Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Going Concern Assessment The going concern concept is fundamental in accounting, implying that a company will continue to operate indefinitely unless there

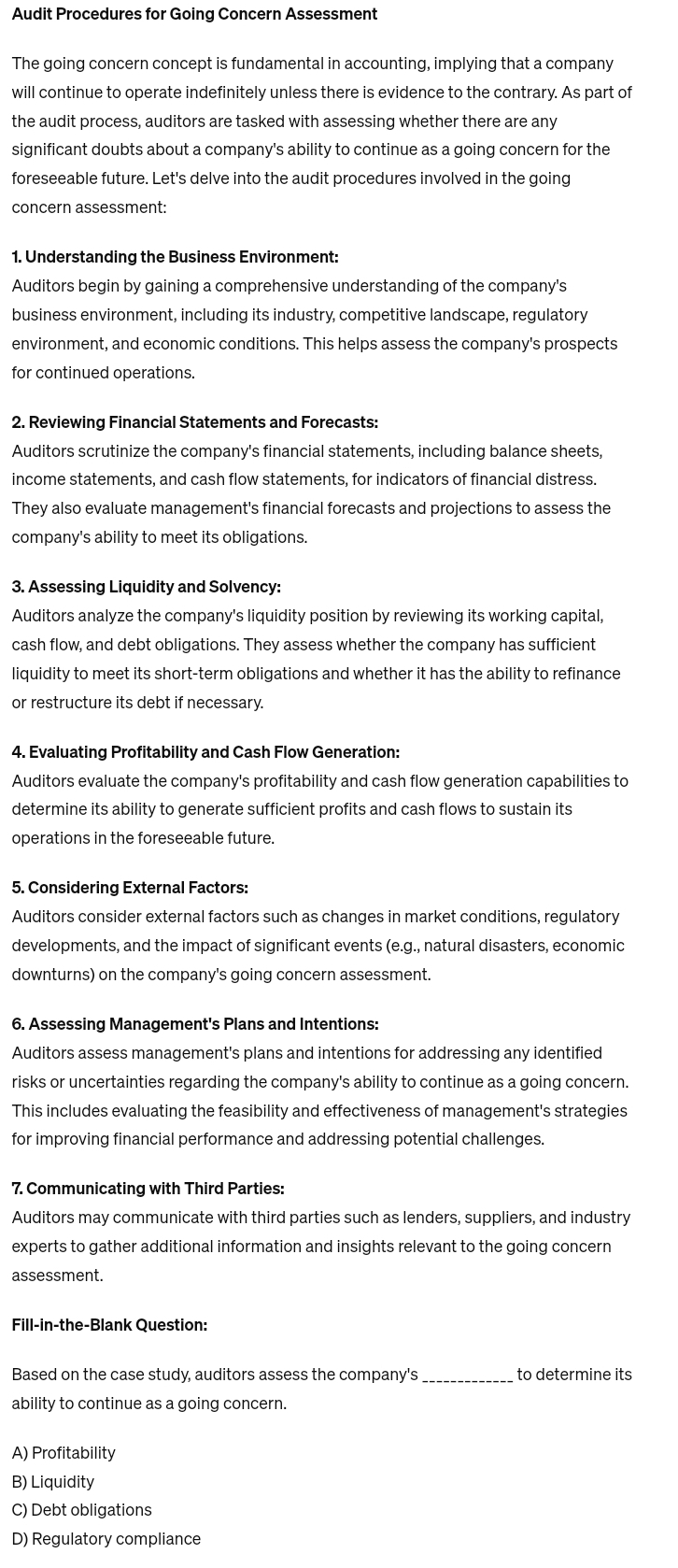

Audit Procedures for Going Concern Assessment

The going concern concept is fundamental in accounting, implying that a company will continue to operate indefinitely unless there is evidence to the contrary. As part of the audit process, auditors are tasked with assessing whether there are any significant doubts about a company's ability to continue as a going concern for the foreseeable future. Let's delve into the audit procedures involved in the going concern assessment:

Understanding the Business Environment:

Auditors begin by gaining a comprehensive understanding of the company's business environment, including its industry, competitive landscape, regulatory environment, and economic conditions. This helps assess the company's prospects for continued operations.

Reviewing Financial Statements and Forecasts:

Auditors scrutinize the company's financial statements, including balance sheets, income statements, and cash flow statements, for indicators of financial distress. They also evaluate management's financial forecasts and projections to assess the company's ability to meet its obligations.

Assessing Liquidity and Solvency:

Auditors analyze the company's liquidity position by reviewing its working capital, cash flow, and debt obligations. They assess whether the company has sufficient liquidity to meet its shortterm obligations and whether it has the ability to refinance or restructure its debt if necessary.

Evaluating Profitability and Cash Flow Generation:

Auditors evaluate the company's profitability and cash flow generation capabilities to determine its ability to generate sufficient profits and cash flows to sustain its operations in the foreseeable future.

Considering External Factors:

Auditors consider external factors such as changes in market conditions, regulatory developments, and the impact of significant events eg natural disasters, economic downturns on the company's going concern assessment.

Assessing Management's Plans and Intentions:

Auditors assess management's plans and intentions for addressing any identified risks or uncertainties regarding the company's ability to continue as a going concern. This includes evaluating the feasibility and effectiveness of management's strategies for improving financial performance and addressing potential challenges.

Communicating with Third Parties:

Auditors may communicate with third parties such as lenders, suppliers, and industry experts to gather additional information and insights relevant to the going concern assessment.

FillintheBlank Question:

Based on the case study, auditors assess the company's

to determine its ability to continue as a going concern.

A Profitability

B Liquidity

C Debt obligations

D Regulatory compliance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started