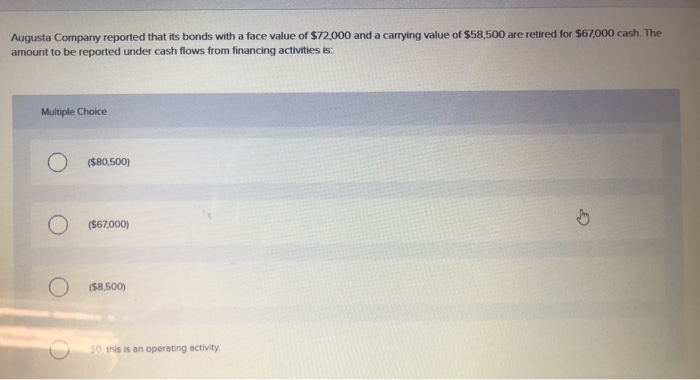

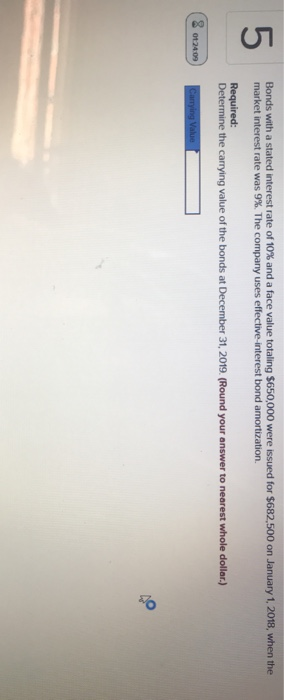

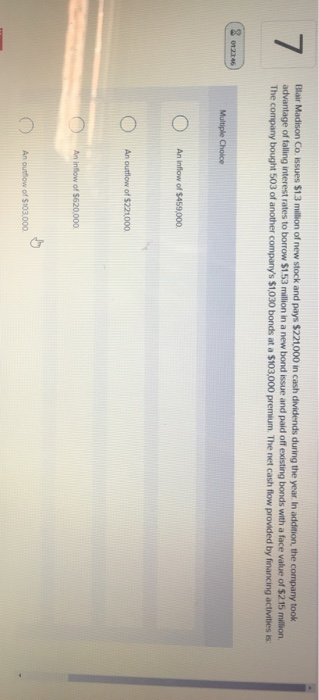

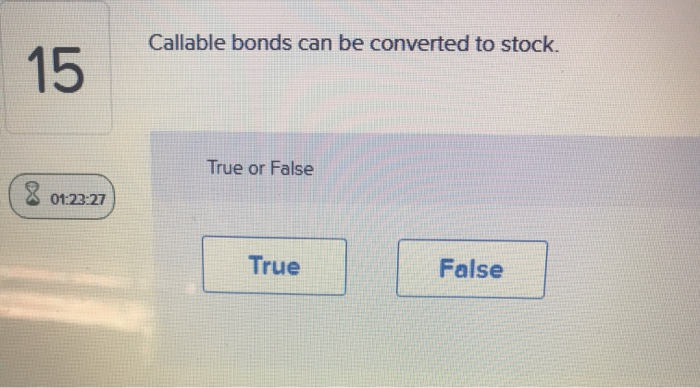

Augusta Company reported that its bonds with a face value of $72,000 and a carrying value of $58,500 are retired for $67,000 cash. The amount to be reported under cash flows from financing activities is: Multiple Choice O (S80,500) (S67000) O (58,500) So this is an operating activity, Bonds with a stated interest rate of 10% and a face value totaling $650,000 were issued for $682,500 on January 1, 2018, when the market interest rate was 9%. The company uses effective interest bond amortization. Required: Determine the carrying value of the bonds at December 31, 2019. (Round your answer to nearest whole dollar.) 802409 Carrying Value Blair Madison Co. issues $1.3 million of new stock and pays $221000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $153 million in a new bond issue and paid off existing bonds with a face value of $215 million The company bought 503 of another company's $1,030 bonds at a $103,000 premium. The net cash flow provided by financing activities is 8 226 Multiple Choice O An inflow of $459.000 O An outflow of $221000 An inflow of $620.000 O An outflow of 5103.000 Callable bonds can be converted to stock. True or False X 01:23:27 True True False False Galaxy Industries buys back 319,000 shares of its stock from investors at $64 a share. Two years later it reissues this stock for 584 a share The stock reissue would be recorded with a debit to Cash for 21 Multiple Choice (8 00:15 0 526.80 million, a credit to Treasury Stock for $20.42 million, and a credit to Additional Paid-in Capital for $6.38 milion O $26.80 million and a credit to Treasury Stock for $26.80 million, $20.42 million, a debit to Additional Paid-in Capital for $6.38 million, a credit to Treasury Stock for $20.42 million, and a credit to Stockholders' Equity for $6 38 million o $26.80 million, a credit to Treasury Stock for $20.42 million and a credit to Gain on Sale of Treasury Stock for $6.38 million 25 ty w w W Mom venenges and a net cash inflow of $101.400 from financing activities. The company paid $134,000 in interest, 5191,500 in income taxes, and 5210,000 in cash dividends. Which of the following statements about the statement of cash flows is not correct? (8000010 Multiple Choice O Supplemental disclosures required for a company ung the indirect method include the amount of interest and the amount of income taxes paid 0 0 The statement of cash flows will show an increase in cash and cash equivalents of $830,400 ) The cash dividends of $210.000 paid will be reported as a cash outflow in the cash flow from investing activities section 0 If the direct method is used, the $134,000 of interest pod and the $191,500 of income taxes paid will be reported in the cash flows from operating activities