Question

AUDITING AND ASSURANCE SERVICES QUESTION 3 PLEASE AND THANK YOU! (BOTH QUESTION ANSWERS MUST BE 100-200 WORDS LONG) The following 2 questions are on detailed

AUDITING AND ASSURANCE SERVICES QUESTION 3 PLEASE AND THANK YOU! (BOTH QUESTION ANSWERS MUST BE 100-200 WORDS LONG)

The following 2 questions are on detailed reporting. You need to go to Ch. 3 handout and read these reports in detail to answer these two questions.

QUESTION 3. How does a disclaimer report due to scope limitation differ from adverse report due to Non-GAAP?

I sent you two word files: the PCAOB new reporting models and a summary of reporting rules. These two documents, my slides and my lecture notes are the primary learning material of this chapter. The PCAOB issued a new reporting model which is now required in practice.

An example of an adverse opinion due to non-GAAP:

Opinion on the Financial Statements

We have audited the accompanying balance sheets of X Company (the "Company") as of December 31, 20X2 and 20X1, the related statements of [titles of the financial statements, e.g., income, comprehensive income, stockholders' equity, and cash flows] for each of the years then ended, and the related notes [and schedules] (collectively referred to as the "financial statements"). In our opinion, because of the effects of the matters discussed in the preceding following paragraphs, the financial statements do not present fairly, in conformity with accounting principles generally accepted in the United States of America, the financial position of the Company as of December 31, 20X2 and 20X1, or the results of its operations or its cash flows for the years then ended.

As discussed in Note X to the financial statements, the Company carries its property, plant and equipment accounts at appraisal values, and provides depreciation on the basis of such values. Further, the Company does not provide for income taxes with respect to differences between financial income and taxable income arising because of the use, for income tax purposes, of the installment method of reporting gross profit from certain types of sales. Accounting principles generally accepted in the United States of America require that property, plant and equipment be stated at an amount not in excess of cost, reduced by depreciation based on such amount, and that deferred income taxes be provided.

Because of the departures from accounting principles generally accepted in the United States of America identified above, as of December 31, 20X2 and 20X1, inventories have been increased $_______ and $_______ by inclusion in manufacturing overhead of depreciation in excess of that based on cost; property, plant and equipment, less accumulated depreciation, is carried at $_______ and $_______ in excess of an amount based on the cost to the Company; and deferred income taxes of $_______ and $_______ have not been recorded; resulting in an increase of $_______ and $_______ in retained earnings and in appraisal surplus of $_______ and $_______, respectively. For the years ended December 31, 20X2 and 20X1, cost of goods sold has been increased $_______ and $_______, respectively, because of the effects of the depreciation accounting referred to above and deferred income taxes of $_______ and $_______ have not been provided, resulting in an increase in net income of $_______ and $_______, respectively.

Basis for Opinion

[Same basic elements as the Basis for Opinion section of the auditor's unqualified report.]

An example of a report disclaiming an opinion resulting from an inability to obtain sufficient appropriate evidential matter because of the scope limitation:

Disclaimer of Opinion on the Financial Statements

We were engaged to audit the accompanying balance sheets of X Company (the "Company") as of December 31, 20X2 and 20X1, and the related statements of [titles of the financial statements, e.g., income, comprehensive income, stockholders' equity, and cash flows] and the related notes [and schedules] (collectively referred to as the "financial statements"). As described in the following paragraph, because the Company did not take physical inventories and we were not able to apply other auditing procedures to satisfy ourselves as to inventory quantities and the cost of property and equipment, we were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the financial statements, and we do not express, an opinion on these financial statements.

The Company did not make a count of its physical inventory in 20X2 or 20X1, stated in the accompanying financial statements at $_______ as of December 31, 20X2, and at $________ as of December 31, 20X1. Further, evidence supporting the cost of property and equipment acquired prior to December 31, 20X1, is no longer available. The Company's records do not permit the application of other auditing procedures to inventories or property and equipment.

Basis for Disclaimer of Opinion

These financial statements are the responsibility of the Company's management. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

[The "scope" paragraph is omitted.]

BELOW IS THE POWER POINTS SLIDES & NOTES REGARDING CHAPTER 3:

slide 2:

slide 2 handout: SUMMARY OF REPORTING OPTIONS:

slide 2 notes:

We have looked at the standard report in detail. The standard report is the one in which you express an "unqualified" (the AICPA standards use the term "unmodified") opinion. Do not use the AICPA term in this class, or it will be confusing (please take a note of this). There are four categories of audit reports: Unqualified, unqualified with explanatory paragraph and modified wording, qualified, adverse or disclaimer.

"Unqualified" means that the auditor concluded that the financial statements were fairly stated, with no exception.

"Qualified" means that the auditor concluded that the financial statements were fairly stated, but with one or more exceptions.

"Adverse" means that the auditor concluded that the financial statements were not fairly stated.

"Disclaimer" means that the auditor expresses no opinion. Of course, "no opinion" is an opinion -- obviously not a favorable one. A friend of yours is asking: "What do you think of this dress on me?" And you say, "no opinion." Sure you do. And also you say it. And also clearly this is not a good one. Same goes with the meaning of a "disclaimer."

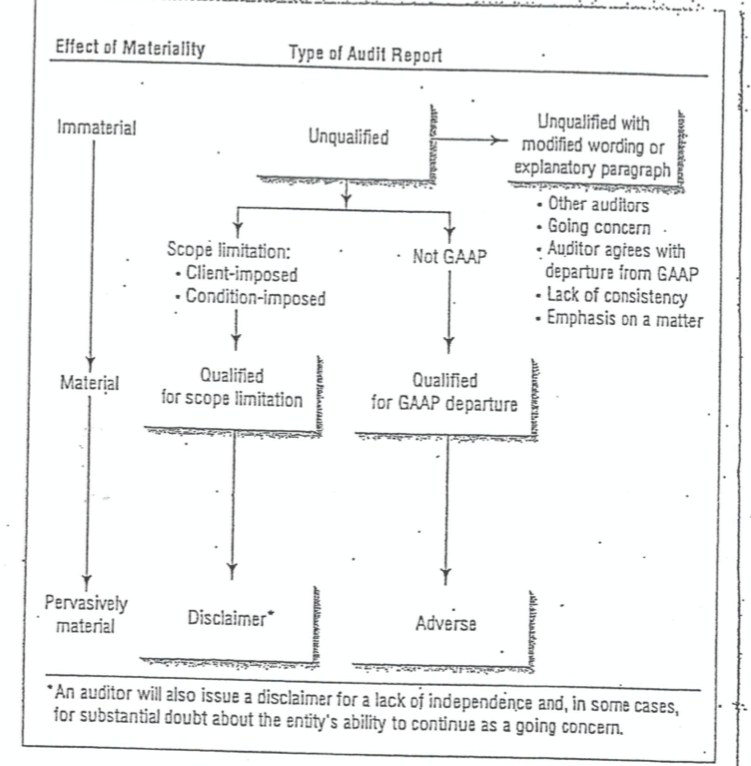

The summary tells you the major decision rules on how you choose an opinion. Basically, there are three factors you need to consider: (1) the level of materiality, (2) whether there is a scope limitation or restriction on financial statements, and (3) (if there is no scope limitation) whether there is a violation of GAAP in the financial statements. Lets look at some details.

slide 3:

slide 3 notes:

We have looked at the standard report in detail. The standard report is the one in which you express an "unqualified" (the AICPA standards use the term "unmodified") opinion. Do not use the AICPA term in this class, or it will be confusing (please take a note of this).

There are four categories of audit reports: Unqualified, unqualified with explanatory paragraph and modified wording, qualified, adverse or disclaimer.

"Unqualified" means that the auditor concluded that the financial statements were fairly stated, with no exception.

"Qualified" means that the auditor concluded that the financial statements were fairly stated, but with one or more exceptions.

"Adverse" means that the auditor concluded that the financial statements were not fairly stated.

"Disclaimer" means that the auditor expresses no opinion. Of course, "no opinion" is an opinion -- obviously not a favorable one. A friend of yours is asking: "What do you think of this dress on me?" And you say, "no opinion." Sure you do. And also you say it. And also clearly this is not a good one. Same goes with the meaning of a "disclaimer."

The summary tells you the major decision rules on how you choose an opinion. Basically, there are three factors you need to consider: (1) the level of materiality, (2) whether there is a scope limitation or restriction on financial statements, and (3) (if there is no scope limitation) whether there is a violation of GAAP in the financial statements. Lets look at some details.

thank you all for giving the time to help with my questions!

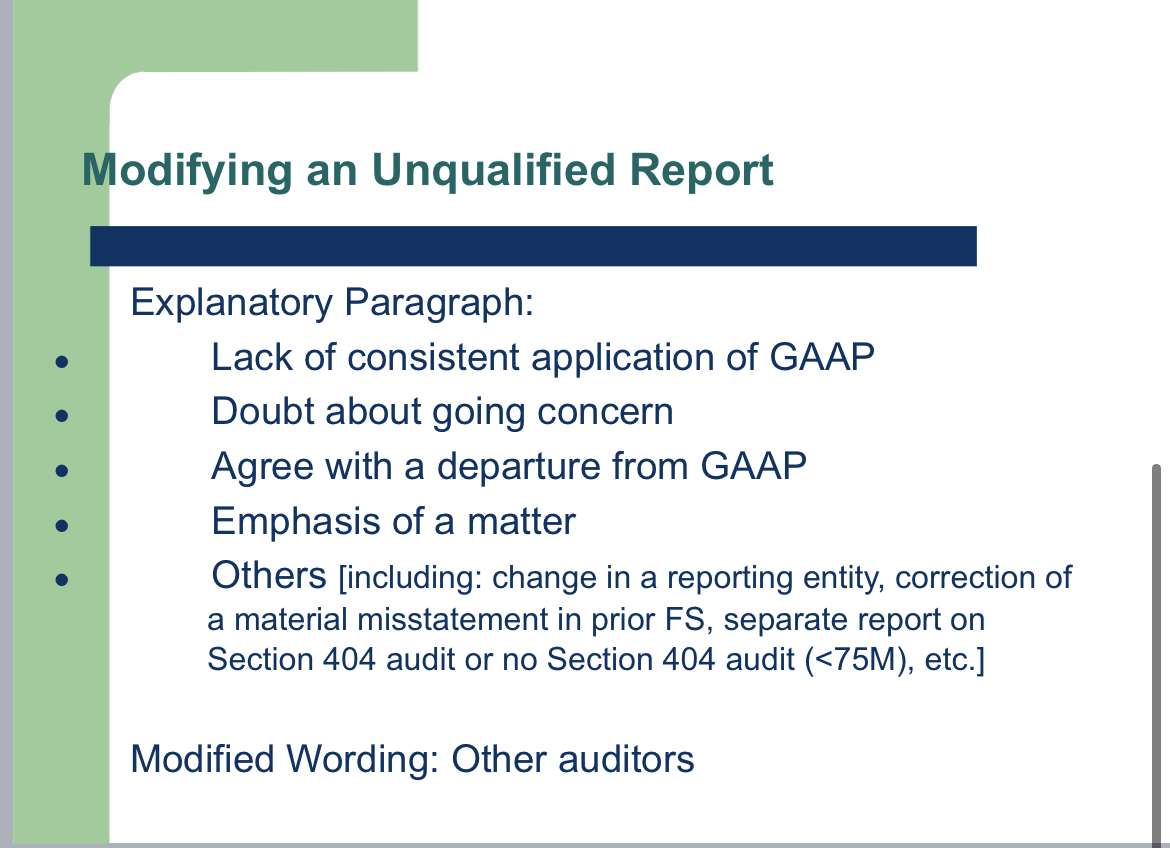

Four categories of audit reports Standard unqualified/unmodified Unqualified with explanatory paragraph and modified wording Qualified Averse or disclaimer Elect of Materiality Type of Audit Report Immaterial Unqualified 272449 Unqualified with modified wording or explanatory paragraph Other auditors . Going concern Auditor agrees with departure from GAAP . Lack of consistency . Emphasis on a matter Not GAAP Scope limitation: - Client-imposed . Condition-imposed Material Qualified for scope limitation Qualified for GAAP departure AN Pervasively material Disclaimer Adverse *An auditor will also issue a disclaimer for a lack of independence and, in some cases, for substantial doubt about the entity's ability to continue as a going concern. Modifying an Unqualified Report Explanatory Paragraph: Lack of consistent application of GAAP Doubt about going concern Agree with a departure from GAAP Emphasis of a matter Others (including: change in a reporting entity, correction of a material misstatement in prior FS, separate report on Section 404 audit or no Section 404 audit (Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started