Question

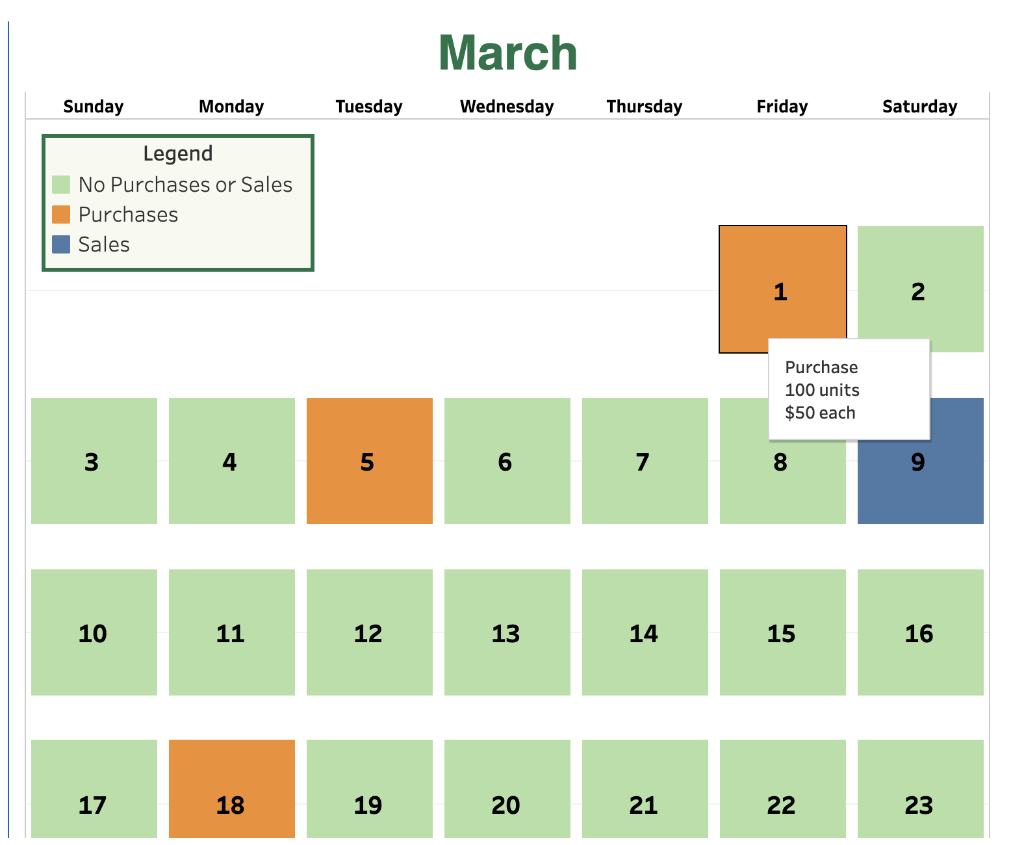

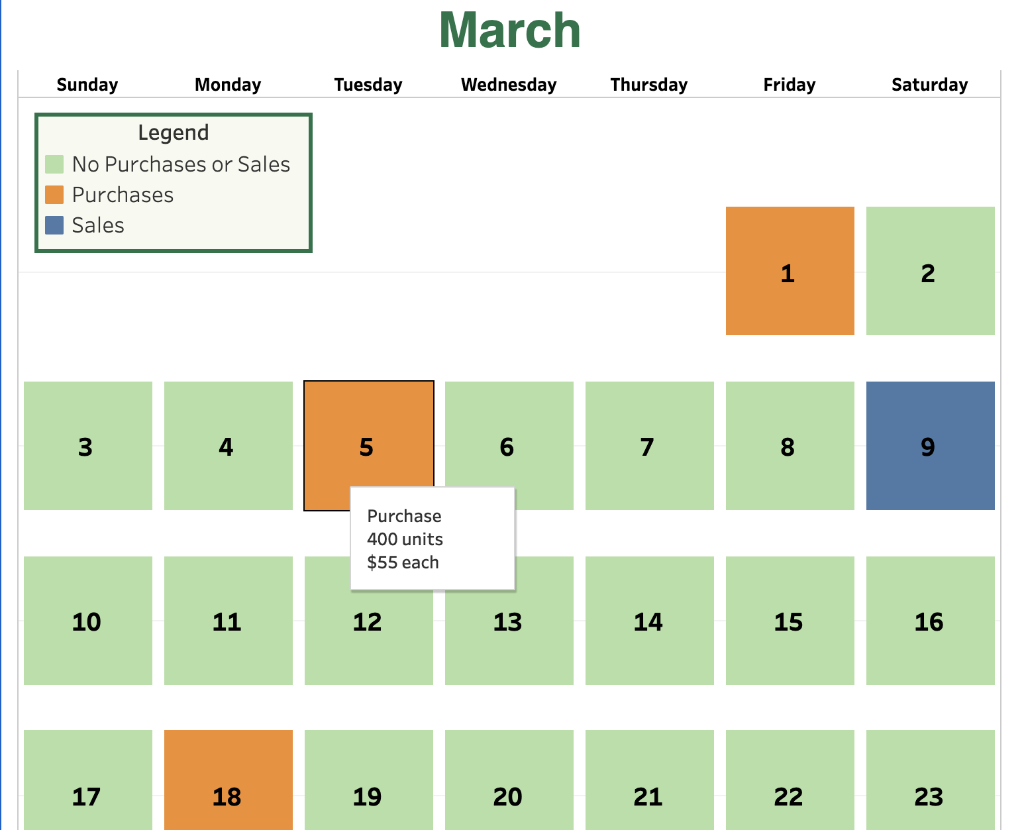

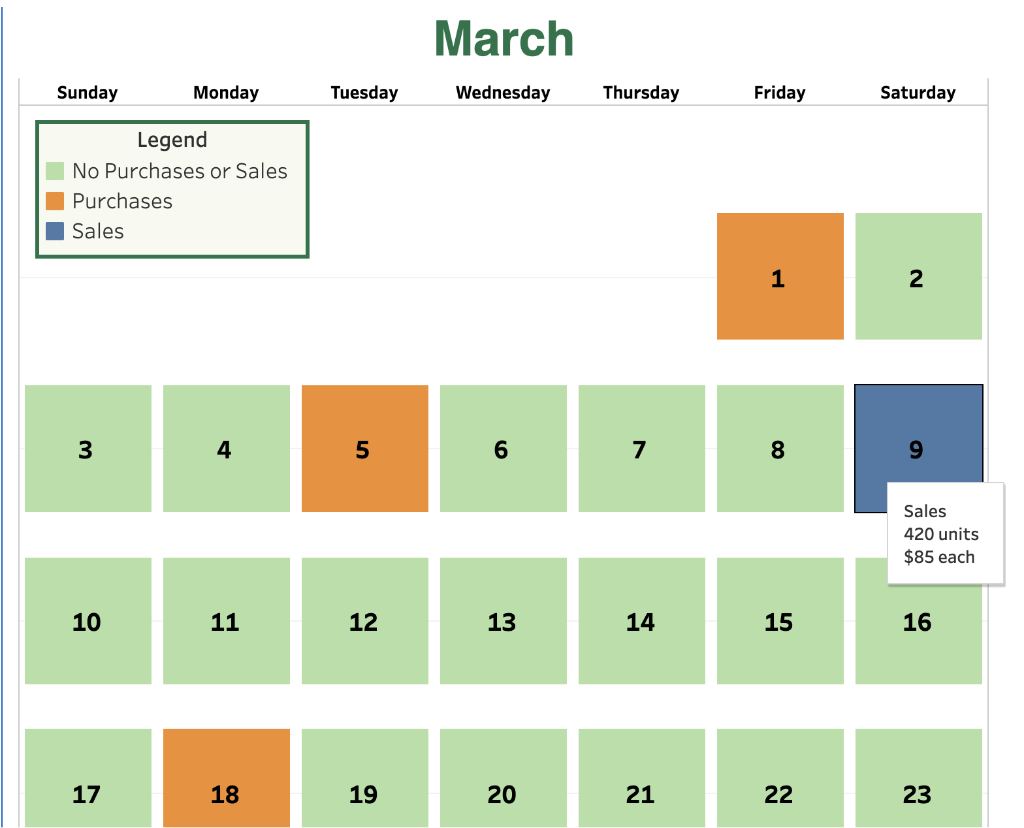

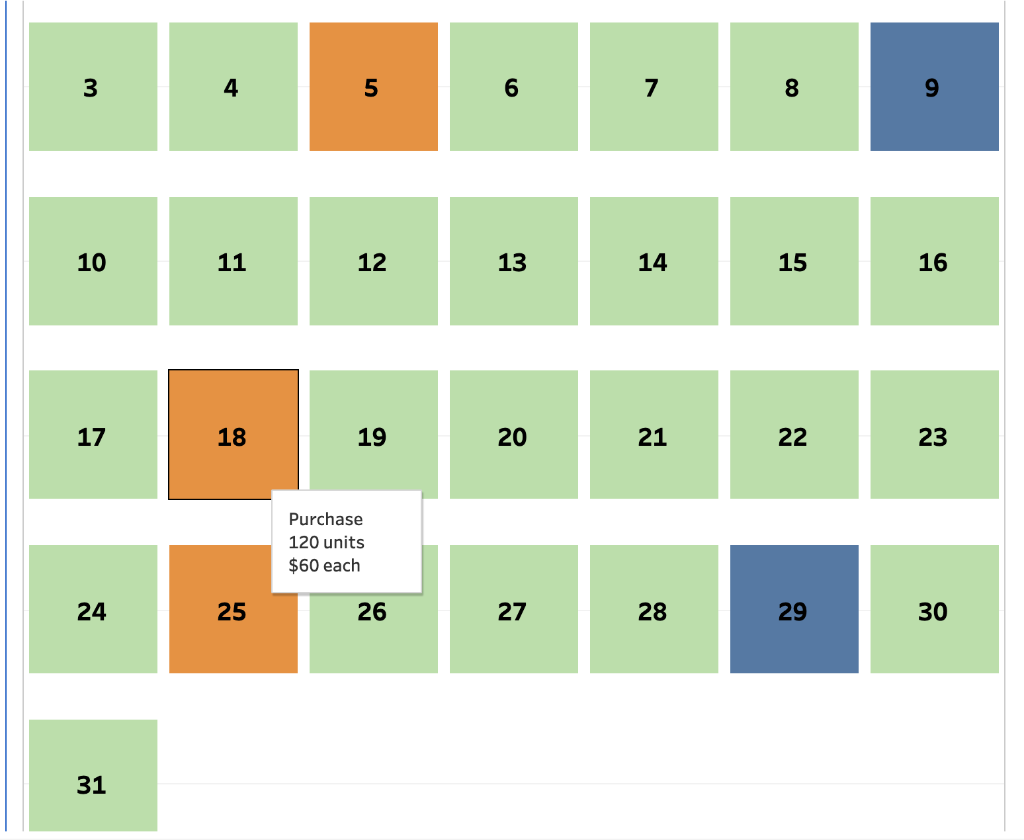

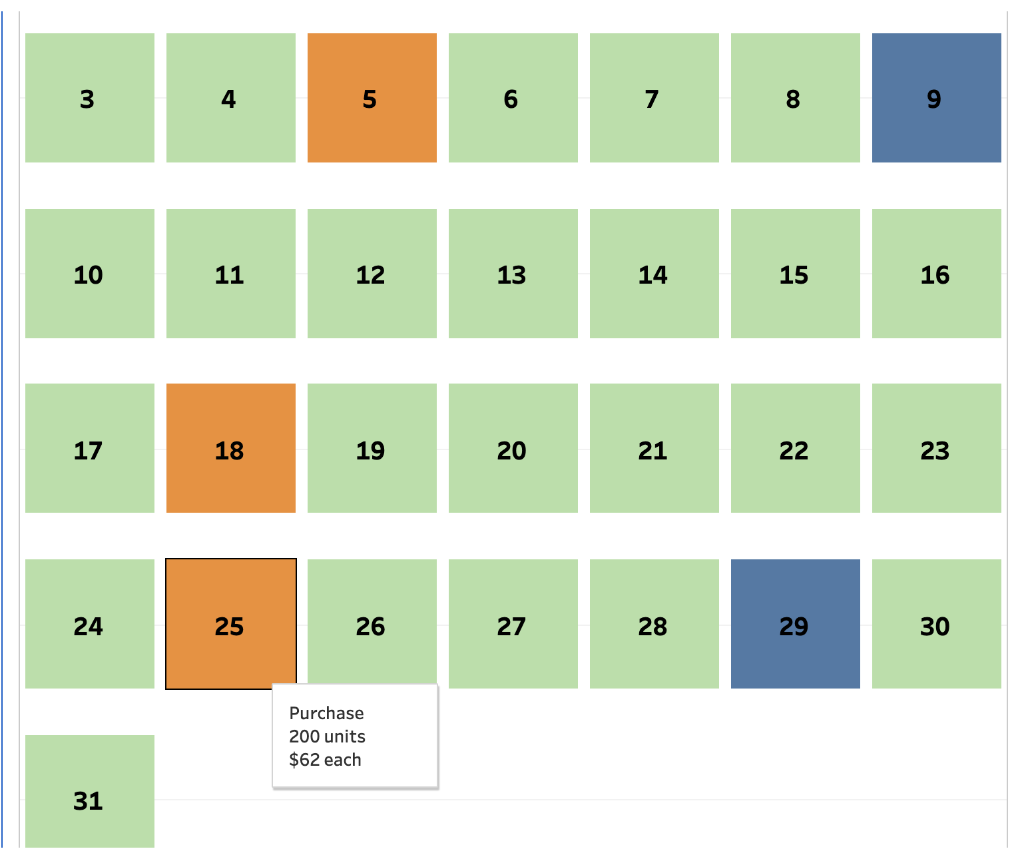

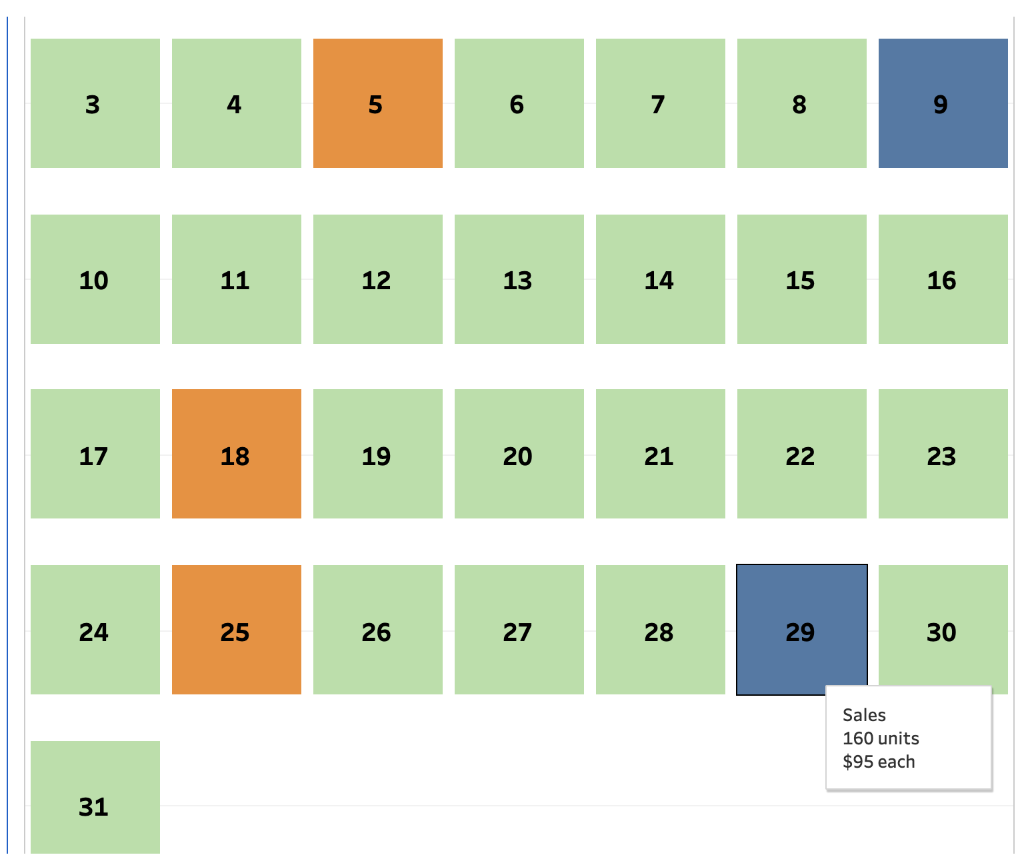

ATV Company began operations on March 1 and uses a perpetual inventory system. It entered into purchases and sales for March as shown in the

ATV Company began operations on March 1 and uses a perpetual inventory system. It entered into purchases and sales for March as shown in the Tableau Dashboard.

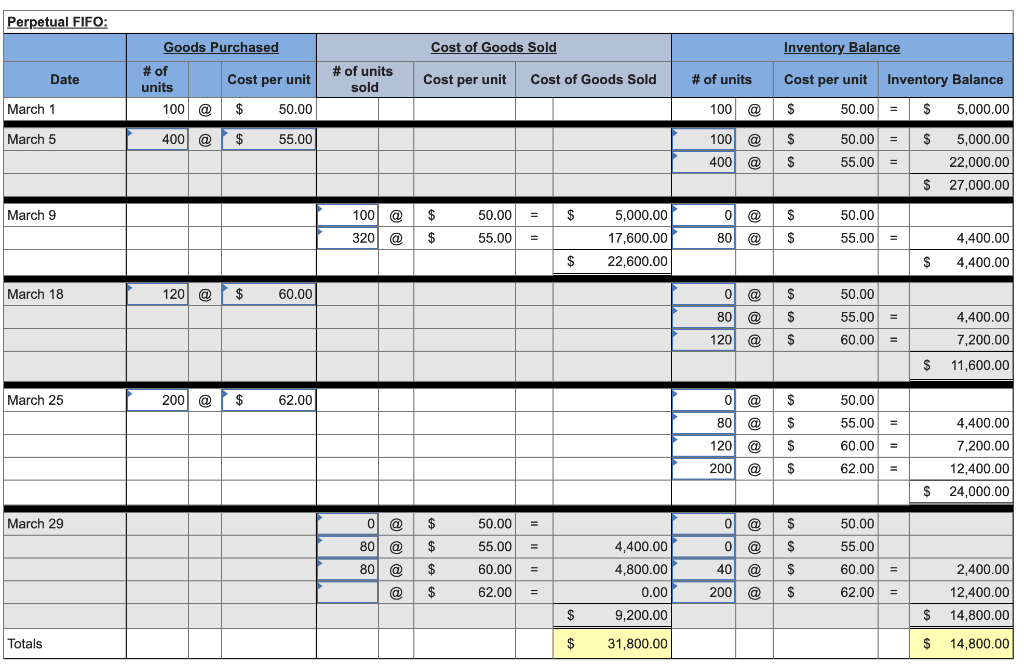

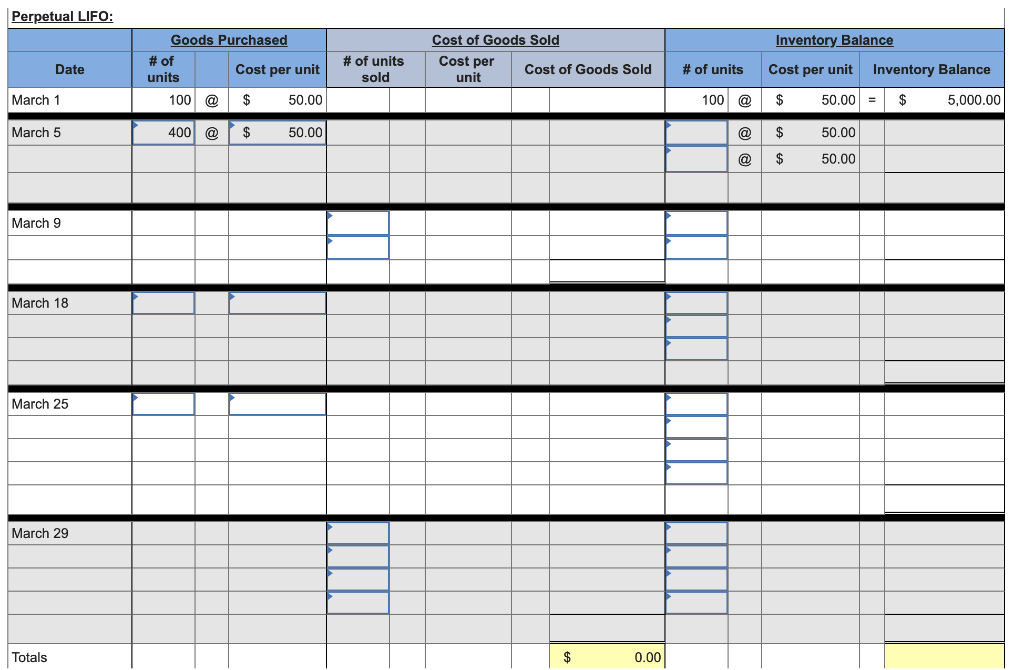

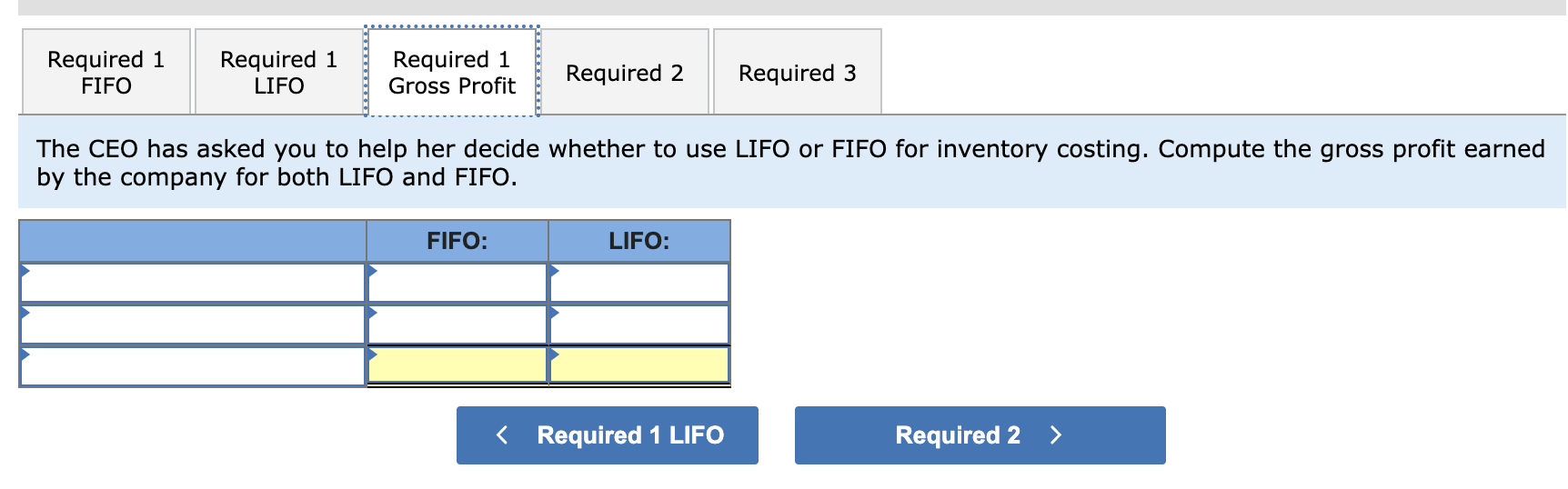

1. The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO. 2. The CEOs bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? 3. Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO?

(Solve everything and send me the correct answers). PLEASE NOT HANDWRITTEN!!!!!!!

March March March 31 \begin{tabular}{|c|c|c|c|c|} \hline 3 & 4 & 5 & 7 \\ \hline 10 & 11 & 12 & 13 & 14 \\ \hline 17 & & & \\ \hline \end{tabular} 9 Sales 160 units $95 each 31 Perpetual FIFO: | Perpetual LIFO: The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO. ne CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the followir ethods would you recommend? Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? March March March 31 \begin{tabular}{|c|c|c|c|c|} \hline 3 & 4 & 5 & 7 \\ \hline 10 & 11 & 12 & 13 & 14 \\ \hline 17 & & & \\ \hline \end{tabular} 9 Sales 160 units $95 each 31 Perpetual FIFO: | Perpetual LIFO: The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO. ne CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the followir ethods would you recommend? Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started