Answered step by step

Verified Expert Solution

Question

1 Approved Answer

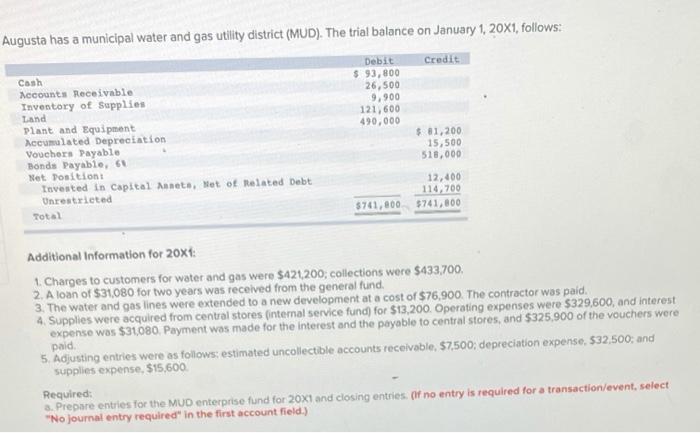

Augusta has a municipal water and gas utility district (MUD). The trial balance on January 1, 20X1, follows: Required: Prepare entries for the MUD enterprise.

Augusta has a municipal water and gas utility district (MUD). The trial balance on January 1, 20X1, follows:

Required: Prepare entries for the MUD enterprise.

Part A. Journal entries:

- Record the charges to customers

- Record the collections on account

- Record the receipt of loan from the general fund.

- Record the extension of the water and gas lines

- Record the payment for the extended lines

- Record the expenses

- Record the payment of the approved vouchers, interest, and payment to the Central Stores Fund

- Record the entry to reduce the revenue for the uncollectible accounts.

- Record the entry to adjust the depreciation for the period.

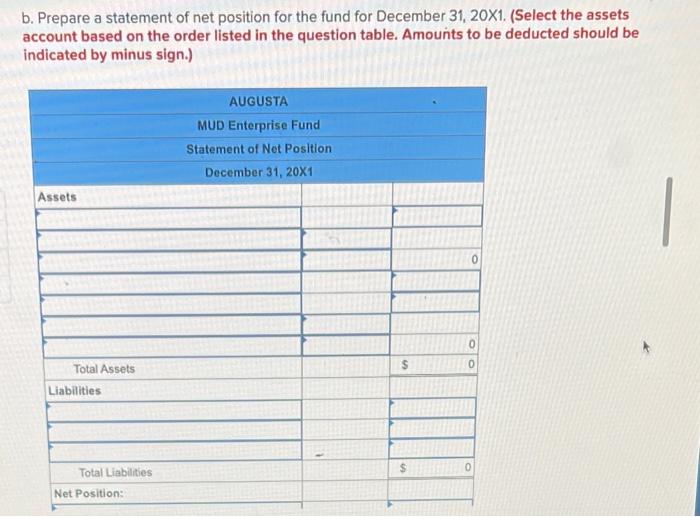

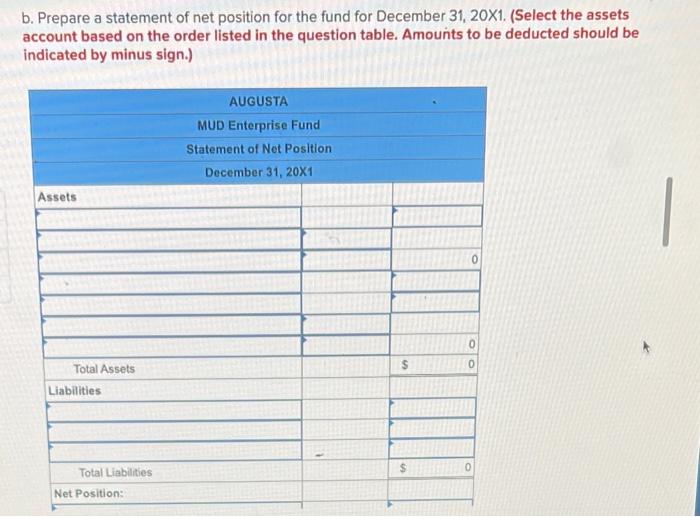

Part B.

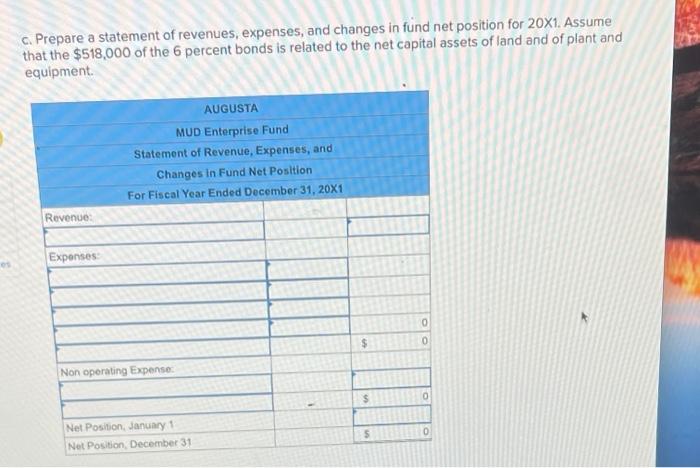

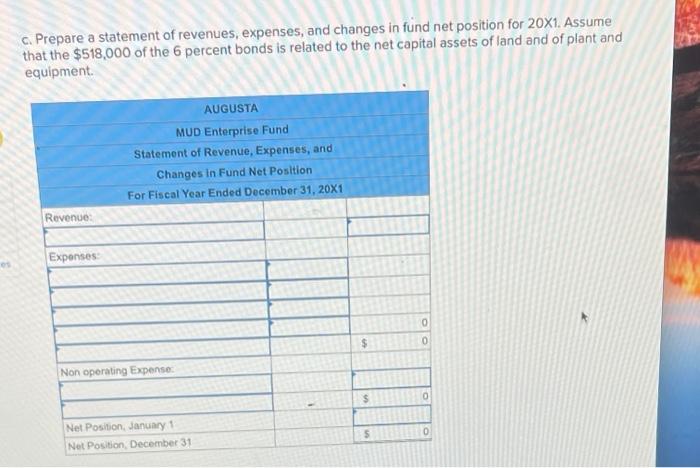

Part C.

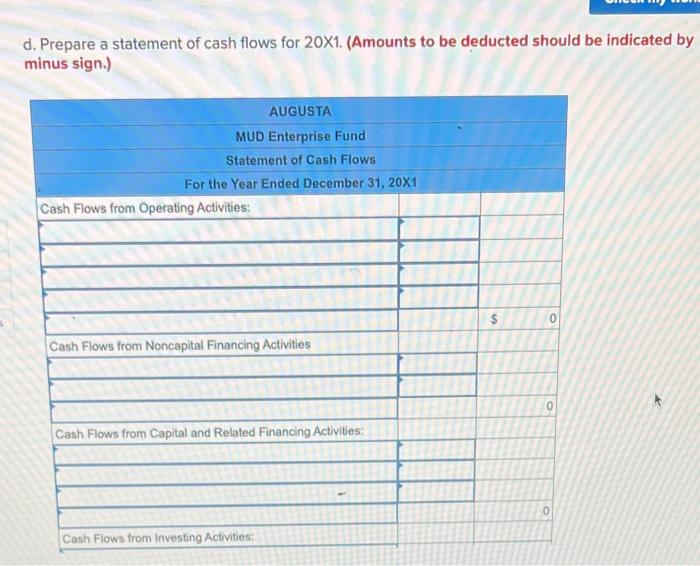

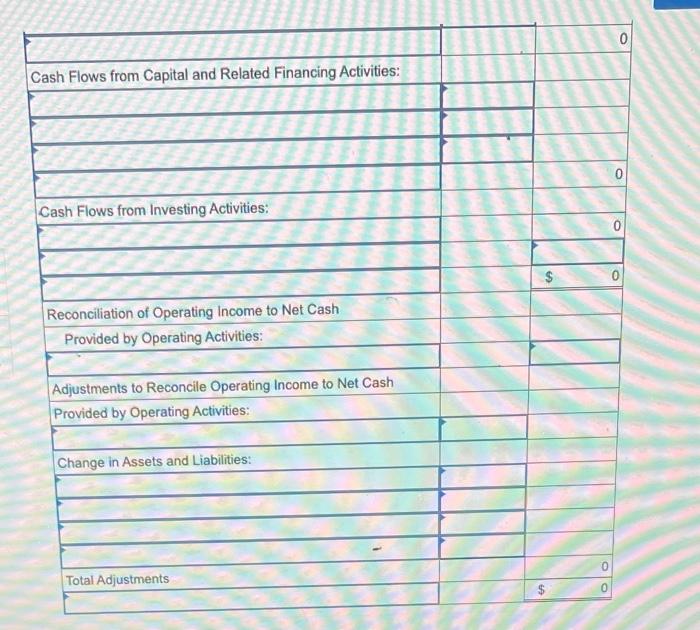

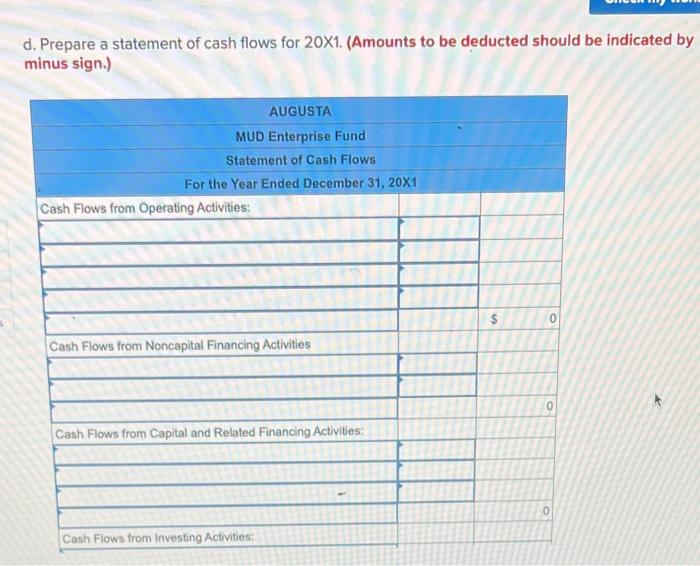

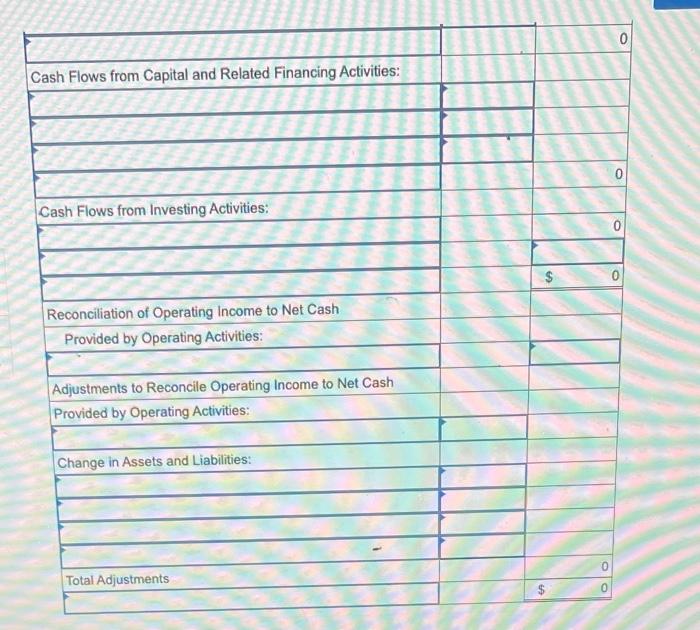

Part D.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started