Auditing question

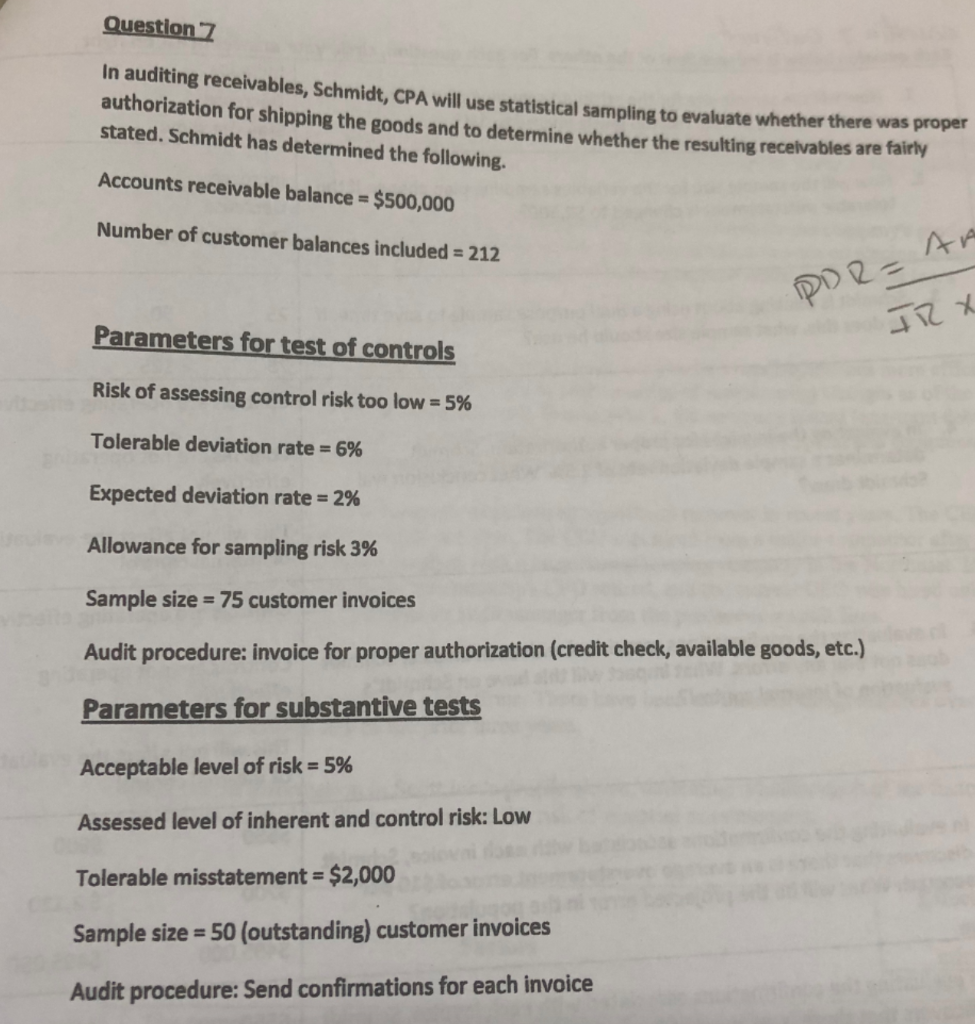

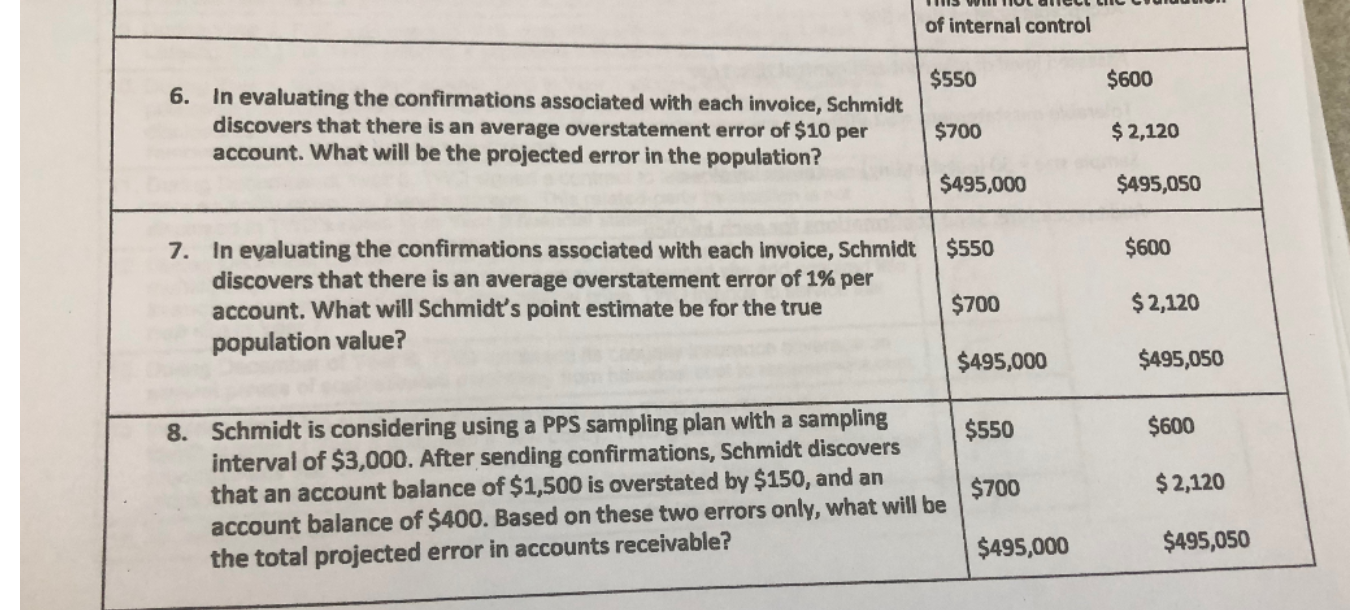

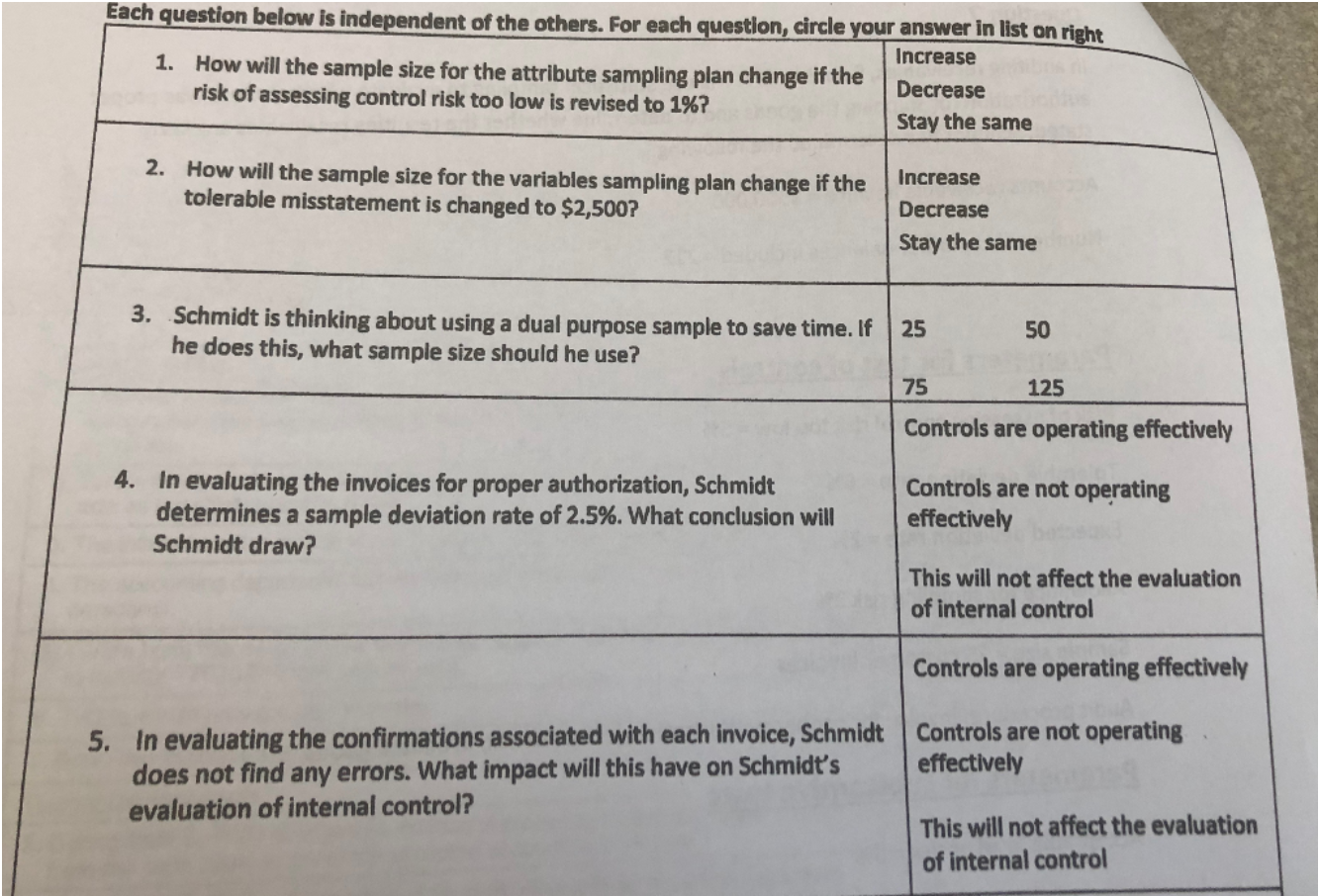

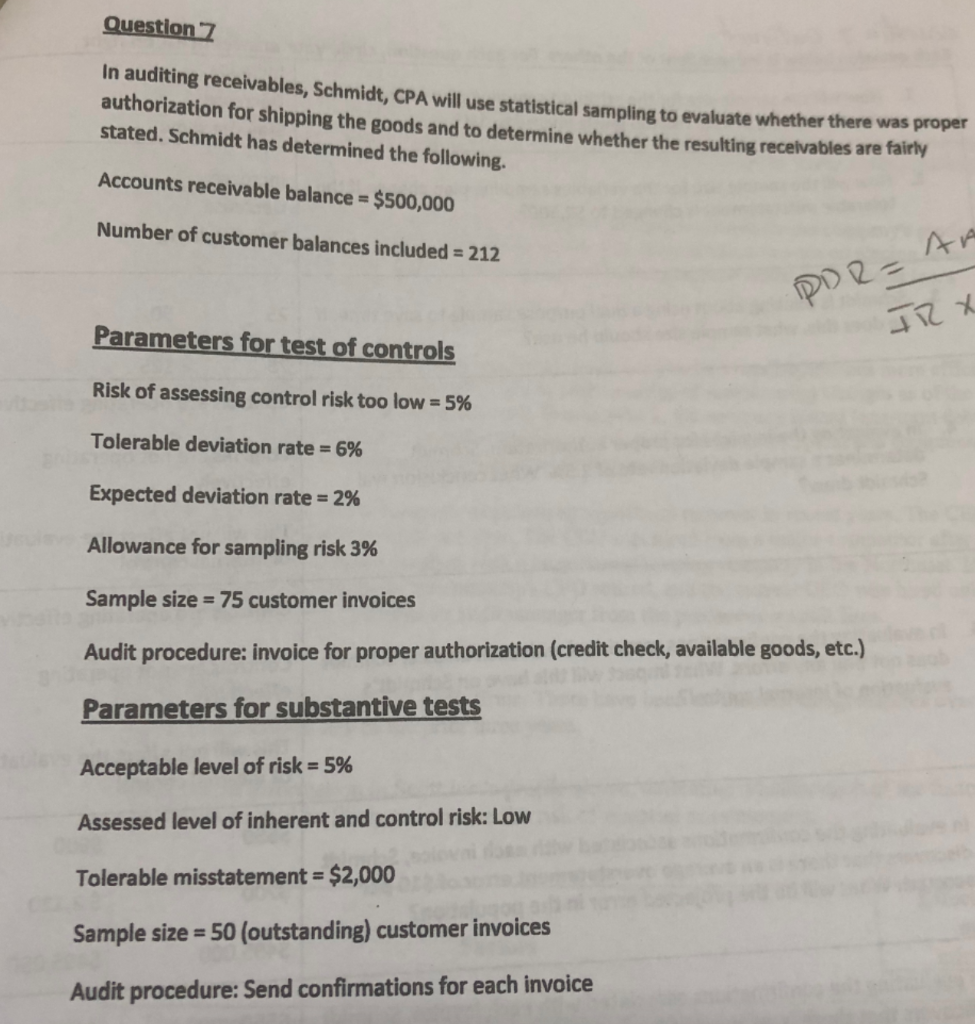

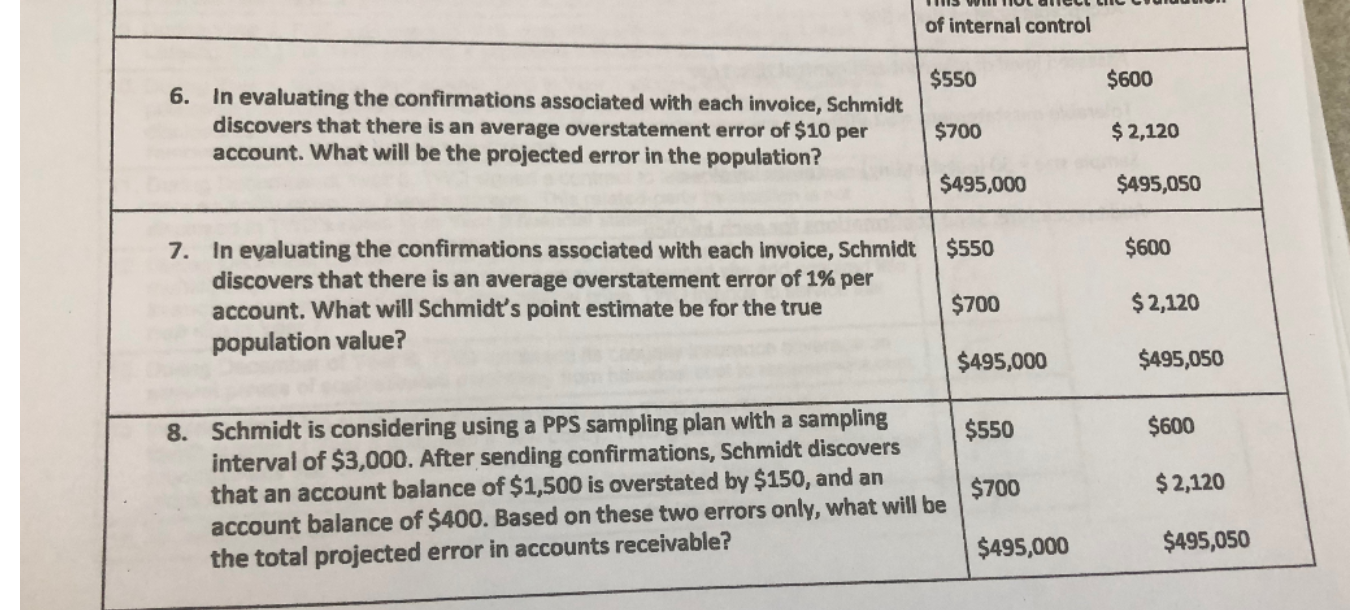

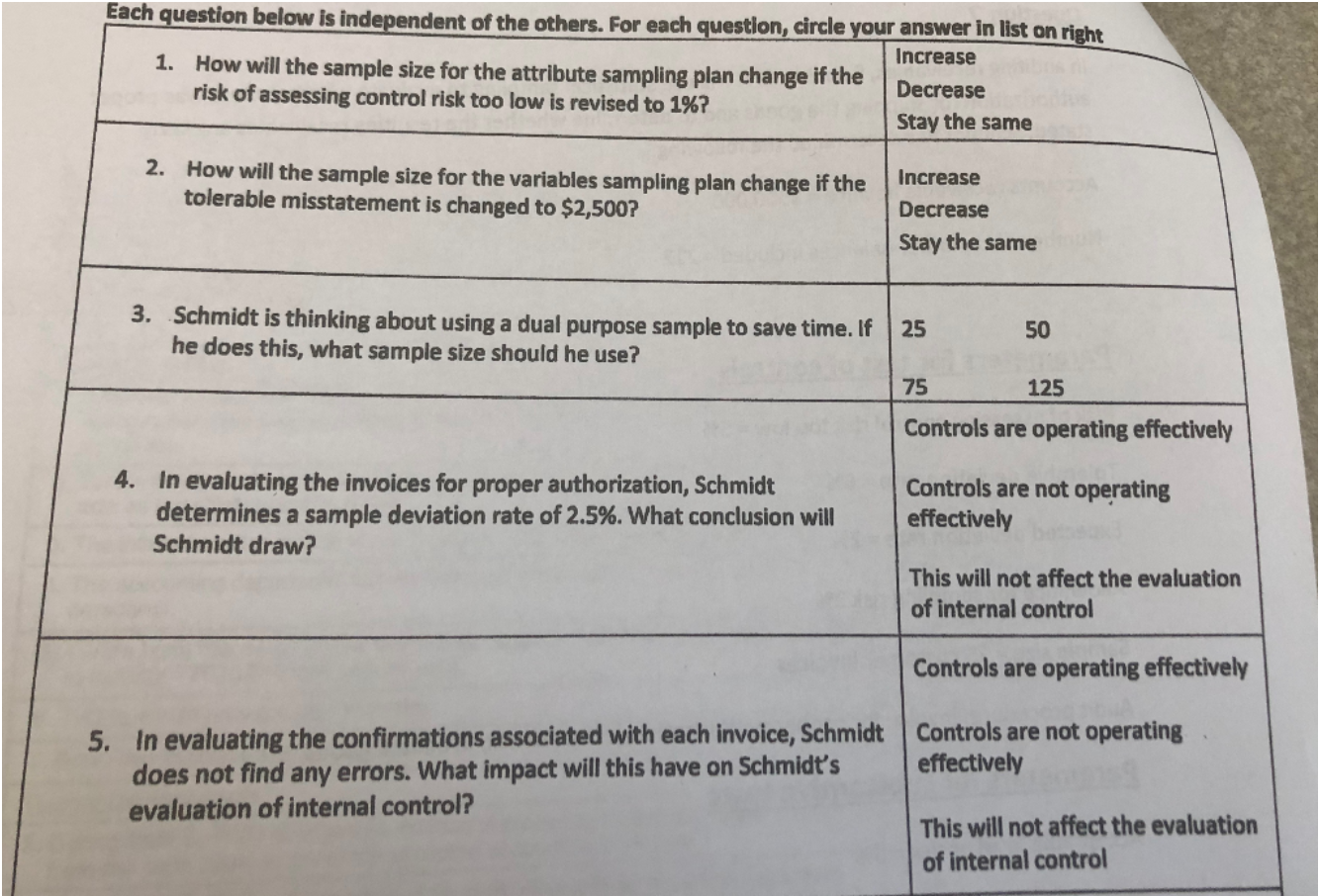

Question 7 In auditing receivables, Schmidt, CPA will use statistical sampling to evaluate whether the For shipping the goods and to determine whether the resulting receivables are fairly stated. Schmidt has determined the following. Accounts receivable balance = $500,000 Number of customer balances included = 212 DDR= AA TRX Parameters for test of controls Risk of assessing control risk too low = 5% Tolerable deviation rate = 6% Expected deviation rate = 2% Allowance for sampling risk 3% Sample size = 75 customer invoices Audit procedure: invoice for proper authorization (credit check, available goods, etc.) Parameters for substantive tests Acceptable level of risk = 5% Assessed level of inherent and control risk: Low Tolerable misstatement = $2,000 Sample size = 50 (outstanding) customer invoices Audit procedure: Send confirmations for each invoice WS WII ULICUL CHEGOU of internal control $550 $600 6. In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of $10 per account. What will be the projected error in the population? $700 $ 2,120 $495,000 $495,050 $600 7. In evaluating the confirmations associated with each invoice, Schmidt | $550 discovers that there is an average overstatement error of 1% per account. What will Schmidt's point estimate be for the true $700 population value? $495,000 $ 2,120 $495,050 $550 $600 Schmidt is considering using a PPS sampling plan with a sampling interval of $3,000. After sending confirmations, Schmidt discovers that an account balance of $1,500 is overstated by $150, and an account balance of $400. Based on these two errors only, what will be the total projected error in accounts receivable? $700 $ 2,120 $495,000 $495,050 Each question below is independent of the others. For each question, circle your answer in list on right Increase 1. How will the sample size for the attribute sampling plan change if the Decrease risk of assessing control risk too low is revised to 1%? Stay the same 2. How will the sample size for the variables sampling plan change if the tolerable misstatement is changed to $2,500? Increase Decrease Stay the same 3. Schmidt is thinking about using a dual purpose sample to save time. If | 25 he does this, what sample size should he use? 75 125 Controls are operating effectively In evaluating the invoices for proper authorization, Schmidt determines a sample deviation rate of 2.5%. What conclusion will Schmidt draw? Controls are not operating effectively This will not affect the evaluation of internal control Controls are operating effectively Controls are not operating effectively 5. In evaluating the confirmations associated with each invoice, Schmidt does not find any errors. What impact will this have on Schmidt's evaluation of internal control? This will not affect the evaluation of internal control Question 7 In auditing receivables, Schmidt, CPA will use statistical sampling to evaluate whether the For shipping the goods and to determine whether the resulting receivables are fairly stated. Schmidt has determined the following. Accounts receivable balance = $500,000 Number of customer balances included = 212 DDR= AA TRX Parameters for test of controls Risk of assessing control risk too low = 5% Tolerable deviation rate = 6% Expected deviation rate = 2% Allowance for sampling risk 3% Sample size = 75 customer invoices Audit procedure: invoice for proper authorization (credit check, available goods, etc.) Parameters for substantive tests Acceptable level of risk = 5% Assessed level of inherent and control risk: Low Tolerable misstatement = $2,000 Sample size = 50 (outstanding) customer invoices Audit procedure: Send confirmations for each invoice WS WII ULICUL CHEGOU of internal control $550 $600 6. In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of $10 per account. What will be the projected error in the population? $700 $ 2,120 $495,000 $495,050 $600 7. In evaluating the confirmations associated with each invoice, Schmidt | $550 discovers that there is an average overstatement error of 1% per account. What will Schmidt's point estimate be for the true $700 population value? $495,000 $ 2,120 $495,050 $550 $600 Schmidt is considering using a PPS sampling plan with a sampling interval of $3,000. After sending confirmations, Schmidt discovers that an account balance of $1,500 is overstated by $150, and an account balance of $400. Based on these two errors only, what will be the total projected error in accounts receivable? $700 $ 2,120 $495,000 $495,050 Each question below is independent of the others. For each question, circle your answer in list on right Increase 1. How will the sample size for the attribute sampling plan change if the Decrease risk of assessing control risk too low is revised to 1%? Stay the same 2. How will the sample size for the variables sampling plan change if the tolerable misstatement is changed to $2,500? Increase Decrease Stay the same 3. Schmidt is thinking about using a dual purpose sample to save time. If | 25 he does this, what sample size should he use? 75 125 Controls are operating effectively In evaluating the invoices for proper authorization, Schmidt determines a sample deviation rate of 2.5%. What conclusion will Schmidt draw? Controls are not operating effectively This will not affect the evaluation of internal control Controls are operating effectively Controls are not operating effectively 5. In evaluating the confirmations associated with each invoice, Schmidt does not find any errors. What impact will this have on Schmidt's evaluation of internal control? This will not affect the evaluation of internal control