Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AUCW student is considering a coffee shop business after graduating. 1. The student has limited funds and is considering one retail coffee shop in

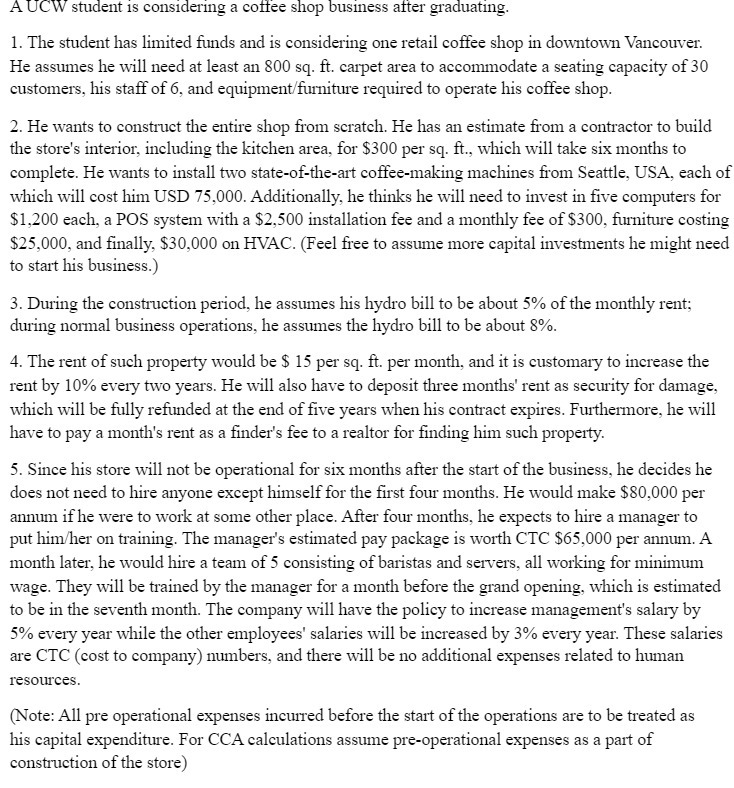

AUCW student is considering a coffee shop business after graduating. 1. The student has limited funds and is considering one retail coffee shop in downtown Vancouver. He assumes he will need at least an 800 sq. ft. carpet area to accommodate a seating capacity of 30 customers, his staff of 6, and equipment/furniture required to operate his coffee shop. 2. He wants to construct the entire shop from scratch. He has an estimate from a contractor to build the store's interior, including the kitchen area, for $300 per sq. ft., which will take six months to complete. He wants to install two state-of-the-art coffee-making machines from Seattle, USA, each of which will cost him USD 75,000. Additionally, he thinks he will need to invest in five computers for $1,200 each, a POS system with a $2,500 installation fee and a monthly fee of $300, furniture costing $25,000, and finally, $30,000 on HVAC. (Feel free to assume more capital investments he might need to start his business.) 3. During the construction period, he assumes his hydro bill to be about 5% of the monthly rent; during normal business operations, he assumes the hydro bill to be about 8%. 4. The rent of such property would be $ 15 per sq. ft. per month, and it is customary to increase the rent by 10% every two years. He will also have to deposit three months' rent as security for damage, which will be fully refunded at the end of five years when his contract expires. Furthermore, he will have to pay a month's rent as a finder's fee to a realtor for finding him such property. 5. Since his store will not be operational for six months after the start of the business, he decides he does not need to hire anyone except himself for the first four months. He would make $80,000 per annum if he were to work at some other place. After four months, he expects to hire a manager to put him/her on training. The manager's estimated pay package is worth CTC $65,000 per annum. A month later, he would hire a team of 5 consisting of baristas and servers, all working for minimum wage. They will be trained by the manager for a month before the grand opening, which is estimated to be in the seventh month. The company will have the policy to increase management's salary by 5% every year while the other employees' salaries will be increased by 3% every year. These salaries are CTC (cost to company) numbers, and there will be no additional expenses related to human resources. (Note: All pre operational expenses incurred before the start of the operations are to be treated as his capital expenditure. For CCA calculations assume pre-operational expenses as a part of construction of the store)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the considerations and calculations required to start the coffee shop business lets break down the information provided stepbystep Step 1 U...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started