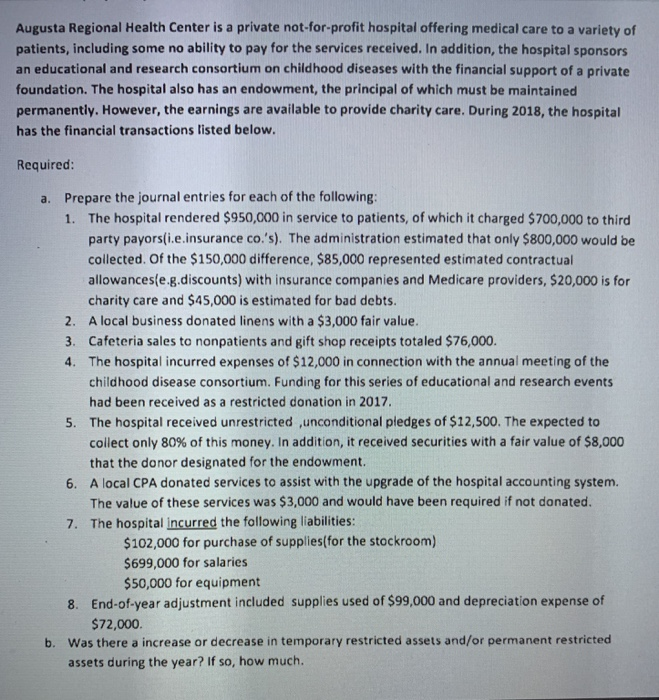

Augusta Regional Health Center is a private not-for-profit hospital offering medical care to a variety of patients, including some no ability to pay for the services received. In addition, the hospital sponsors an educational and research consortium on childhood diseases with the financial support of a private foundation. The hospital also has an endowment, the principal of which must be maintained permanently. However, the earnings are available to provide charity care. During 2018, the hospital has the financial transactions listed below. Required: a. Prepare the journal entries for each of the following: 1. The hospital rendered $950,000 in service to patients, of which it charged $700,000 to third party payors(i.e.insurance co's). The administration estimated that only $800,000 would be collected. Of the $150,000 difference, $85,000 represented estimated contractual allowances(e.g.discounts) with insurance companies and Medicare providers, $20,000 is for charity care and $45,000 is estimated for bad debts. 2. A local business donated linens with a $3,000 fair value. 3. Cafeteria sales to nonpatients and gift shop receipts totaled $76,000 4. The hospital incurred expenses of $12,000 in connection with the annual meeting of the childhood disease consortium. Funding for this series of educational and research events had been received as a restricted donation in 2017. 5. The hospital received unrestricted unconditional pledges of $12,500. The expected to collect only 80% of this money. In addition, it received securities with a fair value of $8,000 that the donor designated for the endowment. 6. A local CPA donated services to assist with the upgrade of the hospital accounting system. The value of these services was $3,000 and would have been required if not donated. 7. The hospital incurred the following liabilities: $102,000 for purchase of supplies(for the stockroom) $699,000 for salaries $50,000 for equipment 8. End-of-year adjustment included supplies used of $99,000 and depreciation expense of $72,000. b. Was there a increase or decrease in temporary restricted assets and/or permanent restricted assets during the year? If so, how much