Question

AUGREAL ELECTRONICS AugReal Electronics is a midsized electronics manufacturer headquartered in Key West, FL. The company president is Shelly Couts, who inherited the company. The

AUGREAL ELECTRONICS

AugReal Electronics is a midsized electronics manufacturer headquartered in Key West, FL. The company president is Shelly Couts, who inherited the company. The company originally repaired radios and other household appliances when it was founded over 70 years ago. Over the years, the company has expanded, and it is now a reputable manufacturer of various specialty electronic items. You, a recent business school graduate, have been hired by the company in its finance department.

One of the major revenue-producing items manufactured by AugReal is a smart phone. AugReal currently has one smart phone model on the market and sales have been excellent. The smart phone is a unique item in that it comes in a variety of tropical colors and is preprogrammed to play Jimmy Buffett music. However, as with any electronic item, technology changes rapidly, and the current smart phone has limited features in comparison with newer models. AugReal spent $950,000 to develop a prototype for a new smart phone that has all the features of the existing one but adds new features such as Pokmon luring and capturing. The company has spent a further $300,000 for a marketing study to determine the expected sales figures for the new smart phone.

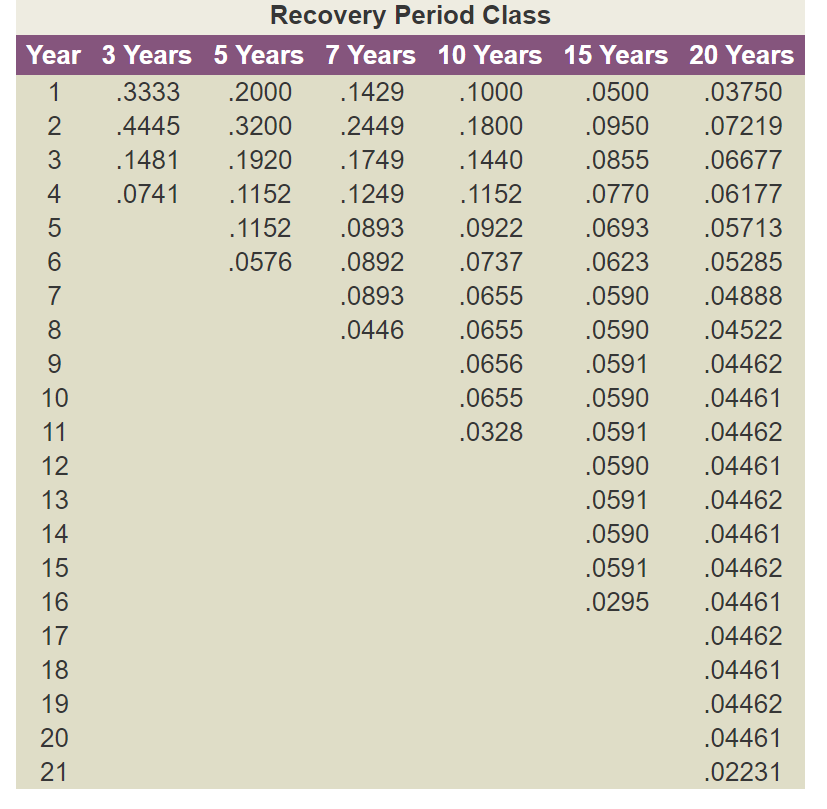

AugReal can manufacture the new smart phone for $245 each in variable costs. Fixed costs for the operation are estimated to run $3.1 million per year. The estimated sales volume (in units) is 162,000, 146,000, 67,000, 48,000, and 44,000 per year for the next five years, respectively, and no sales after the fifth year. The unit price of the new smart phone will be $385. The necessary manufacturing equipment can be purchased for $34.5 million and will be depreciated on a seven-year MACRS schedule (see Table 6.3, p. 175). It is believed the value of the equipment in five years will be $7.5 million.

Net working capital for the smart phones will be 23 percent of sales and will occur with the timing of the cash flows for the year (i.e., there is no initial outlay for NWC). Changes in NWC will thus first occur in Year 1 with the first year's sales. AugReal has a 35 percent corporate tax rate and a required return of 12 percent.

Shelly has asked you to prepare an analysis in an Excel file that answers the following questions.

QUESTIONS

- What is the payback period of the project?

- What is the profitability index of the project?

- What is the IRR of the project?

- What is the NPV of the project?

- Should AugReal produce the new smart phone?

In addition, she wants to see the NPV and IRR under two additional, separate scenarios: phone price of $495 and additional sales per year of 100 units.

If the three scenarios have equal probability of occurring, what are the predicted NPV and IRR of this project?

Your continued employment for the company depends on accurate analysis and a well-formatted Excel file that prints nicely on four pages in portrait mode with appropriate page breaks, numbered pages, titles/headers/labels/etc. The fourth page should be a text block that summarizes your findings and ultimate recommendation for go or no go on the project.

Recovery Period Class Year 3 Years 5 Years 7 Years 10 Years 15 Years 20 Years 03750 07219 06677 06177 05713 05285 04888 04522 04462 04461 04462 04461 04462 04461 04462 04461 04462 04461 04462 04461 02231 1 3333 .2000 1429 100 2 4445 3200 2449 1800 1920 1749 1440 1249 1152 1152 .0893 .0922 0576 .0892 .0737 0893 .0655 0446 .0655 .0656 .0655 .0328 .0500 .0950 0855 .0770 0693 0623 0590 0590 .0591 0590 .0591 0590 .0591 0590 .0591 .0295 3 1481 0741 1152 4 6 8 9 20 21 Recovery Period Class Year 3 Years 5 Years 7 Years 10 Years 15 Years 20 Years 03750 07219 06677 06177 05713 05285 04888 04522 04462 04461 04462 04461 04462 04461 04462 04461 04462 04461 04462 04461 02231 1 3333 .2000 1429 100 2 4445 3200 2449 1800 1920 1749 1440 1249 1152 1152 .0893 .0922 0576 .0892 .0737 0893 .0655 0446 .0655 .0656 .0655 .0328 .0500 .0950 0855 .0770 0693 0623 0590 0590 .0591 0590 .0591 0590 .0591 0590 .0591 .0295 3 1481 0741 1152 4 6 8 9 20 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started