Answered step by step

Verified Expert Solution

Question

1 Approved Answer

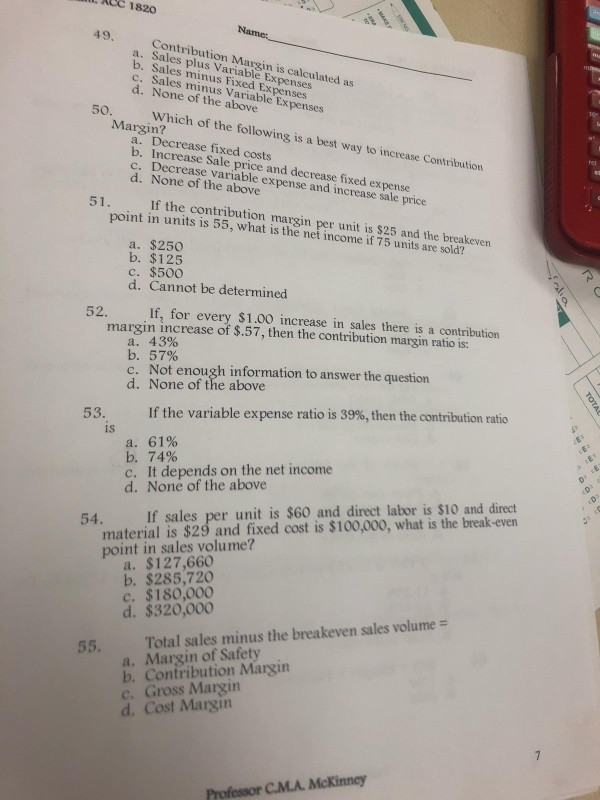

AUC 1820 49 Contribution Margin is calculated as a. Sales plus Variable Expenses b. Sales minus Fixed Expenses c. Sales minus Variable Expenses d. None

AUC 1820 49 Contribution Margin is calculated as a. Sales plus Variable Expenses b. Sales minus Fixed Expenses c. Sales minus Variable Expenses d. None of the above 50 Which of the following is a best way to increase Contribution Margin? a. Decrease fixed costs b. Increase Sale price and decrease fixed expense c. Decrease variab d. None of the above rei le expense and increase sale price 51If pt nts is 55, what is the net income if 7 the contribution margin per unit is $25 and the breakeven units ae sol? a. $250 b. $125 c. $500 d. Cannot be determined 52. If, for every $1.00 increase in sales there is a contribution margin increase of $.57, then the contribution margin ratio is: a. 43% b. 57% c. Not enough information to answer the question d. None of the above 53. If the variable expense ratio is 39%, then the contribution ratio is a. 61% b. 74% c. It depends on the net income d. None of the above material is $29 and fixed cost is $100,000, what is the break-even point in sales volume? 54. If sales per unit is $60 and direct labor is $10 and direct a. $127,660 b. $285,720 c. $180,000 d. $320,000 55. Total sales minus the breakeven sales volume - a. Margin of Safety b. Contribution Margin c. Gross Margin d. Cost Margin Professor C.M.A. McKinney

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started