Answered step by step

Verified Expert Solution

Question

1 Approved Answer

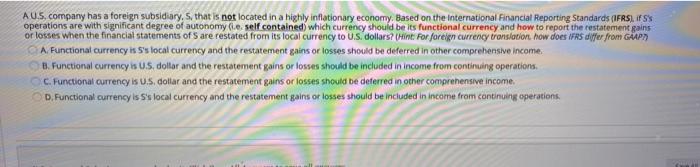

AU.S.company has a foreign subsidiary, S. that is not located in a highly inflationary economy. Based on the International Financial Reporting Standards (IFRS), ISS operations

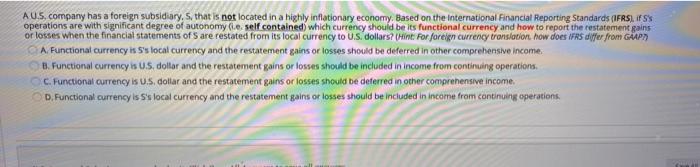

AU.S.company has a foreign subsidiary, S. that is not located in a highly inflationary economy. Based on the International Financial Reporting Standards (IFRS), ISS operations are with significant degree of autonomy (ie self contained which currency should be its functional currency and how to report the restatement gains or losses when the financial statements of S are restated from its local currency to U.S. dollars? (Hint For foreign currency translation how does it differ from GAAPS A Functional currency is S's local currency and the restatement gains or losses should be deferred in other comprehensive income B. Functional currency is U.S. dollar and the restatement gains or losses should be included in income from continuing operations, C. Functional currency is U.S. dollar and the restatement gains or losses should be deferred in other comprehensive income D. Functional currency is S's local currency and the restatement gains or losses should be included in income from continuing operations

AU.S.company has a foreign subsidiary, S. that is not located in a highly inflationary economy. Based on the International Financial Reporting Standards (IFRS), ISS operations are with significant degree of autonomy (ie self contained which currency should be its functional currency and how to report the restatement gains or losses when the financial statements of S are restated from its local currency to U.S. dollars? (Hint For foreign currency translation how does it differ from GAAPS A Functional currency is S's local currency and the restatement gains or losses should be deferred in other comprehensive income B. Functional currency is U.S. dollar and the restatement gains or losses should be included in income from continuing operations, C. Functional currency is U.S. dollar and the restatement gains or losses should be deferred in other comprehensive income D. Functional currency is S's local currency and the restatement gains or losses should be included in income from continuing operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started