Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Not - for - Profit Organizations: Audit procedures for not - for - profit organizations ( NPOs ) focus on ensuring compliance

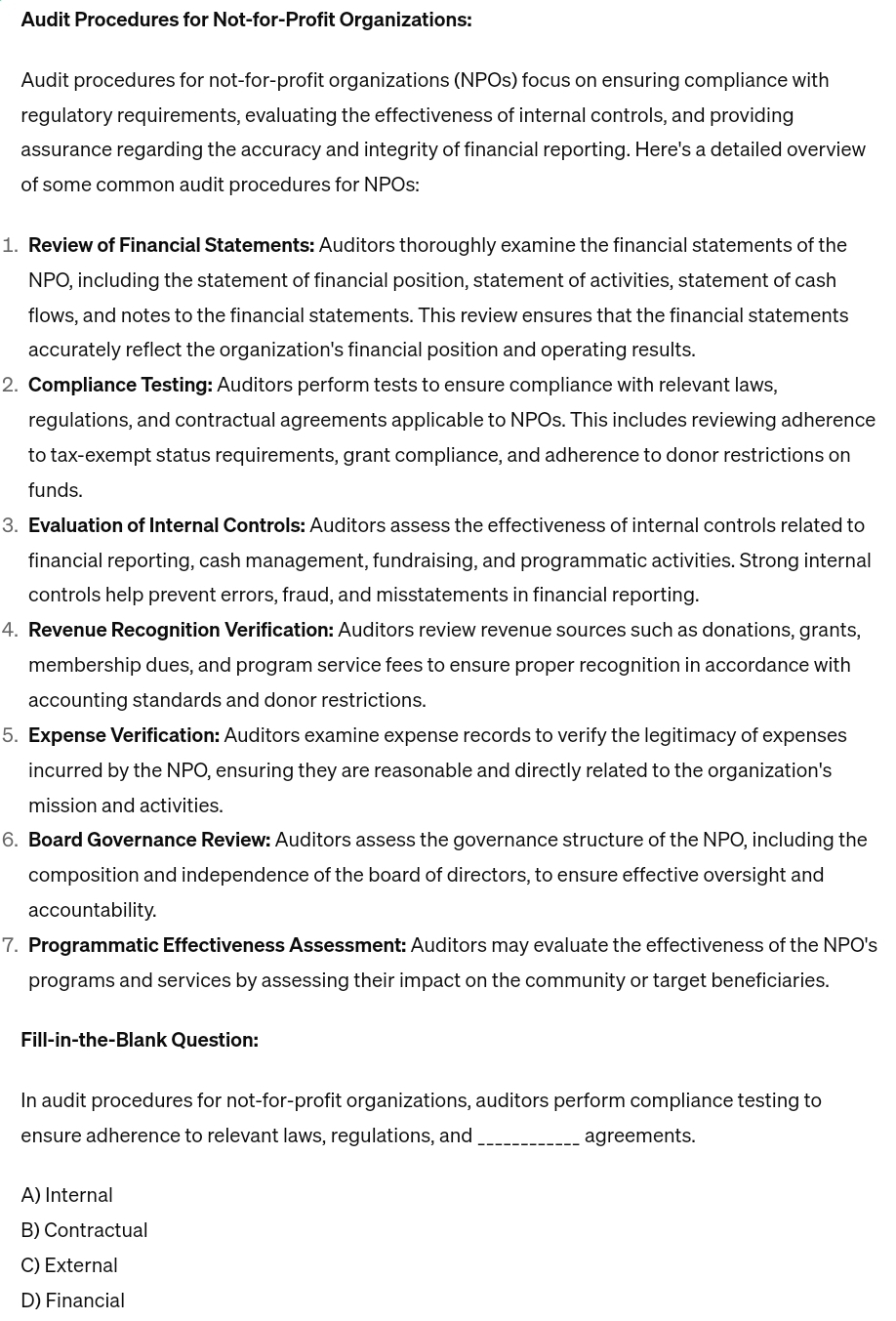

Audit Procedures for NotforProfit Organizations:

Audit procedures for notforprofit organizations NPOs focus on ensuring compliance with regulatory requirements, evaluating the effectiveness of internal controls, and providing assurance regarding the accuracy and integrity of financial reporting. Here's a detailed overview of some common audit procedures for NPOs:

Review of Financial Statements: Auditors thoroughly examine the financial statements of the NPO, including the statement of financial position, statement of activities, statement of cash flows, and notes to the financial statements. This review ensures that the financial statements accurately reflect the organization's financial position and operating results.

Compliance Testing: Auditors perform tests to ensure compliance with relevant laws, regulations, and contractual agreements applicable to NPOs. This includes reviewing adherence to taxexempt status requirements, grant compliance, and adherence to donor restrictions on funds.

Evaluation of Internal Controls: Auditors assess the effectiveness of internal controls related to financial reporting, cash management, fundraising, and programmatic activities. Strong internal controls help prevent errors, fraud, and misstatements in financial reporting.

Revenue Recognition Verification: Auditors review revenue sources such as donations, grants, membership dues, and program service fees to ensure proper recognition in accordance with accounting standards and donor restrictions.

Expense Verification: Auditors examine expense records to verify the legitimacy of expenses incurred by the NPO, ensuring they are reasonable and directly related to the organization's mission and activities.

Board Governance Review: Auditors assess the governance structure of the NPO, including the composition and independence of the board of directors, to ensure effective oversight and accountability.

Programmatic Effectiveness Assessment: Auditors may evaluate the effectiveness of the NPO's programs and services by assessing their impact on the community or target beneficiaries.

FillintheBlank Question:

In audit procedures for notforprofit organizations, auditors perform compliance testing to ensure adherence to relevant laws, regulations, and agreements.

A Internal

B Contractual

C External

D Financial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started