Question

Aug. 10. Purchased merchandise on account, $25,000, terms FOB shipping point, n/eom. Paid $600 cash to the freight company for delivery of the merchandise. Statement

Aug. 10. Purchased merchandise on account, $25,000, terms FOB shipping point, n/eom. Paid $600 cash to the freight company for delivery of the merchandise.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aug. 13. Paid for invoice of August 3, less debit memorandum of August 9.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Aug 31. Paid for invoice of August 10.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Feedback

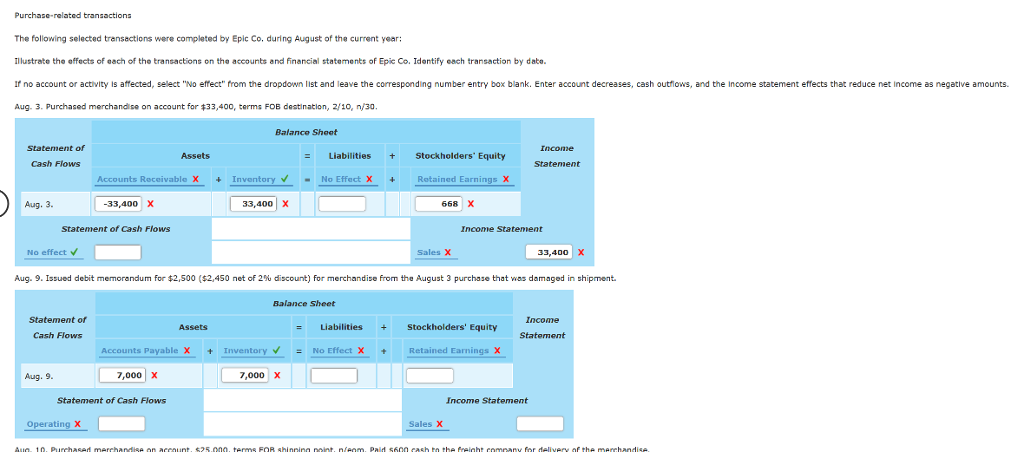

Aug. 3. Note that the FOB destination freight is the sellers expense.

Aug. 9. Any discounts or returns are recorded directly by the buyer who debits Accounts Payable and credits Merchandise Inventory, basically reversing what was done in recording the purchase.

Aug. 10. Under the FOB shipping point, freight is paid by the buyer.

Aug. 13. The cash paid is the difference between the invoice and the discount.

Aug. 31. The cash paid on account in this case is equal to the invoice.

Purchase-related transactions The following selected transactions were completed by Epic Co, during August of the current year: Illustrate the effects of each of the transactions on the accounts and financial statements of Epic Co. Identify each transaction by date. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases, cash outflows, and the income statement effects that reduce net income as negative amounts. Aug. 3. Purchased merchandise on account for $33,400, terms FOB destination, 2/10, n/30. Balance Sheet statement of Cash Flows Assets = Liabilities Stockholders' Equity Incone Statement Accounts Receivable X + Inventory - No Effect X + Retained Earnings X Aug. 3. -33,400 X 33,400 x 668 X Statement of Cash Flows Income Statement No effect ? Sales X 33,400 x Aug. 9. Issued debit memorandum for $2,500 ($2,450 net of 2% discount) For merchandise from the August 3 purchase that was damaged in shipment. Balance sheet Statement of Cash Flows Assets = Liabilities Stockholders' Equity Income Statement Accounts Payable X + Inventory ? = No Effect X + Retained Earnings X Aug. 9. 7,000 X 7,000 x Statement of Cash Flows Income Statement Operating X Sales X un 10. Purchased merchandise an account. $25.000 terms FOR Shinning point. niem. Pald 5600 cash to the frelor company for delivery of the merchandiseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started