AUS MNC in energy is using this capital budgeting model for a 4-year foreign project in Portugal. NPV = $10 mil + 2 mil

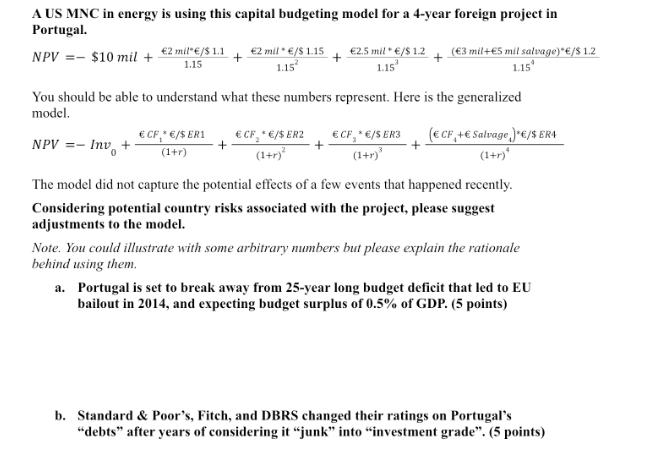

AUS MNC in energy is using this capital budgeting model for a 4-year foreign project in Portugal. NPV = $10 mil + 2 mil /$ 1.1 1.15 2 mil /$ 1.15 1.15 2.5 mil* /$ 1.2 + (3 mil+5 mil salvage)* /$ 1.2 1.15 1.15 You should be able to understand what these numbers represent. Here is the generalized model. NPV =- Inv+ CF,* /$ER1 CF*/$ ER2 CF, * /S ER3 (1+r) (1+r) + (1+r) ( CF, + Salvage) */$ ER4 (1+r)* The model did not capture the potential effects of a few events that happened recently. Considering potential country risks associated with the project, please suggest adjustments to the model. Note. You could illustrate with some arbitrary numbers but please explain the rationale behind using them. a. Portugal is set to break away from 25-year long budget deficit that led to EU bailout in 2014, and expecting budget surplus of 0.5% of GDP. (5 points) b. Standard & Poor's, Fitch, and DBRS changed their ratings on Portugal's "debts" after years of considering it "junk" into "investment grade". (5 points)

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets consider the potential adjustments to the capital budgeting model based on the recent even...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started