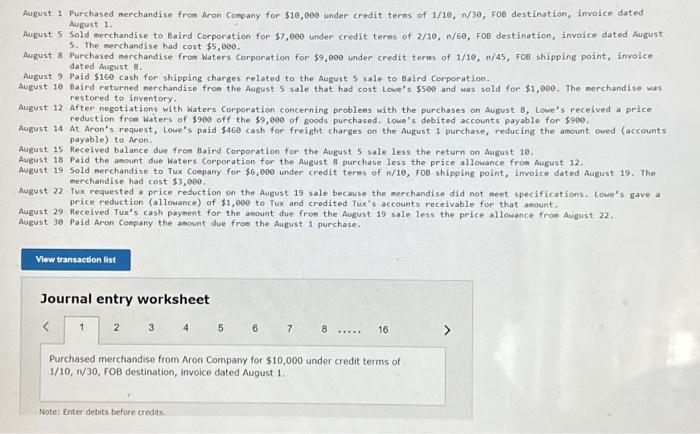

August 1 Purchased merchandise from Aron Conpany for $10,000 under credit terms of 1/10,n/30, Fo8 destination, invoice dated August 1. August 5 Sold aerchandise to Baird Corporation for 57,00 under credit terns of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost \$\$, 000 . August 8 Purchased merchandise fron Waters Corporation for $9,000 under credit terns of 1/10, n/45, Fo8 shipping point, invoice dated August 8. August 9 Paid $160 cash for shipping charges related to the August 5 sale to Baird Corporation. August 10 baird returned merchandise from the August $ sale that had cost Lome's $500 and was sold for $1, 000 . The merchandise was restored to inventory. August 12 After nogotiations with Waters Corporation concerning problens with the purchases on August B, Lowe's received a price reduction from waters of $900 off the $9,000 of goods purchased. Lowe's debited accounts payable for $900. August 14 At Aron's request, Lowe's paid $460 cash for freight charges on the August 1 purchase, reducing the arount owed (accounts payable) to Aron. August 15 Received balance due from Baird Corporation for the August 5 sale less the return on August 10. August 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12. August 19 Sold nerchandise to Tux Coepany for $6,000 under credit teres of n/10, for shipping point, invoice dated August 19 . The merchandise had cost $3,000. August 22 Tux requested a price reduction on the August 19 sale because the merchandise did not neet specifications. Lowe's gave a price reduction (allowance) of $1,000 to Tux ard credited Tux's accounts receivable for that anount. August 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22 , August 30 Paid Aron Company the anount due fros the August 1 purchase: Journal entry worksheet \begin{tabular}{llllllllll} 2 & 3 & 4 & 5 & 6 & 7 & 8 & & 16 \end{tabular} Purchased merchandise from Aron Company for $10,000 under credit terms of 1/10,N30,FOB destination, invoice dated August 1. Note: Enter debits before credits