Question

Audit Procedures : Compare the current-year accounts receivable balance to the prior-years balances after adjusting for any increase or decrease in sales and other economic

Audit Procedures :

Compare the current-year accounts receivable balance to the prior-years balances after adjusting for any increase or decrease in sales and other economic factors.

reperform the aging of accounts receivable. Again, because the auditor creates this type of evidence, it is normally viewed as highly reliable.

recomputed of accrued interest

obtaining an electronic file from the company and using computer-assisted audit techniques, to check the accuracy of the summarization of the file Send a report to a consignee to verify that an entitys inventory has been consigned.

Send a letter to the firm's bank to obtain the correct balances ask the internal auditor to explain the entity and its environment including internal control involves informal oral questions from the employees in the production department monitoring of the counting of inventories by the entitys personnel counting cash on hand count marketable securities sample of purchase transactions included in the purchases journal and ensure that they are supported by receiving documents The auditor ensure that the inventory is recorded in the perpetual inventory records. Compare the detail of a total balance with similar detail for the preceding year the auditor compare the price on an invoice to an approved price list

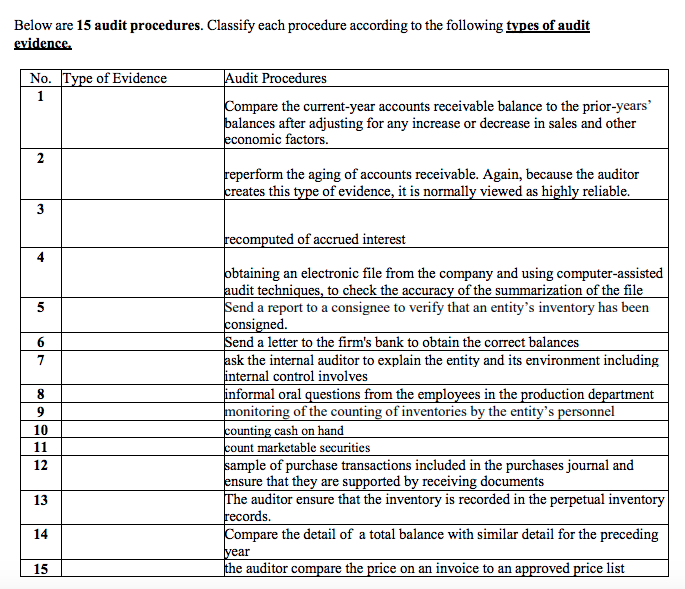

Below are 15 audit procedures. Classify each procedure according to the following types of audit evidence. No. Type of Evidence 1 Audit Procedures Compare the current-year accounts receivable balance to the prior-years' balances after adjusting for any increase or decrease in sales and other economic factors. reperform the aging of accounts receivable. Again, because the auditor creates this type of evidence, it is normally viewed as highly reliable. 2 3 recomputed of accrued interest 4 5 7 8 9 10 11 12 obtaining an electronic file from the company and using computer-assisted audit techniques, to check the accuracy of the summarization of the file Send a report to a consignee to verify that an entity's inventory has been consigned Send a letter to the firm's bank to obtain the correct balances ask the internal auditor to explain the entity and its environment including internal control involves informal oral questions from the employees in the production department monitoring of the counting of inventories by the entity's personnel counting cash on hand count marketable securities sample of purchase transactions included in the purchases journal and ensure that they are supported by receiving documents The auditor ensure that the inventory is recorded in the perpetual inventory records. Compare the detail of a total balance with similar detail for the preceding 13 14 year 15 the auditor compare the price on an invoice to an approved price list

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started