Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the

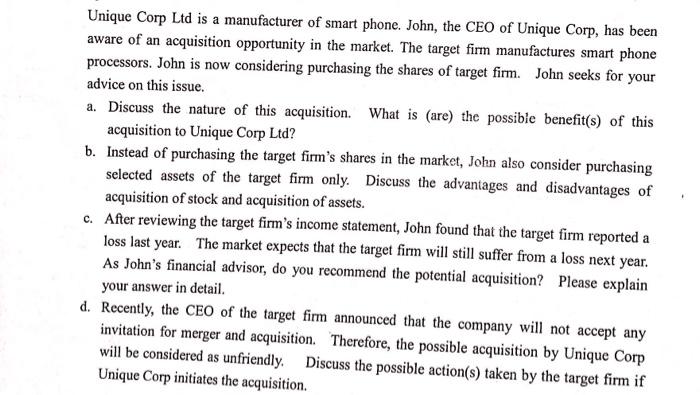

Unique Corp Ltd is a manufacturer of smart phone. John, the CEO of Unique Corp, has been aware of an acquisition opportunity in the market. The target firm manufactures smart phone processors. John is now considering purchasing the shares of target firm. John seeks for your advice on this issue. a. Discuss the nature of this acquisition. What is (are) the possible benefit(s) of this acquisition to Unique Corp Ltd? b. Instead of purchasing the target firm's shares in the market, John also consider purchasing selected assets of the target firm only. Discuss the advantages and disadvantages of acquisition of stock and acquisition of assets. c. After reviewing the target firm's income statement, John found that the target firm reported a loss last year. The market expects that the target firm will still suffer from a loss next year. As John's financial advisor, do you recommend the potential acquisition? Please explain your answer in detail. d. Recently, the CEO of the target firm announced that the company will not accept any invitation for merger and acquisition. Therefore, the possible acquisition by Unique Corp will be considered as unfriendly. Discuss the possible action(s) taken by the target firm if Unique Corp initiates the acquisition.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ans a When an entity acquires another entity where the target company is a part of the supply chain of the product of the acquiring company such an ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started