Answered step by step

Verified Expert Solution

Question

1 Approved Answer

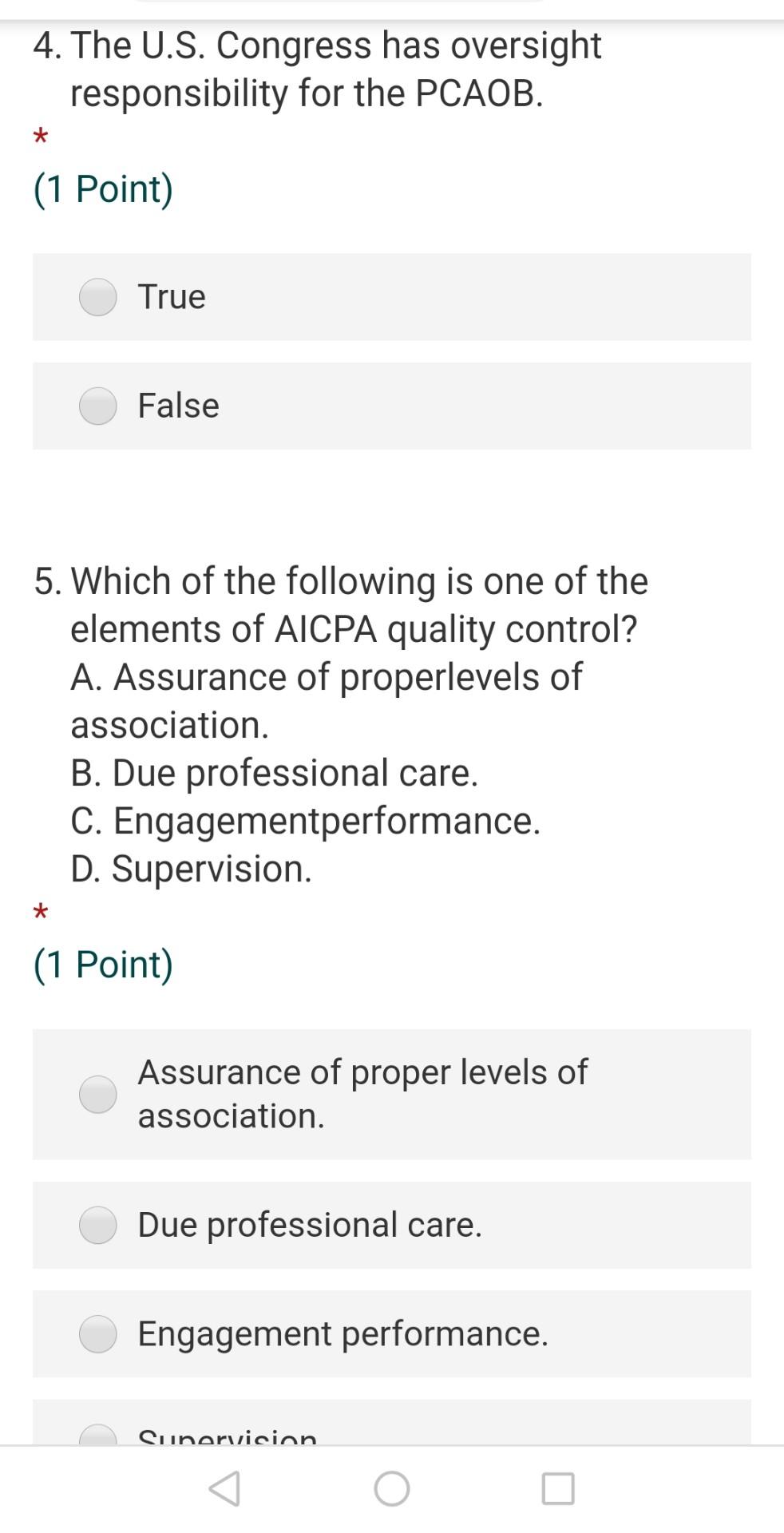

AUDITING URGENT 4. The U.S. Congress has oversight responsibility for the PCAOB. * (1 Point) True False 5. Which of the following is one of

AUDITING URGENT

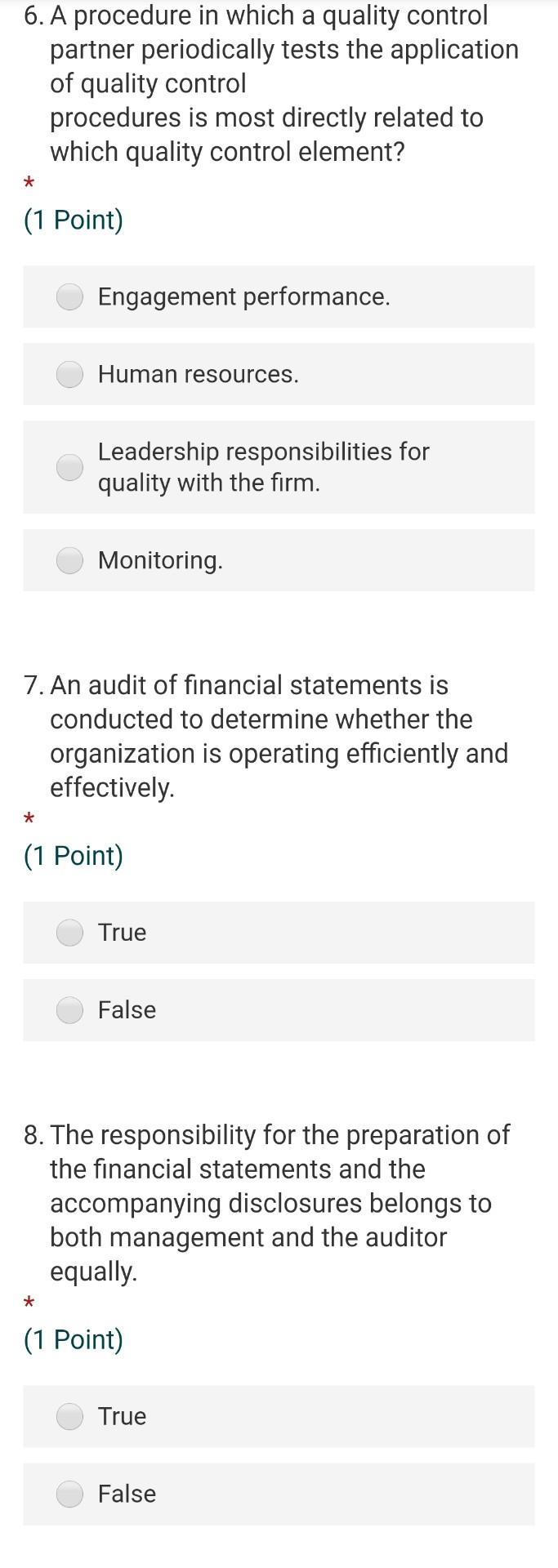

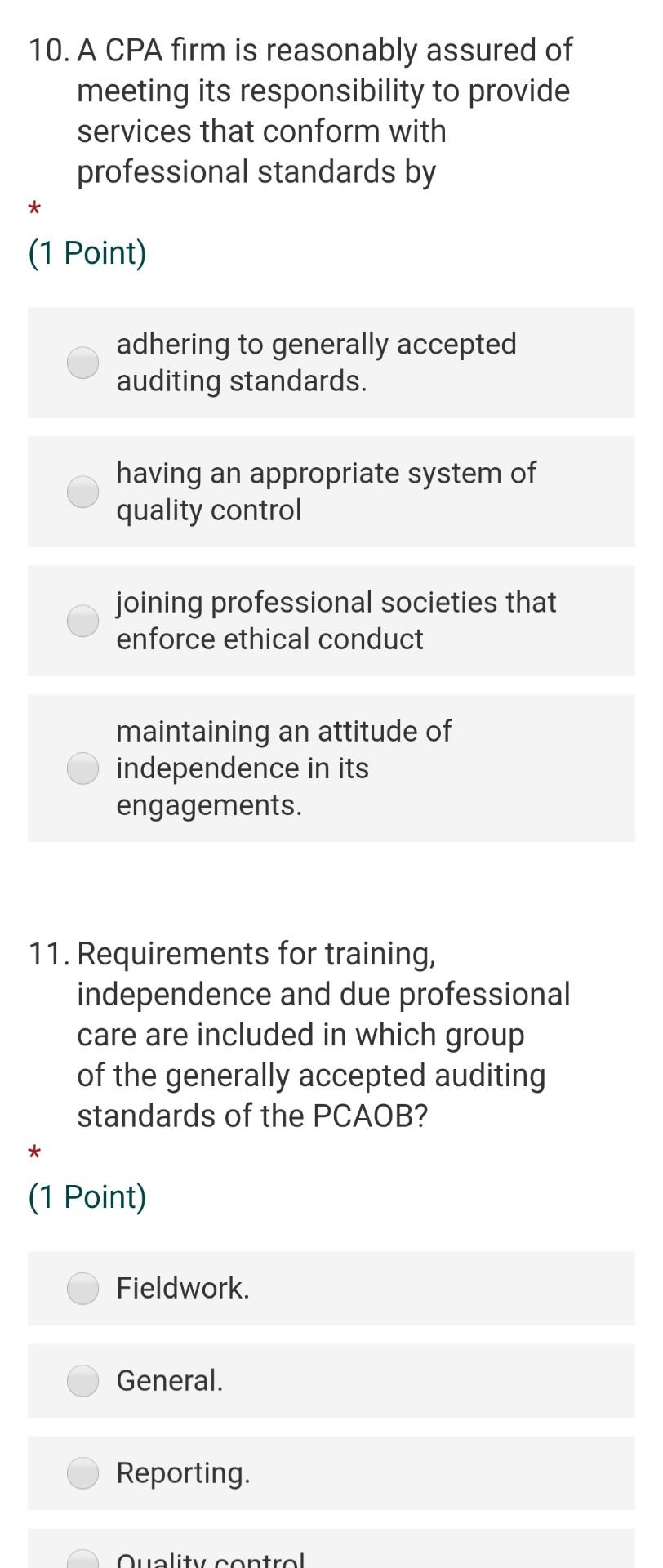

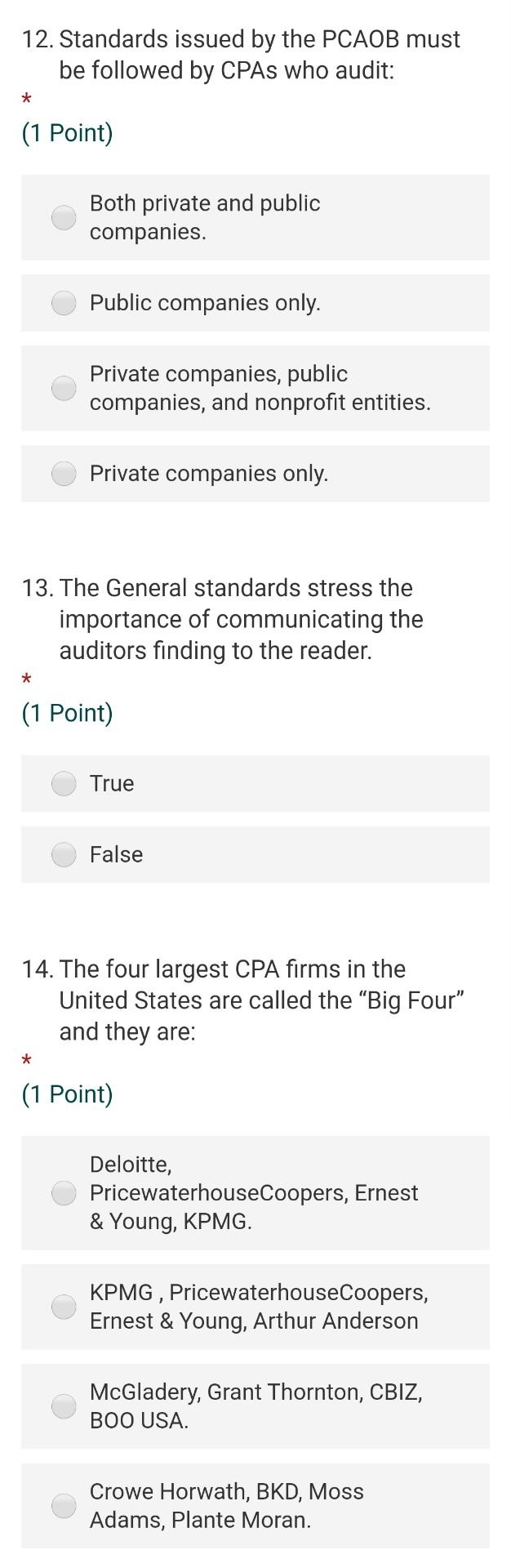

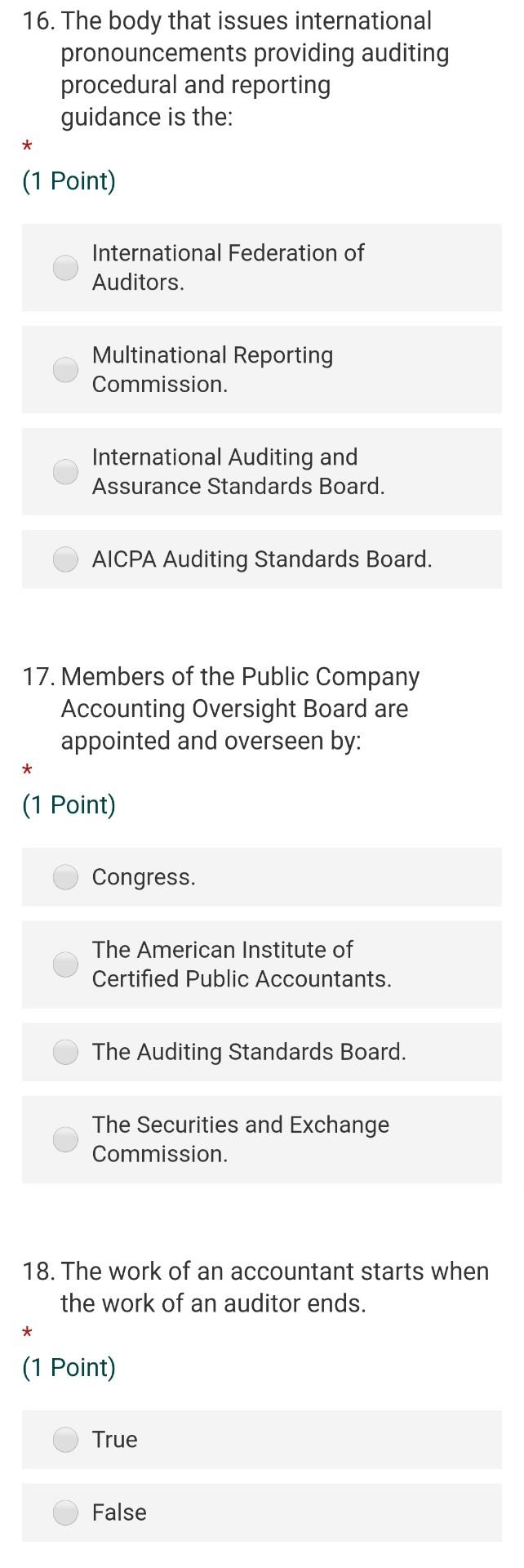

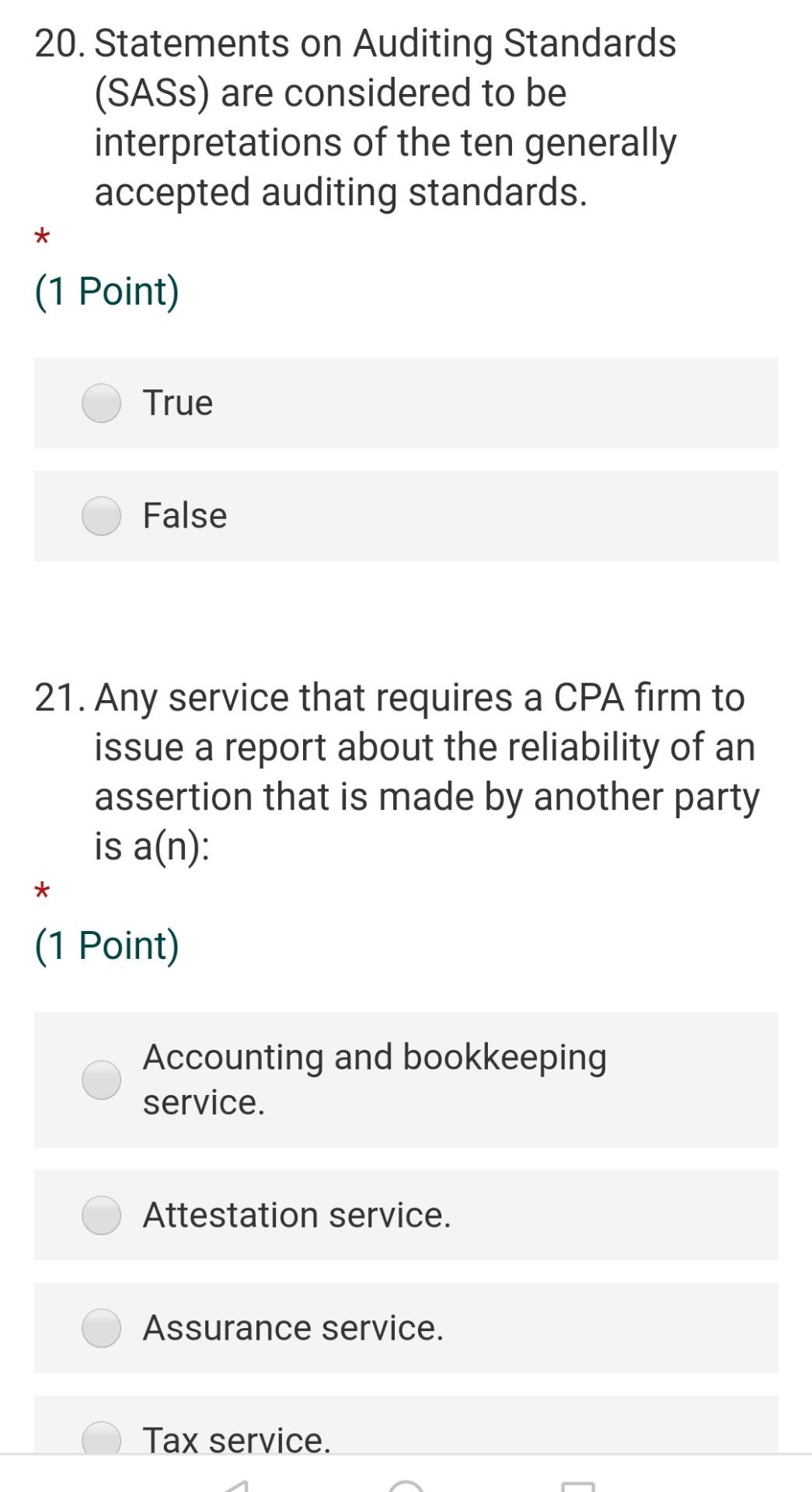

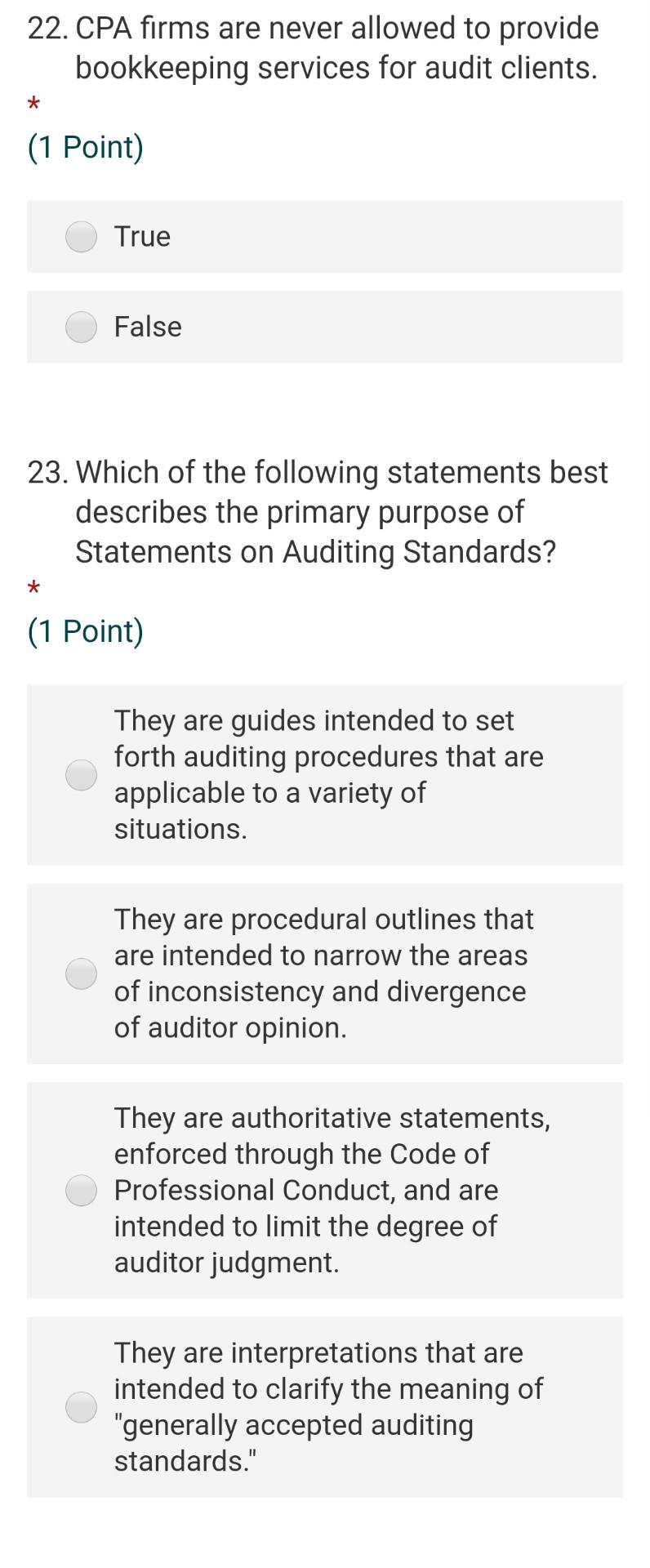

4. The U.S. Congress has oversight responsibility for the PCAOB. * (1 Point) True False 5. Which of the following is one of the elements of AICPA quality control? A. Assurance of properlevels of association. B. Due professional care. C. Engagementperformance. D. Supervision * (1 Point) Assurance of proper levels of association. Due professional care. Engagement performance. Sunarvision 6. A procedure in which a quality control partner periodically tests the application of quality control procedures is most directly related to which quality control element? * (1 Point) Engagement performance. Human resources. Leadership responsibilities for quality with the firm. Monitoring 7. An audit of financial statements is conducted to determine whether the organization is operating efficiently and effectively * (1 Point) True False 8. The responsibility for the preparation of the financial statements and the accompanying disclosures belongs to both management and the auditor equally * (1 Point) True False 10. A CPA firm is reasonably assured of meeting its responsibility to provide services that conform with professional standards by * (1 Point) adhering to generally accepted auditing standards. having an appropriate system of quality control joining professional societies that enforce ethical conduct maintaining an attitude of independence in its engagements. 11. Requirements for training, independence and due professional care are included in which group of the generally accepted auditing standards of the PCAOB? * (1 Point) Fieldwork. General. Reporting. Quality control 12. Standards issued by the PCAOB must be followed by CPAS who audit: * (1 Point) Both private and public companies. Public companies only. Private companies, public companies, and nonprofit entities. Private companies only. 13. The General standards stress the importance of communicating the auditors finding to the reader. * (1 Point) True False 14. The four largest CPA firms in the United States are called the Big Four" and they are: * (1 Point) Deloitte, PricewaterhouseCoopers, Ernest & Young, KPMG. KPMG, PricewaterhouseCoopers, Ernest & Young, Arthur Anderson McGladery, Grant Thornton, CBIZ, BOO USA. Crowe Horwath, BKD, Moss Adams, Plante Moran. 16. The body that issues international pronouncements providing auditing procedural and reporting guidance is the: * (1 Point) International Federation of Auditors. Multinational Reporting Commission. International Auditing and Assurance Standards Board. AICPA Auditing Standards Board. 17. Members of the Public Company Accounting Oversight Board are appointed and overseen by: (1 Point) Congress. The American Institute of Certified Public Accountants. The Auditing Standards Board. The Securities and Exchange Commission. 18. The work of an accountant starts when the work of an auditor ends. * (1 Point) True False 20. Statements on Auditing Standards (SASs) are considered to be interpretations of the ten generally accepted auditing standards. * (1 Point) True False 21. Any service that requires a CPA firm to issue a report about the reliability of an assertion that is made by another party is a(n): * (1 Point) Accounting and bookkeeping service. Attestation service. Assurance service. Tax service. 22. CPA firms are never allowed to provide bookkeeping services for audit clients. * (1 Point) True False 23. Which of the following statements best describes the primary purpose of Statements on Auditing Standards? * (1 Point) They are guides intended to set forth auditing procedures that are applicable to a variety of situations. They are procedural outlines that are intended to narrow the areas of inconsistency and divergence of auditor opinion. They are authoritative statements, enforced through the Code of Professional Conduct, and are intended to limit the degree of auditor judgment. They are interpretations that are intended to clarify the meaning of "generally accepted auditing standards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started