Aud Theo

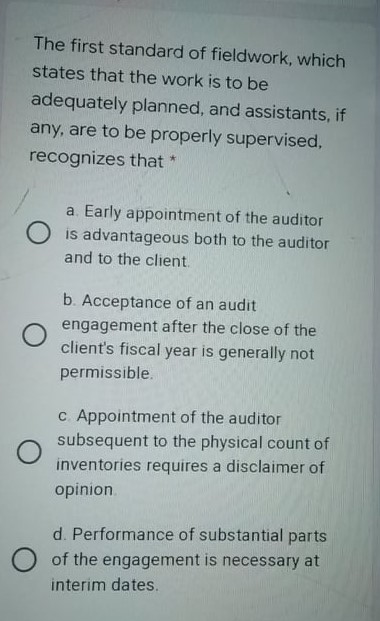

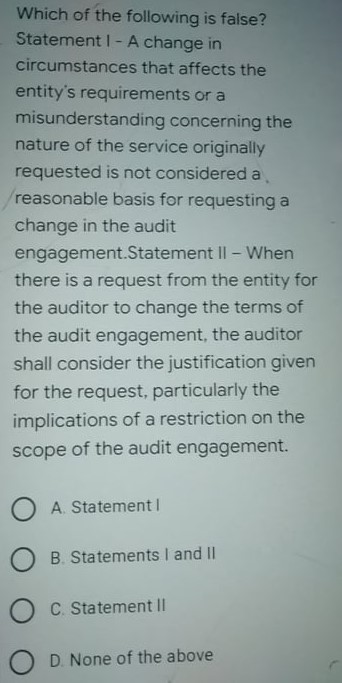

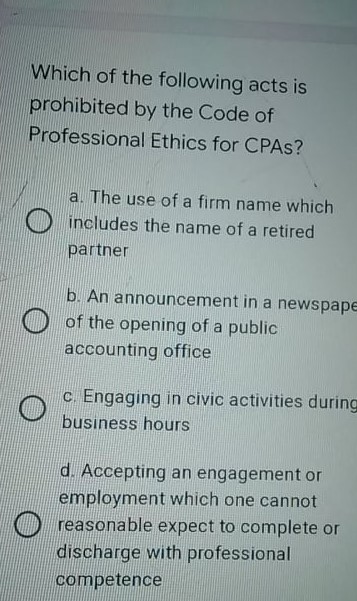

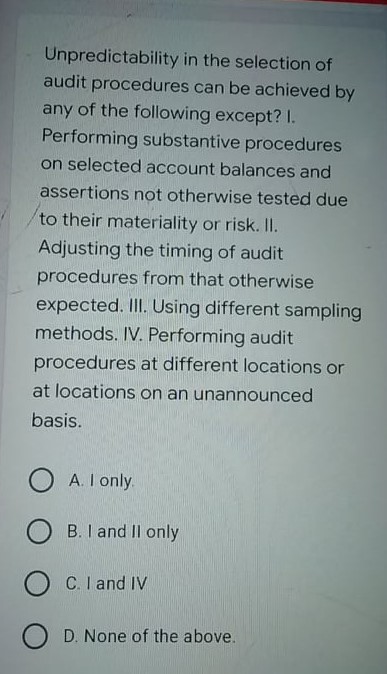

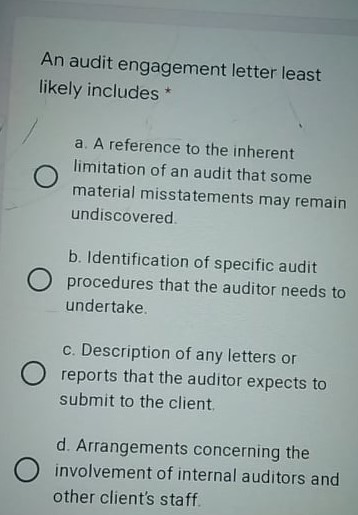

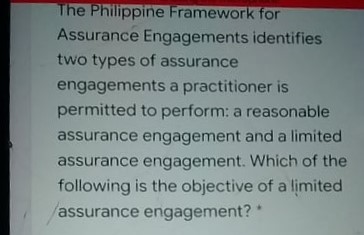

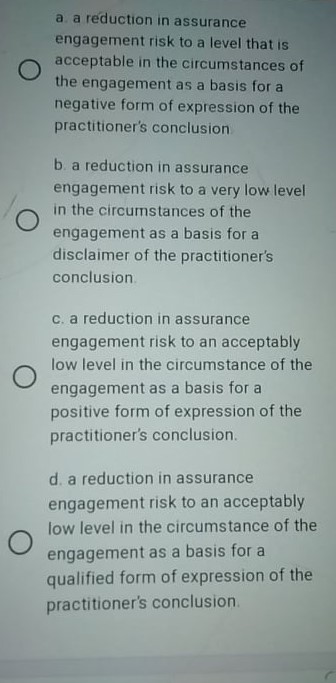

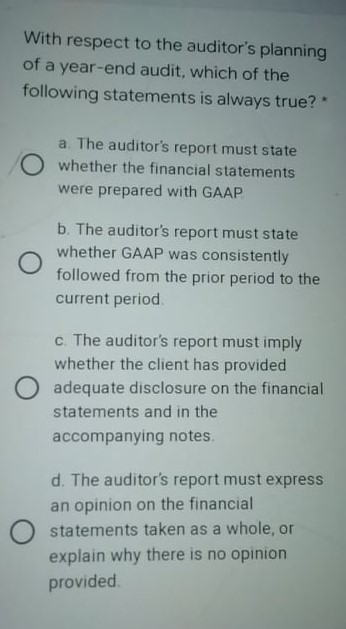

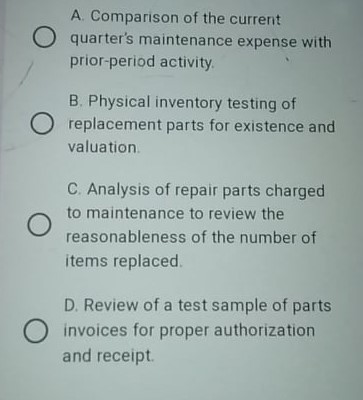

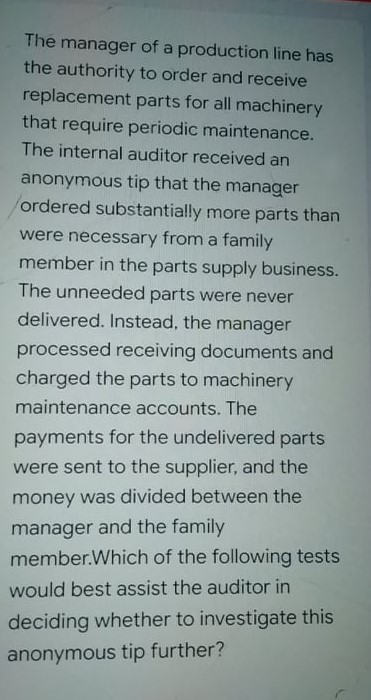

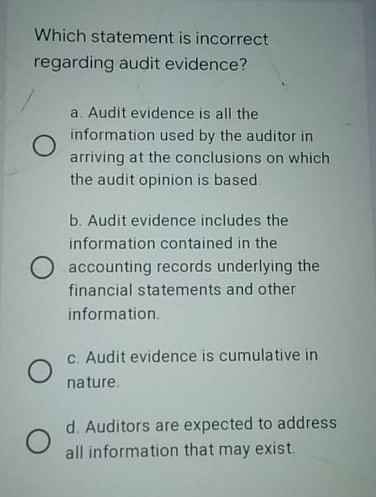

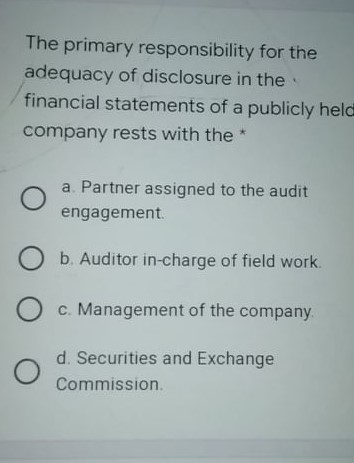

The first standard of fieldwork, which states that the work is to be adequately planned, and assistants, if any, are to be properly supervised, recognizes that * a. Early appointment of the auditor O is advantageous both to the auditor and to the client b. Acceptance of an audit C engagement after the close of the client's fiscal year is generally not permissible. c. Appointment of the auditor O subsequent to the physical count of inventories requires a disclaimer of opinion d. Performance of substantial parts of the engagement is necessary at interim dates.Which of the following is false? Statement | - A change in circumstances that affects the entity's requirements or a misunderstanding concerning the nature of the service originally requested is not considered a reasonable basis for requesting a change in the audit engagement.Statement II - When there is a request from the entity for the auditor to change the terms of the audit engagement, the auditor shall consider the justification given for the request, particularly the implications of a restriction on the scope of the audit engagement. A. Statement / O B. Statements | and II C. Statement II O D. None of the aboveWhich of the following acts is prohibited by the Code of Professional Ethics for CPAs? a. The use of a firm name which includes the name of a retired partner b. An announcement in a newspape of the opening of a public accounting office c Engaging in civic activities during business hours d. Accepting an engagement or employment which one cannot reasonable expect to complete or discharge with professional competenceUnpredictability in the selection of audit procedures can be achieved by any of the following except? I. Performing substantive procedures on selected account balances and assertions not otherwise tested due to their materiality or risk. II. Adjusting the timing of audit procedures from that otherwise expected. Ill. Using different sampling methods. IV. Performing audit procedures at different locations or at locations on an unannounced basis. A. I only O B. I and II only C. I and IV D. None of the above.An audit engagement letter least likely includes * a. A reference to the inherent O limitation of an audit that some material misstatements may remain undiscovered. b. Identification of specific audit O procedures that the auditor needs to undertake. c. Description of any letters or O reports that the auditor expects to submit to the client d. Arrangements concerning the O involvement of internal auditors and other client's staffThe Philippine Framework for Assurance Engagements identifies two types of assurance engagements a practitioner is permitted to perform: a reasonable assurance engagement and a limited assurance engagement. Which of the following is the objective of a limited assurance engagement?a a reduction in assurance engagement risk to a level that is D acceptable in the circumstances of the engagement as a basis for a negative form of expression of the practitioner's conclusion b a reduction in assurance engagement risk to a very low level C in the circumstances of the engagement as a basis for a disclaimer of the practitioner's conclusion c. a reduction in assurance engagement risk to an acceptable O low level in the circumstance of the engagement as a basis for a positive form of expression of the practitioner's conclusion. d. a reduction in assurance engagement risk to an acceptable low level in the circumstance of the engagement as a basis for a qualified form of expression of the practitioner's conclusionWith respect to the auditor's planning of a year-end audit, which of the following statements is always true? * a. The auditor's report must state whether the financial statements were prepared with GAAP b. The auditor's report must state whether GAAP was consistently followed from the prior period to the current period c. The auditor's report must imply whether the client has provided O adequate disclosure on the financial statements and in the accompanying notes d. The auditor's report must express an opinion on the financial statements taken as a whole, or explain why there is no opinion providedA. Comparison of the current O quarter's maintenance expense with prior-period activity B. Physical inventory testing of O replacement parts for existence and valuation. C. Analysis of repair parts charged O to maintenance to review the reasonableness of the number of items replaced. D. Review of a test sample of parts invoices for proper authorization and receipt.The manager of a production line has the authority to order and receive replacement parts for all machinery that require periodic maintenance. The internal auditor received an anonymous tip that the manager ordered substantially more parts than were necessary from a family member in the parts supply business. The unneeded parts were never delivered. Instead, the manager processed receiving documents and charged the parts to machinery maintenance accounts. The payments for the undelivered parts were sent to the supplier, and the money was divided between the manager and the family member.Which of the following tests would best assist the auditor in deciding whether to investigate this anonymous tip further?Which statement is incorrect regarding audit evidence? a. Audit evidence is all the O information used by the auditor in arriving at the conclusions on which the audit opinion is based b. Audit evidence includes the information contained in the O accounting records underlying the financial statements and other information. O c. Audit evidence is cumulative in nature. d. Auditors are expected to address O all information that may exist.The primary responsibility for the adequacy of disclosure in the financial statements of a publicly held company rests with the * a Partner assigned to the audit engagement. O b. Auditor in-charge of field work O c. Management of the company d. Securities and Exchange Commission