Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aust Ltd is a manufacturer of unique sports cars. On 1 July 2022. Austin Ltd signed a long-term agreement with GoodYear Ltd to supply

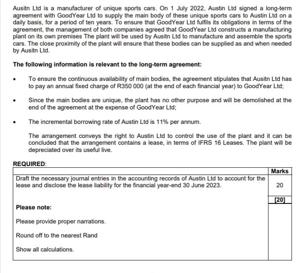

Aust Ltd is a manufacturer of unique sports cars. On 1 July 2022. Austin Ltd signed a long-term agreement with GoodYear Ltd to supply the main body of these unique sports cars to Austin Ltd on a daily basis, for a period of ten years. To ensure that GoodYear Ltd futis its obligations in terms of the agreement, the management of both companies agreed that GoodYear Ltd constructs a manufacturing plant on its own premises The plant will be used by Ausin Ltd to manufacture and assemble the sports cars. The close proximity of the plant will ensure that these bodies can be supplied as and when needed by Aus Lid The following information is relevant to the long-term agreement To ensure the continuous availability of main bodies, the agreement stipulates that Ausn Ltd has to pay an annual fixed charge of R350 000 (at the end of each financial year) to GoodYear Ltd Since the main bodies are unique, the plant has no other purpose and will be demolished at the end of the agreement at the expense of GoodYear Lid The incremental borrowing rate of Austin Ltd is 11% per annum The amangement conveys the right to Austin Ltd to control the use of the plant and it can be concluded that the arrangement contains a lease, in terms of IFRS 16 Leases. The plant will be depreciated over tulive REQUIRED Draft the necessary journal entries in the accounting records of Austin Ltd to account for the lease and disclose the lease liability for the financial year-end 30 June 2023. Please note: Please provide proper narrations Round off to the nearest Rand Show all calculations Marks 20 1201

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answers and Explanation Journal Entries On 1 July 2022 when the agreement was signed Debit Prepaid R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started