Question

Audit Program Audit work steps / procedures are clearly stated and listed for each asset and liability, formatted in a table. Assets: Total comprehensive

Audit Program – Audit work steps / procedures are clearly stated and listed for each asset and liability, formatted in a table.

Assets:

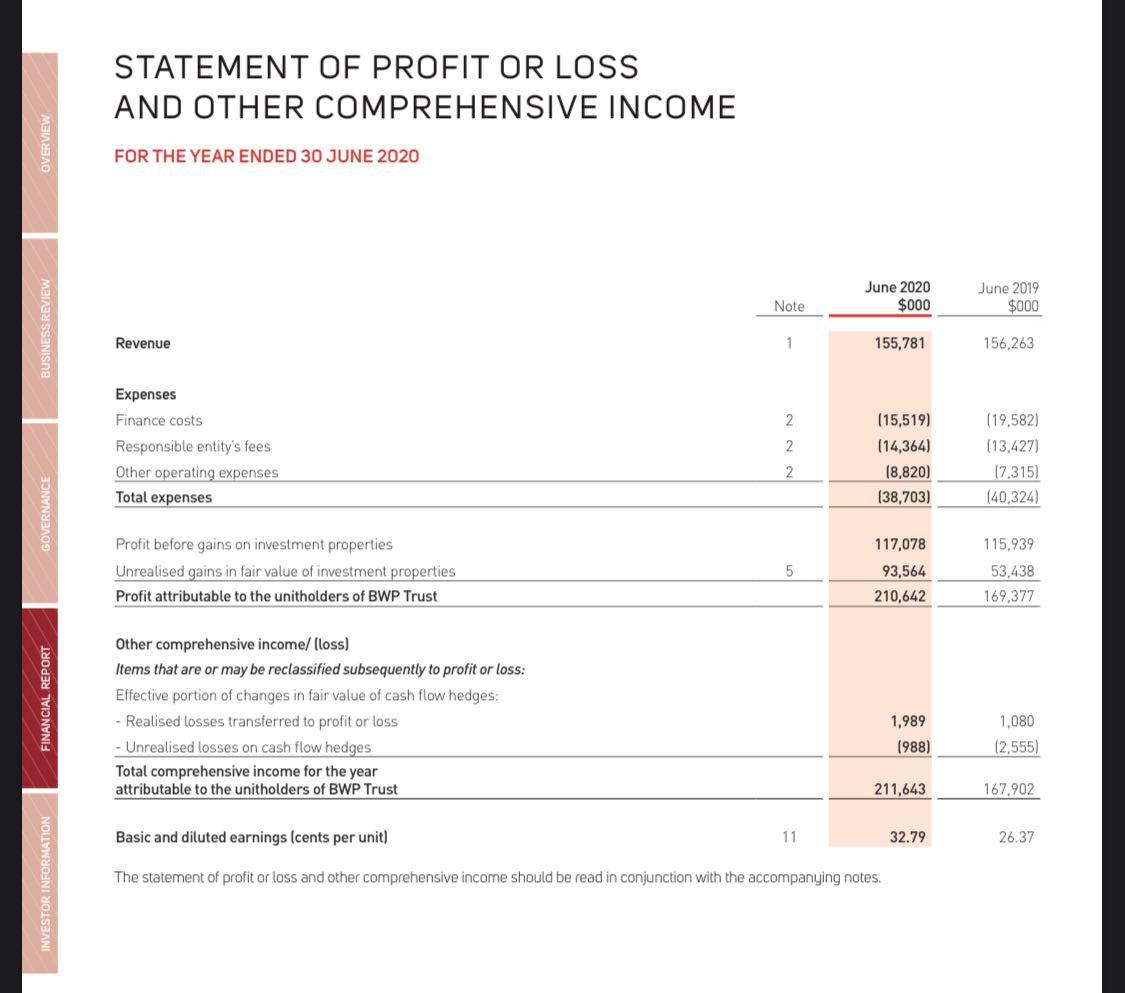

Total comprehensive income for the year (Profit before tax) $211,643,000 (pg28)

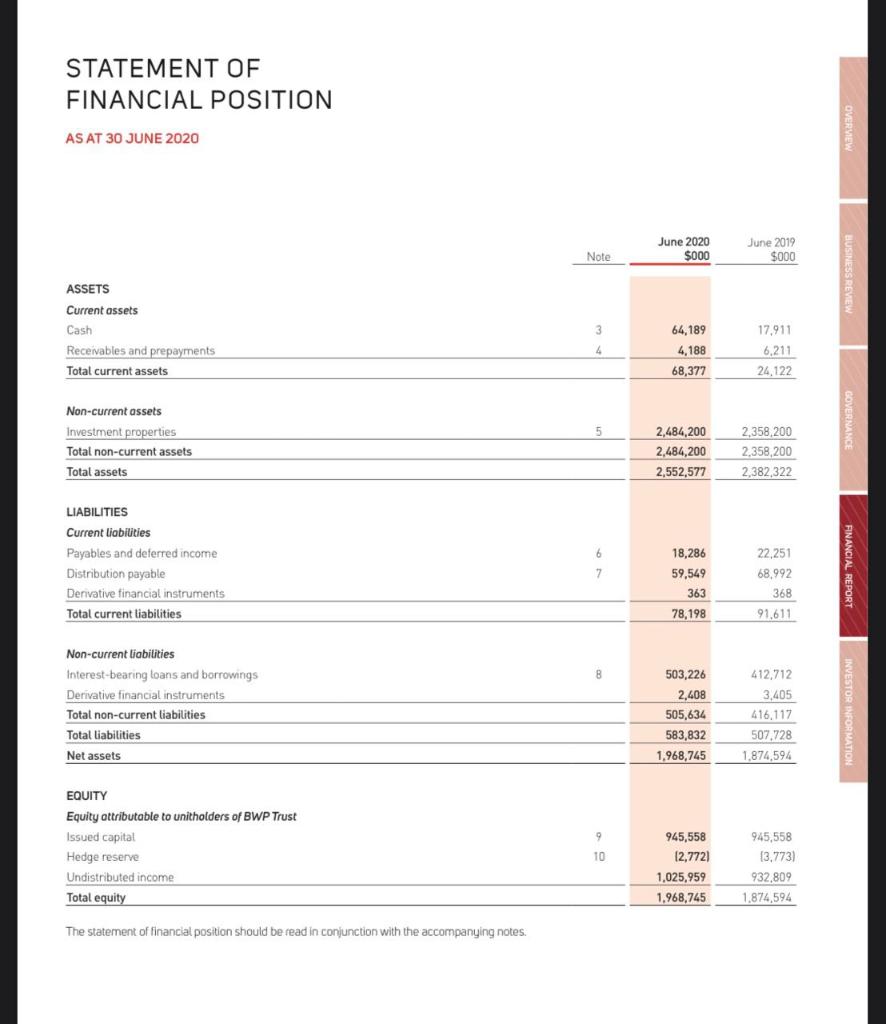

Investment properties $2,484,200,000 (pg 29)

Total Assets $2,552,577,000 (pg29)

Net Assets $1,968,745,000 (pg29)

Receivables and prepayments $68,377,000 (pg29)

Liabilities:

Derivative financial instruments $363,000 (pg29)

Interest-bearing loans and borrowings $503,226,000 (pg29)

Derivative financial instruments $2,408,000 (pg29)

Payable and deferred income $18,286,000(pg29)

Total liabilities $583,832,000 (pg29)

OVERVIEW BUSINESS REVIEW GOVERNANCE FINANCIAL REPORT INVESTOR INFORMATION STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 Revenue Expenses Finance costs Responsible entity's fees Other operating expenses Total expenses Profit before gains on investment properties Unrealised gains in fair value of investment properties Profit attributable to the unitholders of BWP Trust Other comprehensive income/ [loss) Items that are or may be reclassified subsequently to profit or loss: Effective portion of changes in fair value of cash flow hedges: - Realised losses transferred to profit or loss Unrealised losses on cash flow hedges Total comprehensive income for the year attributable to the unitholders of BWP Trust Note 1 22 2 5 June 2020 $000 11 155,781 (15,519) (14,364) (8,820) (38,703) 117,078 93,564 210,642 Basic and diluted earnings (cents per unit) The statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes. 1,989 (988) 211,643 32.79 June 2019 $000 156,263 (19,582) (13,427) (7,315) (40,324) 115,939 53,438 169,377 1,080 (2,555) 167,902 26.37

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Audit procedures are the processes and methods auditors use to obtain sufficient appropriate audit evidence to give their professional judgment about the effectiveness of an organizations internal con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started