Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aussi World Ltd sells outdoor furniture settings. The company is not registered for GST. The accounting records at 30 June 2019 reveal the following

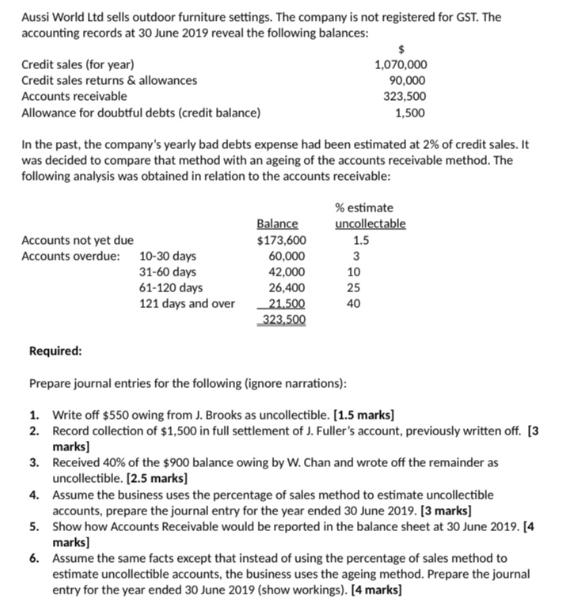

Aussi World Ltd sells outdoor furniture settings. The company is not registered for GST. The accounting records at 30 June 2019 reveal the following balances: Credit sales (for year) Credit sales returns & allowances Accounts receivable Allowance for doubtful debts (credit balance) In the past, the company's yearly bad debts expense had been estimated at 2% of credit sales. It was decided to compare that method with an ageing of the accounts receivable method. The following analysis was obtained in relation to the accounts receivable: Accounts not yet due Accounts overdue: 10-30 days 31-60 days 61-120 days 121 days and over Balance $173,600 60,000 42,000 26,400 21.500 323.500 % estimate uncollectable 1.5 3 1,070,000 90,000 323,500 1,500 10 25 40 Required: Prepare journal entries for the following (ignore narrations): 1. Write off $550 owing from J. Brooks as uncollectible. [1.5 marks] 2. Record collection of $1,500 in full settlement of J. Fuller's account, previously written off. [3 marks] 3. Received 40% of the $900 balance owing by W. Chan and wrote off the remainder as uncollectible. [2.5 marks] 4. Assume the business uses the percentage of sales method to estimate uncollectible accounts, prepare the journal entry for the year ended 30 June 2019. [3 marks] 5. Show how Accounts Receivable would be reported in the balance sheet at 30 June 2019. [4 marks] 6. Assume the same facts except that instead of using the percentage of sales method to estimate uncollectible accounts, the business uses the ageing method. Prepare the journal entry for the year ended 30 June 2019 (show workings). [4 marks]

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Write off 550 owing from J Brooks as uncollectible Accounts Receivable Dr 550 Allowance for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started