Answered step by step

Verified Expert Solution

Question

1 Approved Answer

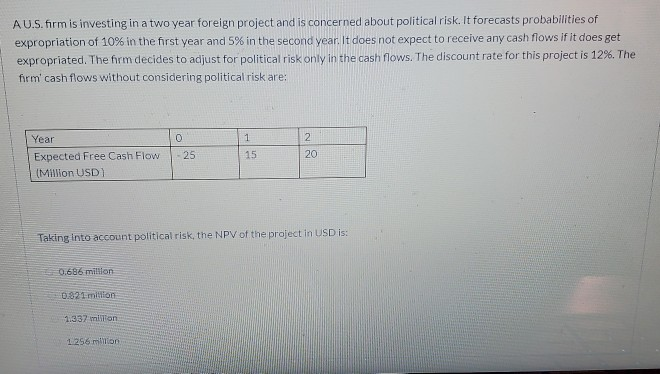

AU.S.firm is investing in a two year foreign project and is concerned about political risk. It forecasts probabilities of expropriation of 10% in the first

AU.S.firm is investing in a two year foreign project and is concerned about political risk. It forecasts probabilities of expropriation of 10% in the first year and 5% in the second year. It does not expect to receive any cash flows if it does get expropriated. The firm decides to adjust for political risk only in the cash flows. The discount rate for this project is 12%. The firm cash flows without considering political risk are: Year -25 Expected Free Cash Flow (Million USD) Taking into account political risk, the NPV of the project in USD is: 0.686 million 0.821 millon 1.337 milyon 1256 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started