Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auropean company issues common shares that pay taxable dividends and bearer shares that pay an dentical dividend but offer an opportunity to evade taxes: Bearer

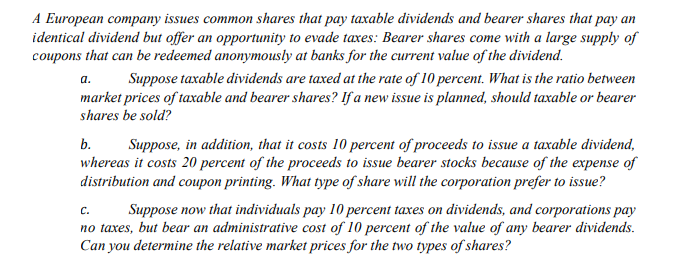

Auropean company issues common shares that pay taxable dividends and bearer shares that pay an dentical dividend but offer an opportunity to evade taxes: Bearer shares come with a large supply of oupons that can be redeemed anonymously at banks for the current value of the dividend. a. Suppose taxable dividends are taxed at the rate of 10 percent. What is the ratio between market prices of taxable and bearer shares? If a new issue is planned, should taxable or bearer shares be sold? b. Suppose, in addition, that it costs 10 percent of proceeds to issue a taxable dividend, whereas it costs 20 percent of the proceeds to issue bearer stocks because of the expense of distribution and coupon printing. What type of share will the corporation prefer to issue? c. Suppose now that individuals pay 10 percent taxes on dividends, and corporations pay no taxes, but bear an administrative cost of 10 percent of the value of any bearer dividends. Can you determine the relative market prices for the two types of shares

Auropean company issues common shares that pay taxable dividends and bearer shares that pay an dentical dividend but offer an opportunity to evade taxes: Bearer shares come with a large supply of oupons that can be redeemed anonymously at banks for the current value of the dividend. a. Suppose taxable dividends are taxed at the rate of 10 percent. What is the ratio between market prices of taxable and bearer shares? If a new issue is planned, should taxable or bearer shares be sold? b. Suppose, in addition, that it costs 10 percent of proceeds to issue a taxable dividend, whereas it costs 20 percent of the proceeds to issue bearer stocks because of the expense of distribution and coupon printing. What type of share will the corporation prefer to issue? c. Suppose now that individuals pay 10 percent taxes on dividends, and corporations pay no taxes, but bear an administrative cost of 10 percent of the value of any bearer dividends. Can you determine the relative market prices for the two types of shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started