Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Service Companies: Audit procedures for service companies focus on evaluating the accuracy of financial statements, internal controls, and compliance with regulatory requirements

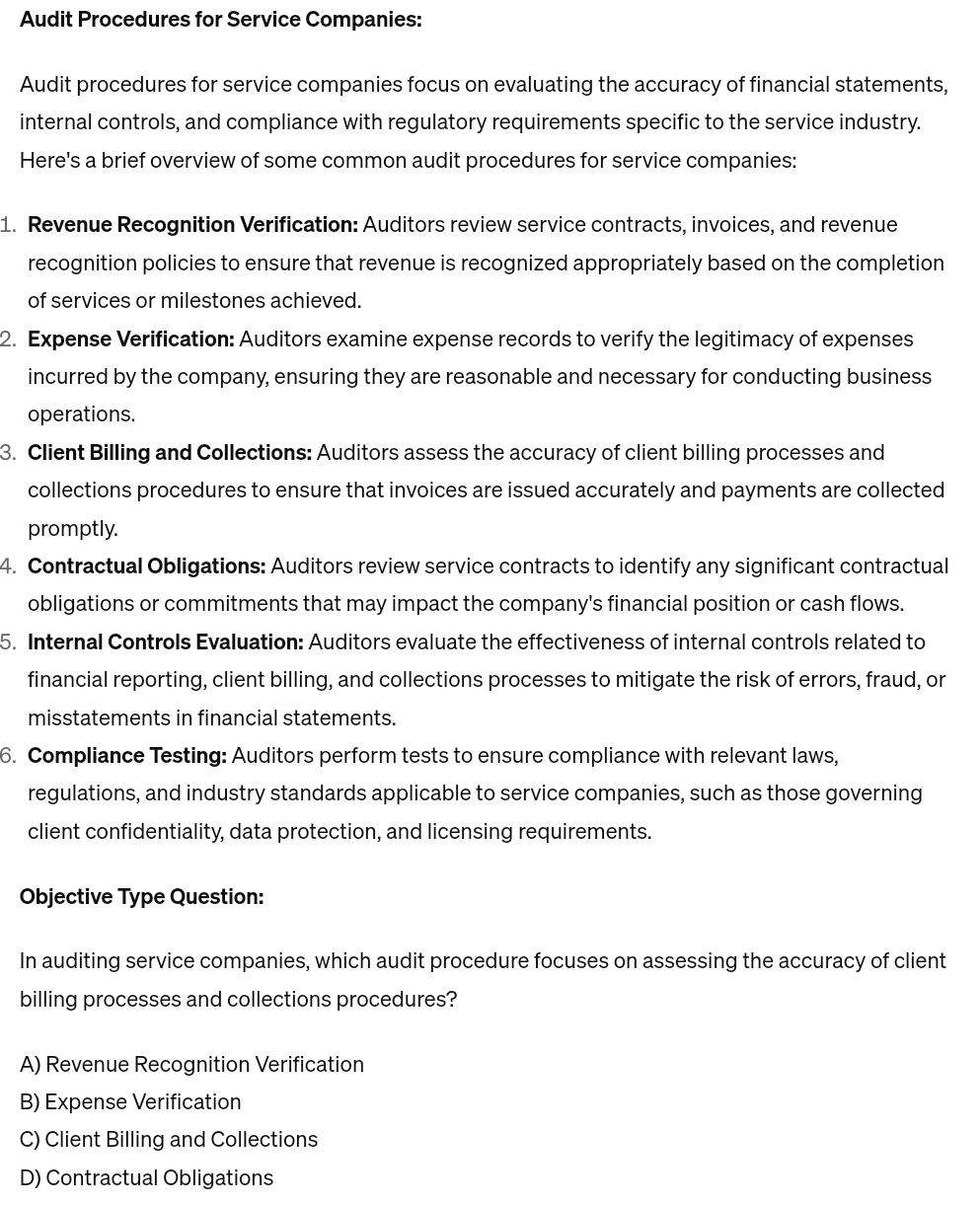

Audit Procedures for Service Companies:

Audit procedures for service companies focus on evaluating the accuracy of financial statements, internal controls, and compliance with regulatory requirements specific to the service industry.

Here's a brief overview of some common audit procedures for service companies:

Revenue Recognition Verification: Auditors review service contracts, invoices, and revenue recognition policies to ensure that revenue is recognized appropriately based on the completion of services or milestones achieved.

Expense Verification: Auditors examine expense records to verify the legitimacy of expenses incurred by the company, ensuring they are reasonable and necessary for conducting business operations.

Client Billing and Collections: Auditors assess the accuracy of client billing processes and collections procedures to ensure that invoices are issued accurately and payments are collected promptly.

Contractual Obligations: Auditors review service contracts to identify any significant contractual obligations or commitments that may impact the company's financial position or cash flows.

Internal Controls Evaluation: Auditors evaluate the effectiveness of internal controls related to financial reporting, client billing, and collections processes to mitigate the risk of errors, fraud, or misstatements in financial statements.

Compliance Testing: Auditors perform tests to ensure compliance with relevant laws, regulations, and industry standards applicable to service companies, such as those governing client confidentiality, data protection, and licensing requirements.

Objective Type Question:

In auditing service companies, which audit procedure focuses on assessing the accuracy of client billing processes and collections procedures?

A Revenue Recognition Verification

B Expense Verification

C Client Billing and Collections

D Contractual Obligations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started