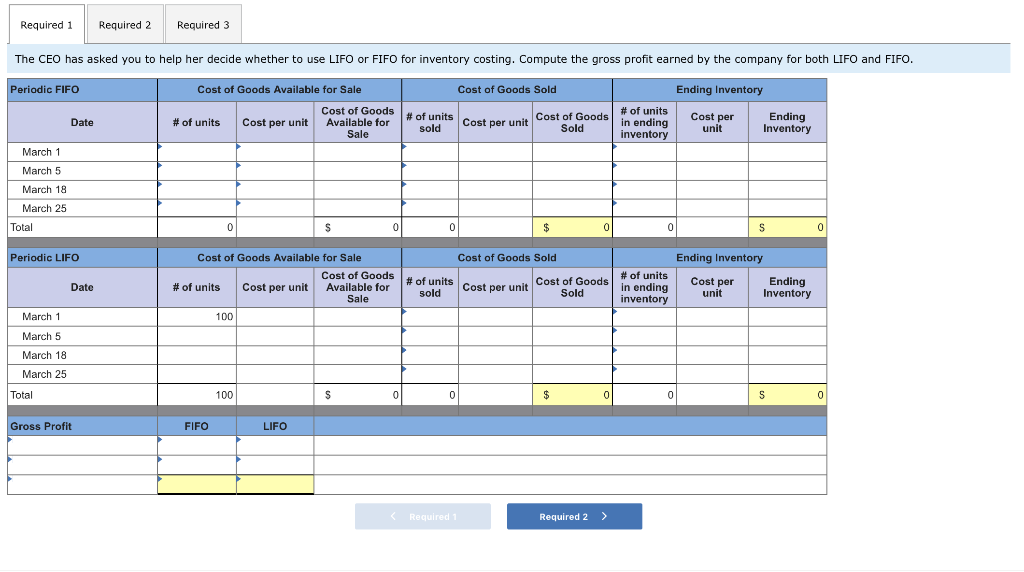

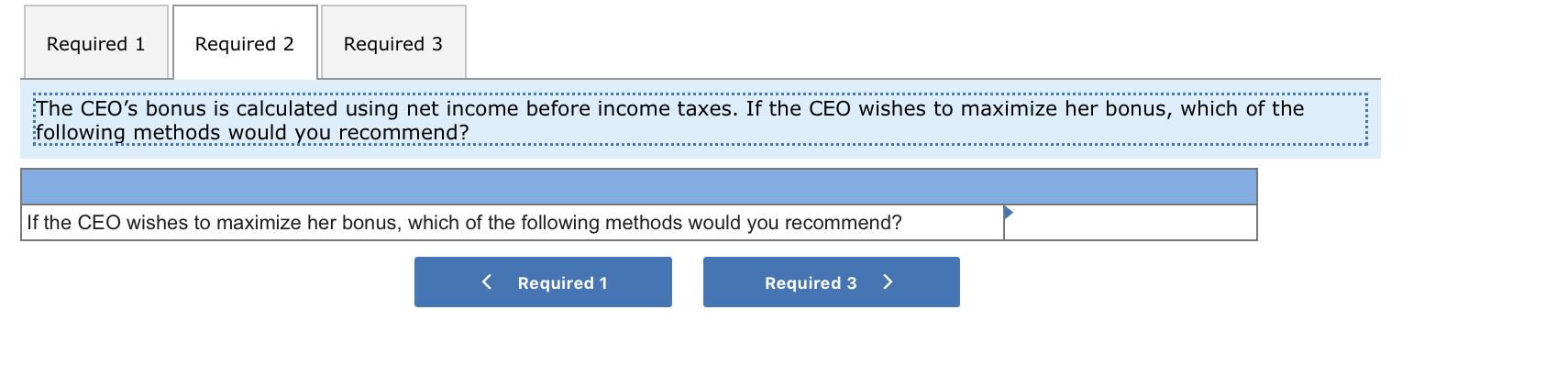

March Thursday Wednesday Sunday Monday Tuesday Friday Saturday Legend |No Purchases or Sal... | Purchases Sales 1 2 3 5 6 7 8 10 11 12 13 14 15 16 18 19 21 22 17 24 26 28 29 30 31 23 20 27 25 ceccceccececcd MARCH 1st100 units $50each 6m- 400 9m -4a0 465 each ecch (SALE 60ecch $62 each 3a5 each (SALE t7 18m 25m-ao0 a b e a u LIJ 1. The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO 2. The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? 3. Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Required 2 Required 1 Required 3 The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Goods Available for Sale #of units in ending inventory Cost per unit Cost of Goods Sold #of units sold Cost per unit Ending Inventory Date #of units Cost per unit March 1 March 5 March 18 March 25 Total 0 0 0 0 0 S Periodic LIFO Cost of Goods Sold Cost of Goods Available for Sale Ending Inventory Cost of Goods Available for Sale #of units #of units Cost per unit Cost of Goods Sold Ending Inventory Cost per unit Date #of units Cost per unit in ending inventory sold March 1 100 March 5 March 18 March 25 Total 100 0 0 0 S 0 Gross Profit FIFO LIFO Required 2 > Required 1 Required 1 Required 2 Required 3 The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? If the CEO wishes to maximize her bonus, which of the following methods would you recommend?

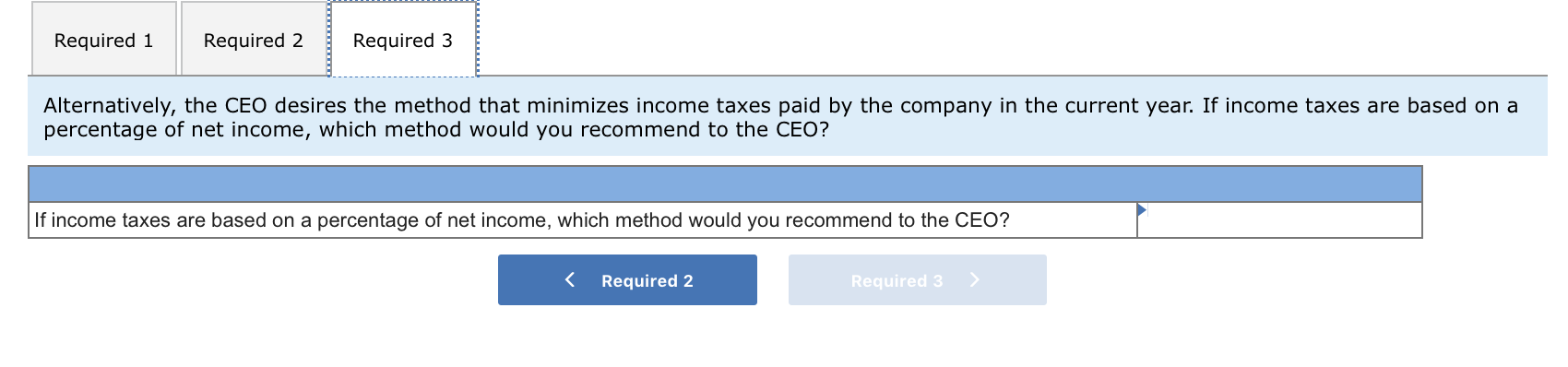

Required 1 Required 2 Required 3 Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Required 2 Required 3 March Thursday Wednesday Sunday Monday Tuesday Friday Saturday Legend |No Purchases or Sal... | Purchases Sales 1 2 3 5 6 7 8 10 11 12 13 14 15 16 18 19 21 22 17 24 26 28 29 30 31 23 20 27 25 ceccceccececcd MARCH 1st100 units $50each 6m- 400 9m -4a0 465 each ecch (SALE 60ecch $62 each 3a5 each (SALE t7 18m 25m-ao0 a b e a u LIJ 1. The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO 2. The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? 3. Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Required 2 Required 1 Required 3 The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Goods Available for Sale #of units in ending inventory Cost per unit Cost of Goods Sold #of units sold Cost per unit Ending Inventory Date #of units Cost per unit March 1 March 5 March 18 March 25 Total 0 0 0 0 0 S Periodic LIFO Cost of Goods Sold Cost of Goods Available for Sale Ending Inventory Cost of Goods Available for Sale #of units #of units Cost per unit Cost of Goods Sold Ending Inventory Cost per unit Date #of units Cost per unit in ending inventory sold March 1 100 March 5 March 18 March 25 Total 100 0 0 0 S 0 Gross Profit FIFO LIFO Required 2 > Required 1 Required 1 Required 2 Required 3 The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? If the CEO wishes to maximize her bonus, which of the following methods would you recommend? Required 1 Required 2 Required 3 Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Required 2 Required 3