Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auckland Teddy Bears Manufacturers manufactures stuffed teddy bears being sold locally and internationally. The company currently makes use of an absorption costing system on

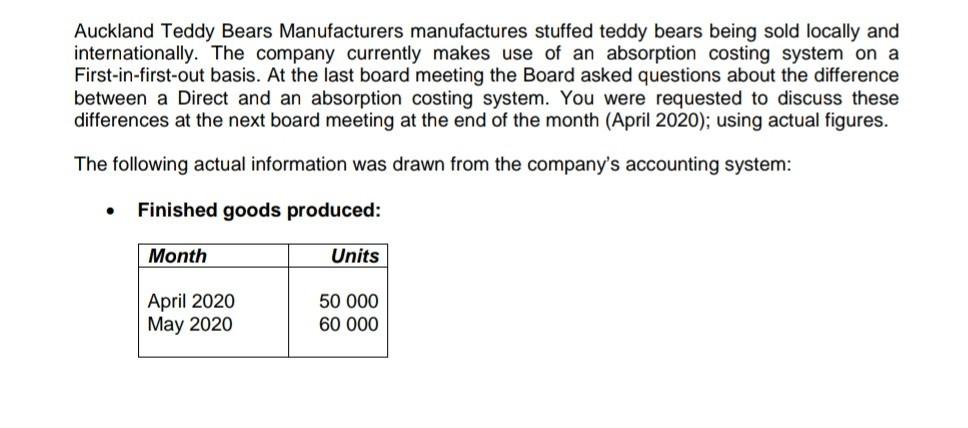

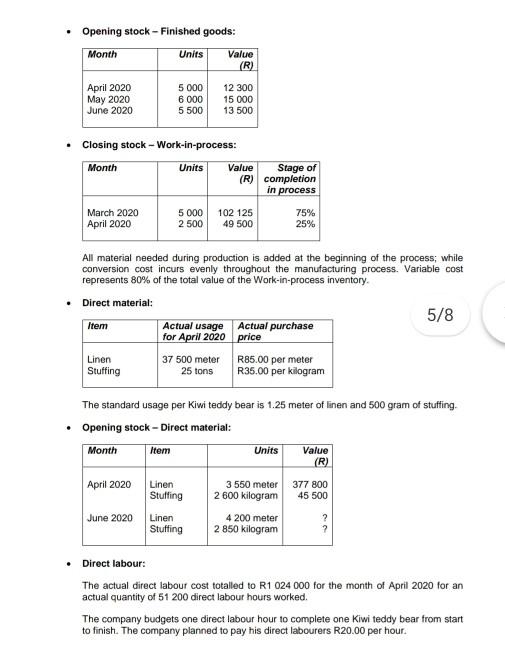

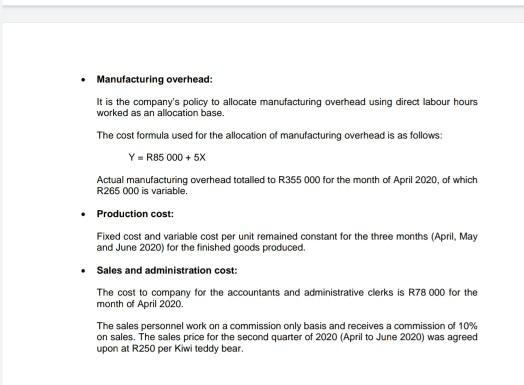

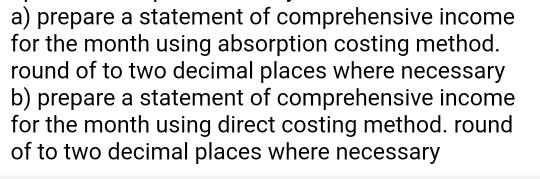

Auckland Teddy Bears Manufacturers manufactures stuffed teddy bears being sold locally and internationally. The company currently makes use of an absorption costing system on a First-in-first-out basis. At the last board meeting the Board asked questions about the difference between a Direct and an absorption costing system. You were requested to discuss these differences at the next board meeting at the end of the month (April 2020); using actual figures. The following actual information was drawn from the company's accounting system: Finished goods produced: Month April 2020 May 2020 Units 50 000 60 000 Opening stock - Finished goods: Month Units April 2020 May 2020 June 2020 March 2020 April 2020 Closing stock - Work-in-process: Month Units Item Linen Stuffing 5 000 6 000 5 500 April 2020 June 2020 All material needed during production is added at the beginning of the process; while conversion cost incurs evenly throughout the manufacturing process. Variable cost represents 80% of the total value of the Work-in-process inventory. Direct material: Actual usage for April 2020 37 500 meter 25 tons Item Value (R) 12 300 15 000 13 500 5 000 102 125 2 500 49 500 Linen Stuffing Value (R) Linen Stuffing Stage of completion in process The standard usage per Kiwi teddy bear is 1.25 meter of linen and 500 gram of stuffing. Opening stock - Direct material: Month Actual purchase price 75% 25% R85.00 per meter R35.00 per kilogram Units 3 550 meter 2 600 kilogram 4 200 meter 2 850 kilogram Value (R) 377 800 45 500 ? 5/8 ? Direct labour: The actual direct labour cost totalled to R1 024 000 for the month of April 2020 for an actual quantity of 51 200 direct labour hours worked. The company budgets one direct labour hour to complete one Kiwi teddy bear from start to finish. The company planned to pay his direct labourers R20.00 per hour. Manufacturing overhead: It is the company's policy to allocate manufacturing overhead using direct labour hours worked as an allocation base. The cost formula used for the allocation of manufacturing overhead is as follows: Y = R85 000 + 5X Actual manufacturing overhead totalled to R355 000 for the month of April 2020, of which R265 000 is variable. Production cost: Fixed cost and variable cost per unit remained constant for the three months (April, May and June 2020) for the finished goods produced. Sales and administration cost: The cost to company for the accountants and administrative clerks is R78 000 for the month of April 2020. The sales personnel work on a commission only basis and receives a commission of 10% on sales. The sales price for the second quarter of 2020 (April to June 2020) was agreed upon at R250 per Kiwi teddy bear. a) prepare a statement of comprehensive income for the month using absorption costing method. round of to two decimal places where necessary b) prepare a statement of comprehensive income for the month using direct costing method. round of to two decimal places where necessary

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Auckland Teddy Bears Manufacturers Statement of Comprehensive Income For the Month ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started