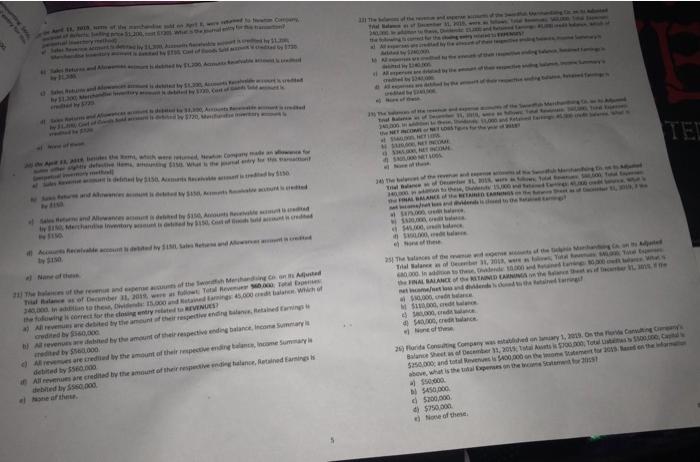

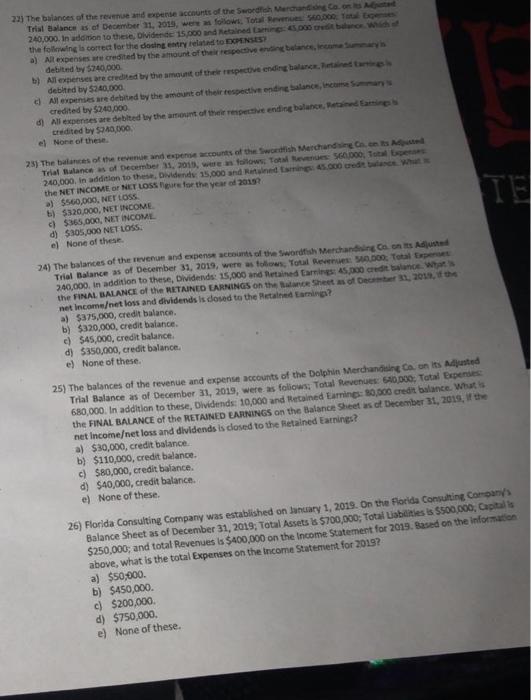

Aurt 11, 2018, sem of the manches ating $1,200, whi L3 A try moment Cal of Sl Sakurss Stand Alois de by 31.300 Merchandy 100, Cost of Ac SAM As them, wh were returned Nation Company ght defective Hems, amounting $150 What the mal entry is defined by $150 A i treded by $130 Stand Allowances account is deed by $150, Accounts Reveable suis credited by Merchandise Inventory amunt is otted by $150, Cost of N 1150 buldi crede by $150. None of the 21 The le of the revenue and expense aunts of the Sword Merchanding Con Afted Til Balance of December 31, 2018, were as followt Total Revenue $60.000 Total 340,000 in addition to thes, Ovids 15.000 and Retained Earnings: 45,000 credit balance Which of the following is correct for the closing entry related to REVENUES? a) All revenues are debited by the amount of their respective ending Balance, Retained Earnings credited by $560,000 All revenues are debited by the amount of their respective ending balance, income Summary is redited by $560.000 Al revenues are creded by the amount of their respective ending balance, Income Summary debited by $560.000 All revenues are credited by the amount of their respective ending balance, Retained Earnings is debited by $560,000 e None of these HIP SE w mitte aganjesta te SA spring and beer w for 211 The be The Bl SAYING al Ai 29 deed y Mempers 2 The Tral Ba 340000 4 revenue and emp EN STOR P SANET INCOR SET INCOR SLO MET 34) the bal Trial Balance of Decr IN champi 1994 (karte Re TOMMY Have faites Marchaning yw onary TED FAL BALANCE B to the M15,000 RETAINED EARNINGS es and vidends is closed t hala $475,000 $30,000 b $4,000, balance 5000, balance None of the Tex 25 The balances of the mnie wnd expense acts of the Dei Mang (on to jed Trial Balance December 31, 2018, were a Total Revenues 480.000 in add to these, dende 10.000 and Retained taning 80,000 ALANCE the RETAINED EARNINGS net/et los $10,000, barce M$110,000, credit balance 000, cred c W the Balans that of camber , 2015 4) $40,000, credit balance None of these 26) Florida Consulting Company was established on January 1, 2019, On the Per Caming Com Balance Sheet as of December 31, 2015; Total Assets is $700,000, Total times $500,000 Cap $250,000 and total Revenues is $400,000 on the ome Statement for 2015. Read on the informe above, what is the total Expenses on the come Statement for 2015 $50,000 $450,000 $200,000 4 $750,000 e) None of these. 22) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on its Apated Trial Balance as of December 31, 2019, were as follows, Total Revenues 560,000 Total Expenses 240,000. In addition to these, Dividende: 15,000 and Retained Earnings: 45,000 credit balance. Which of the following is correct for the dosing entry related to EXPENSES a) All expenses are credited by the amount of their respective ending balance, income Summary is debited by $240,000 b) All expenses are credited by the amount of their respective ending balance, Retained Earrings debited by $240,000 All expenses are debited by the amount of their respective ending balance, income Summary credited by $240,000 d) All expenses are debited by the amount of their respective ending balance, Retained Earnings s credited by $240,000 el None of these. 23) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on Its Adjusted Trial Balance as of December 31, 2010, were as follows; Total Revenues: 560,000, Total Expenses 240,000. In addition to these, Dividends: 15,000 and Retained tamings: 45.000 credit balance What is the NET INCOME or NET LOSS figure for the year of 2015? a) $560,000, NET LOSS. b) c) $320,000, NET INCOME $365,000, NET INCOME d) $305,000 NET LOSS. e) None of these. 24) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on its Adjusted Trial Balance as of December 31, 2019, were as follows, Total Revenues: 560,000 Total Expenses 240,000. In addition to these, Dividends: 15,000 and Retained Earnings: 45,000 credit balance. What is the FINAL BALANCE of the RETAINED EARNINGS on the Balance Sheet as of December 31, 2019, if the net incomeet loss and dividends is closed to the Retained Eamings? a) $375,000, credit balance. b) $320,000, credit balance. c) $45,000, credit balance. d) $350,000, credit balance. e) None of these. 25) The balances of the revenue and expense accounts of the Dolphin Merchandising Co, on its Adjusted Trial Balance as of December 31, 2019, were as follows: Total Revenues: 640,000; Total Expenses 680,000. In addition to these, Dividends: 10,000 and Retained Earnings: 80,000 credit balance. What is the FINAL BALANCE of the RETAINED EARNINGS on the Balance Sheet as of December 31, 2019, if the net Incomeet loss and dividends is closed to the Retained Earnings? a) $30,000, credit balance. b) $110,000, credit balance. c) $80,000, credit balance. d) $40,000, credit balance.. e) None of these. 26) Florida Consulting Company was established on January 1, 2019. On the Florida Consulting Company's Balance Sheet as of December 31, 2019; Total Assets is $700,000; Total Liabilities is $500,000, Capital is $250,000; and total Revenues is $400,000 on the Income Statement for 2019. Based on the information above, what is the total Expenses on the Income Statement for 2019? a) $50,000. b) $450,000. c) $200,000. d) $750,000. e) None of these. Aurt 11, 2018, sem of the manches ating $1,200, whi L3 A try moment Cal of Sl Sakurss Stand Alois de by 31.300 Merchandy 100, Cost of Ac SAM As them, wh were returned Nation Company ght defective Hems, amounting $150 What the mal entry is defined by $150 A i treded by $130 Stand Allowances account is deed by $150, Accounts Reveable suis credited by Merchandise Inventory amunt is otted by $150, Cost of N 1150 buldi crede by $150. None of the 21 The le of the revenue and expense aunts of the Sword Merchanding Con Afted Til Balance of December 31, 2018, were as followt Total Revenue $60.000 Total 340,000 in addition to thes, Ovids 15.000 and Retained Earnings: 45,000 credit balance Which of the following is correct for the closing entry related to REVENUES? a) All revenues are debited by the amount of their respective ending Balance, Retained Earnings credited by $560,000 All revenues are debited by the amount of their respective ending balance, income Summary is redited by $560.000 Al revenues are creded by the amount of their respective ending balance, Income Summary debited by $560.000 All revenues are credited by the amount of their respective ending balance, Retained Earnings is debited by $560,000 e None of these HIP SE w mitte aganjesta te SA spring and beer w for 211 The be The Bl SAYING al Ai 29 deed y Mempers 2 The Tral Ba 340000 4 revenue and emp EN STOR P SANET INCOR SET INCOR SLO MET 34) the bal Trial Balance of Decr IN champi 1994 (karte Re TOMMY Have faites Marchaning yw onary TED FAL BALANCE B to the M15,000 RETAINED EARNINGS es and vidends is closed t hala $475,000 $30,000 b $4,000, balance 5000, balance None of the Tex 25 The balances of the mnie wnd expense acts of the Dei Mang (on to jed Trial Balance December 31, 2018, were a Total Revenues 480.000 in add to these, dende 10.000 and Retained taning 80,000 ALANCE the RETAINED EARNINGS net/et los $10,000, barce M$110,000, credit balance 000, cred c W the Balans that of camber , 2015 4) $40,000, credit balance None of these 26) Florida Consulting Company was established on January 1, 2019, On the Per Caming Com Balance Sheet as of December 31, 2015; Total Assets is $700,000, Total times $500,000 Cap $250,000 and total Revenues is $400,000 on the ome Statement for 2015. Read on the informe above, what is the total Expenses on the come Statement for 2015 $50,000 $450,000 $200,000 4 $750,000 e) None of these. 22) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on its Apated Trial Balance as of December 31, 2019, were as follows, Total Revenues 560,000 Total Expenses 240,000. In addition to these, Dividende: 15,000 and Retained Earnings: 45,000 credit balance. Which of the following is correct for the dosing entry related to EXPENSES a) All expenses are credited by the amount of their respective ending balance, income Summary is debited by $240,000 b) All expenses are credited by the amount of their respective ending balance, Retained Earrings debited by $240,000 All expenses are debited by the amount of their respective ending balance, income Summary credited by $240,000 d) All expenses are debited by the amount of their respective ending balance, Retained Earnings s credited by $240,000 el None of these. 23) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on Its Adjusted Trial Balance as of December 31, 2010, were as follows; Total Revenues: 560,000, Total Expenses 240,000. In addition to these, Dividends: 15,000 and Retained tamings: 45.000 credit balance What is the NET INCOME or NET LOSS figure for the year of 2015? a) $560,000, NET LOSS. b) c) $320,000, NET INCOME $365,000, NET INCOME d) $305,000 NET LOSS. e) None of these. 24) The balances of the revenue and expense accounts of the Swordfish Merchandising Co. on its Adjusted Trial Balance as of December 31, 2019, were as follows, Total Revenues: 560,000 Total Expenses 240,000. In addition to these, Dividends: 15,000 and Retained Earnings: 45,000 credit balance. What is the FINAL BALANCE of the RETAINED EARNINGS on the Balance Sheet as of December 31, 2019, if the net incomeet loss and dividends is closed to the Retained Eamings? a) $375,000, credit balance. b) $320,000, credit balance. c) $45,000, credit balance. d) $350,000, credit balance. e) None of these. 25) The balances of the revenue and expense accounts of the Dolphin Merchandising Co, on its Adjusted Trial Balance as of December 31, 2019, were as follows: Total Revenues: 640,000; Total Expenses 680,000. In addition to these, Dividends: 10,000 and Retained Earnings: 80,000 credit balance. What is the FINAL BALANCE of the RETAINED EARNINGS on the Balance Sheet as of December 31, 2019, if the net Incomeet loss and dividends is closed to the Retained Earnings? a) $30,000, credit balance. b) $110,000, credit balance. c) $80,000, credit balance. d) $40,000, credit balance.. e) None of these. 26) Florida Consulting Company was established on January 1, 2019. On the Florida Consulting Company's Balance Sheet as of December 31, 2019; Total Assets is $700,000; Total Liabilities is $500,000, Capital is $250,000; and total Revenues is $400,000 on the Income Statement for 2019. Based on the information above, what is the total Expenses on the Income Statement for 2019? a) $50,000. b) $450,000. c) $200,000. d) $750,000. e) None of these