Question: AUDITING AND ASSURANCE SERVICES - QUESTION 11 - PLEASE AND THANK YOU! (BOTH QUESTION ANSWERS MUST BE 100-200 WORDS LONG) QUESTION 11. Explain why the

AUDITING AND ASSURANCE SERVICES - QUESTION 11 - PLEASE AND THANK YOU! (BOTH QUESTION ANSWERS MUST BE 100-200 WORDS LONG)

QUESTION 11. Explain why the "non-negligence" defense under common law is often the best one against a third-party lawsuit. Compare it with each of the other available defenses. (100-200 WORDS)

This question is referring to a chapter 5 power point slide:

The Slides have a transcript that describes the topics. The transcript is as follows:

Slide 6:

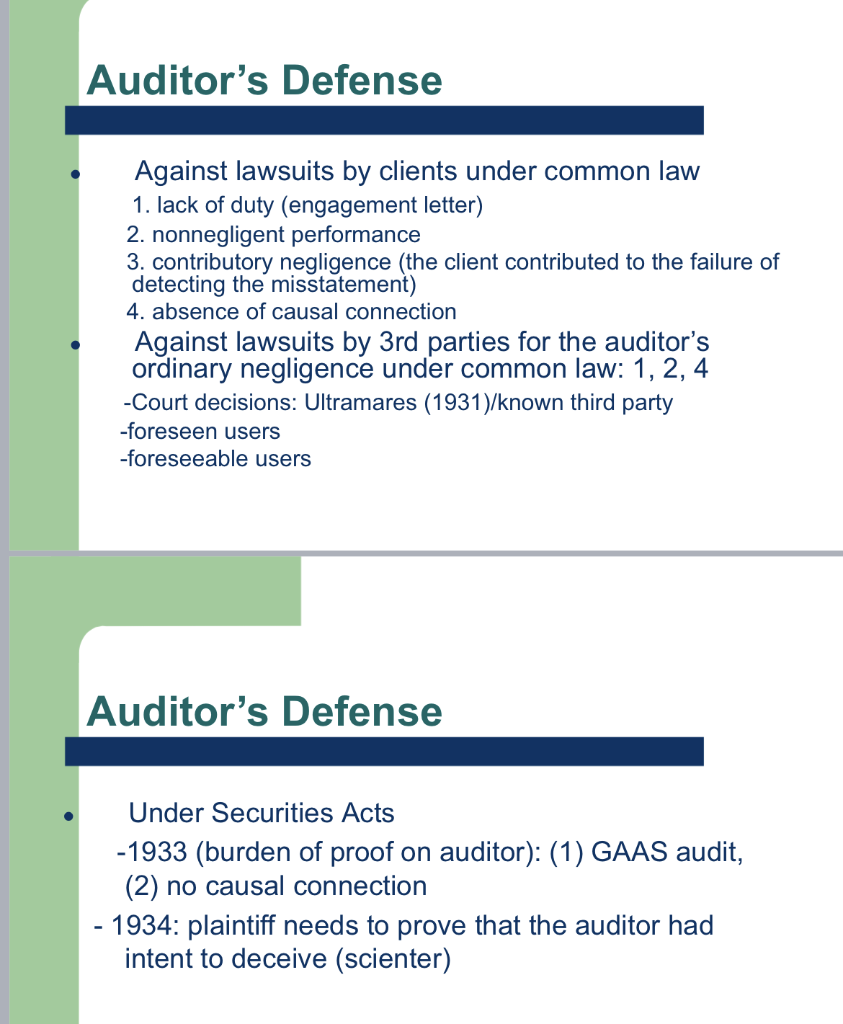

Now lets look at the auditors defense under common law.

If your client company sued you under common law, the first defense you can use is "lack of duty" or "lack of privity." The latter is a legal term meaning that there is no contract for you to perform the duty. The audit contract is in the form of an "audit engagement letter," which describes what job and responsibilities the auditor is contracted to perform and under what terms. No contract, no liability. Note that the US contract law recognizes both oral and written contracts.

The second defense is "non-negligent performance." With this you argue that you performed a GAAS audit.

The third defense is "contributory negligence." With this you argue that the client contributed to your failure to detect the misstatement. For example, there were client imposed scope limitations.

The fourth defense is "absence of causal connection." Let me give you an example of how to use this defense. Lets say there were two things happened: one was that the auditor failed to complete the audit on time, and the other was that the bank denied a loan to the company. The company sued the auditor for causing the bank to deny the loan. The auditor then may argue that the banks loan decision had nothing to do with the delay of the audit, and that the loan decision was based purely on the ongoing relationship between the bank and the company.

Now, if a third party sued you under common law, the situation is a little complicated. The key issue here is whether or not the auditor is liable for the third party if the auditor committed ordinary negligence. The common law has evolved quite significantly on this. There are a lot of complicated court rulings concerning audit. The good news is that in this class you are only required to know just one court ruling, a very important and a very old one. You need to learn this grandfather court ruling because you need to know how much has changed -- how the law today is different from the famous old one.

It was the "Ultramares" case in 1931. On p. 122, there is a brief description of the case in Fig. 5-4. According to the court ruling of this case, auditors are liable for a third party for committing ordinary negligence if the third party is a primary beneficiary of whom the auditor was informed before conducting the audit. Today, in contrast, a third party is able to sue the auditor for committing ordinary negligence and win the case if the third party is a "foreseen user" -- which means that the suing third party now does not have to be known to the auditor.

The broadest concept of the eligible third party is that of "foreseeable user," which is found in the court rulings in a couple of states. The state of Mississippi is one of them. Under this concept, almost any third party can sue the auditor for committing ordinary negligence.

If you get sued by a third party, you can use defenses 1, 2 and 4, but not 3, because you are now dealing with a third party, not your client company.

Slide 7:

The last topic of the chapter is auditors defense under security laws. Only two security laws need to be discussed here: The Securities Act of 1933 and the Securities Exchange Act of 1934. I guess many of you are already familiar with these two security laws.

Auditors responsibilities are quite different under the two security Acts. Auditors responsibilities are much heavier under 1933 Act which deals with initial public offerings of securities. Under this Act any shareholder can sue the auditor if (1) the plaintiff suffered a loss from the security purchased, and (2) that there is at least one material misstatement in the audited financial statements. The plaintiff does not need to provide or prove anything else.

To defend, the auditor has "the burden of proof" that she performed a GAAS audit, or that the loss was not caused by the misstatement in the financial statements. As you can see, auditors have a tough job defending themselves under 1933 Act.

Under the 1934 Act, auditors feel a little relieved because "the burden of proof" is now on the plaintiff to prove that the auditor was intentionally deceiving. The legal term for intentional deceiving is "scienter." "Scienter" can be fraud or constructive fraud (check Table 5-1 on p. 119) for the definitions of "fraud" and "constructive fraud," and of other terms used in this chapter). Note that sometimes it is difficult to distinguish "constructive fraud" and "gross negligence." Legal terms are subject to interpretations. Legal matters can easily get quite complicated. That's why there are so many lawyers in this country.

CHAPTER 5 CONCEPTS FROM BOOK:

thank you all for giving the time to help with my questions!

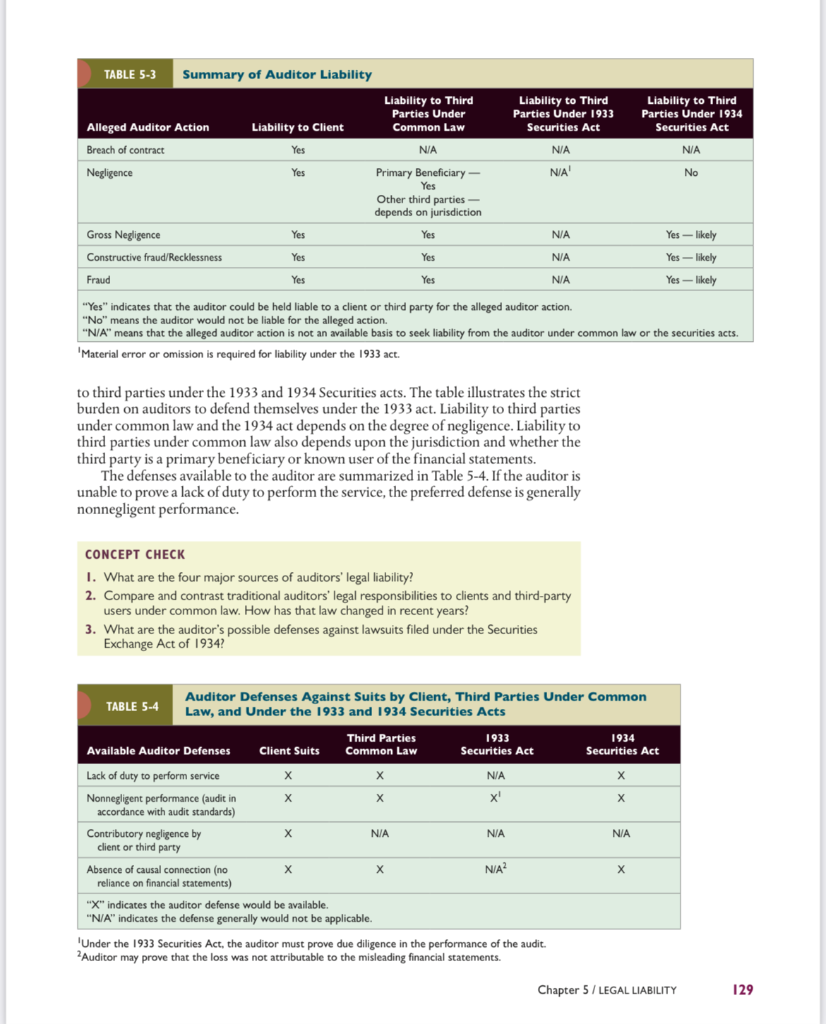

Auditor's Defense Against lawsuits by clients under common law 1. lack of duty (engagement letter) 2. nonnegligent performance 3. contributory negligence (the client contributed to the failure of detecting the misstatement) 4. absence of causal connection Against lawsuits by 3rd parties for the auditor's ordinary negligence under common law: 1, 2, 4 -Court decisions: Ultramares (1931)/known third party -foreseen users -foreseeable users Auditor's Defense Under Securities Acts -1933 (burden of proof on auditor): (1) GAAS audit, (2) no causal connection - 1934: plaintiff needs to prove that the auditor had intent to deceive (scienter) TABLE 5-3 Summary of Auditor Liability Liability to Third Parties Under Common Law Liability to Third Parties Under 1933 Securities Act Liability to Third Parties Under 1934 Securities Act Alleged Auditor Action Breach of contract Liability to Client Yes N/A N/A Negligence Yes NA No Primary Beneficiary - Yes Other third parties - depends on jurisdiction Yes Yes N/A Gross Negligence Constructive fraud/Recklessness Yes -- likely Yes - likely Yes Yes NA Fraud Yes Yes NA Yes - likely "Yes" indicates that the auditor could be held liable to a client or third party for the alleged auditor action. "No" means the auditor would not be liable for the alleged action. "N/A" means that the alleged auditor action is not an available basis to seek liability from the auditor under common law or the securities acts. 'Material error or omission is required for liability under the 1933 act. to third parties under the 1933 and 1934 Securities acts. The table illustrates the strict burden on auditors to defend themselves under the 1933 act. Liability to third parties under common law and the 1934 act depends on the degree of negligence. Liability to third parties under common law also depends upon the jurisdiction and whether the third party is a primary beneficiary or known user of the financial statements. The defenses available to the auditor are summarized in Table 5-4. If the auditor is unable to prove a lack of duty to perform the service, the preferred defense is generally nonnegligent performance. CONCEPT CHECK 1. What are the four major sources of auditors' legal liability? 2. Compare and contrast traditional auditors' legal responsibilities to clients and third-party users under common law. How has that law changed in recent years? 3. What are the auditor's possible defenses against lawsuits filed under the Securities Exchange Act of 1934? Auditor Defenses Against Suits by Client, Third Parties Under Common TABLE 5-4 Law, and Under the 1933 and 1934 Securities Acts Third Parties 1933 1934 Available Auditor Defenses Client Suits Common Law Securities Act Securities Act Lack of duty to perform service X x N/A x Nonnegligent performance (audit in x! accordance with audit standards) Contributory negligence by N/A NA N/A client or third party Absence of causal connection (no X NA? reliance on financial statements) "X" indicates the auditor defense would be available. "N/A" indicates the defense generally would not be applicable. Under the 1933 Securities Act, the auditor must prove due diligence in the performance of the audit. 2 Auditor may prove that the loss was not attributable to the misleading financial statements. Chapter 5 / LEGAL LIABILITY 129 Auditor's Defense Against lawsuits by clients under common law 1. lack of duty (engagement letter) 2. nonnegligent performance 3. contributory negligence (the client contributed to the failure of detecting the misstatement) 4. absence of causal connection Against lawsuits by 3rd parties for the auditor's ordinary negligence under common law: 1, 2, 4 -Court decisions: Ultramares (1931)/known third party -foreseen users -foreseeable users Auditor's Defense Under Securities Acts -1933 (burden of proof on auditor): (1) GAAS audit, (2) no causal connection - 1934: plaintiff needs to prove that the auditor had intent to deceive (scienter) TABLE 5-3 Summary of Auditor Liability Liability to Third Parties Under Common Law Liability to Third Parties Under 1933 Securities Act Liability to Third Parties Under 1934 Securities Act Alleged Auditor Action Breach of contract Liability to Client Yes N/A N/A Negligence Yes NA No Primary Beneficiary - Yes Other third parties - depends on jurisdiction Yes Yes N/A Gross Negligence Constructive fraud/Recklessness Yes -- likely Yes - likely Yes Yes NA Fraud Yes Yes NA Yes - likely "Yes" indicates that the auditor could be held liable to a client or third party for the alleged auditor action. "No" means the auditor would not be liable for the alleged action. "N/A" means that the alleged auditor action is not an available basis to seek liability from the auditor under common law or the securities acts. 'Material error or omission is required for liability under the 1933 act. to third parties under the 1933 and 1934 Securities acts. The table illustrates the strict burden on auditors to defend themselves under the 1933 act. Liability to third parties under common law and the 1934 act depends on the degree of negligence. Liability to third parties under common law also depends upon the jurisdiction and whether the third party is a primary beneficiary or known user of the financial statements. The defenses available to the auditor are summarized in Table 5-4. If the auditor is unable to prove a lack of duty to perform the service, the preferred defense is generally nonnegligent performance. CONCEPT CHECK 1. What are the four major sources of auditors' legal liability? 2. Compare and contrast traditional auditors' legal responsibilities to clients and third-party users under common law. How has that law changed in recent years? 3. What are the auditor's possible defenses against lawsuits filed under the Securities Exchange Act of 1934? Auditor Defenses Against Suits by Client, Third Parties Under Common TABLE 5-4 Law, and Under the 1933 and 1934 Securities Acts Third Parties 1933 1934 Available Auditor Defenses Client Suits Common Law Securities Act Securities Act Lack of duty to perform service X x N/A x Nonnegligent performance (audit in x! accordance with audit standards) Contributory negligence by N/A NA N/A client or third party Absence of causal connection (no X NA? reliance on financial statements) "X" indicates the auditor defense would be available. "N/A" indicates the defense generally would not be applicable. Under the 1933 Securities Act, the auditor must prove due diligence in the performance of the audit. 2 Auditor may prove that the loss was not attributable to the misleading financial statements. Chapter 5 / LEGAL LIABILITY 129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts