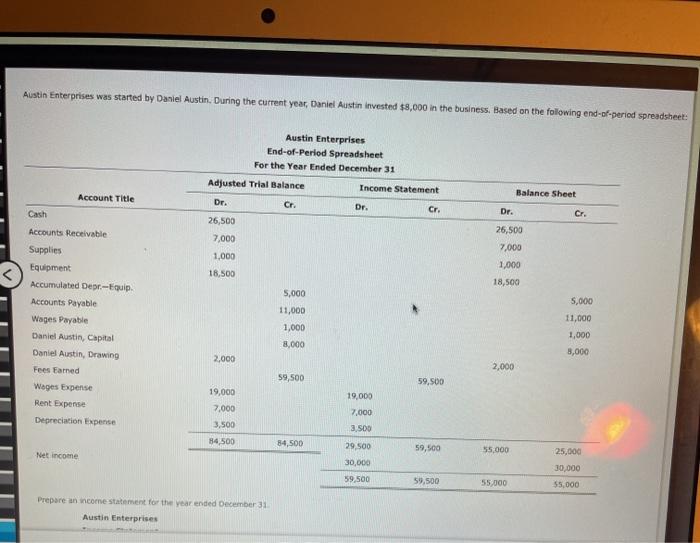

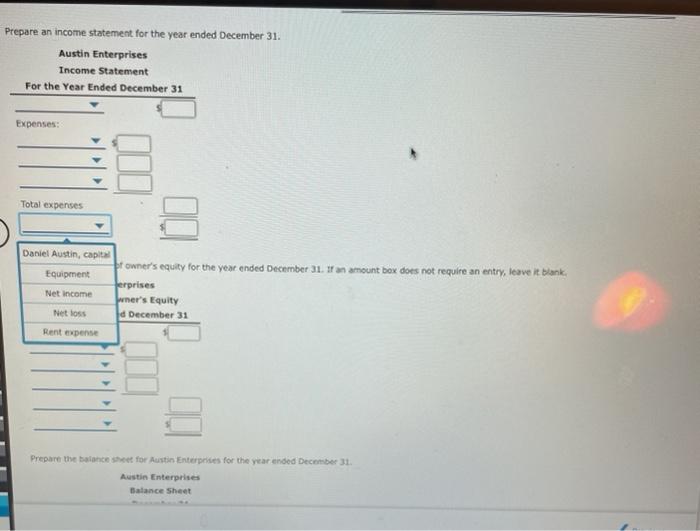

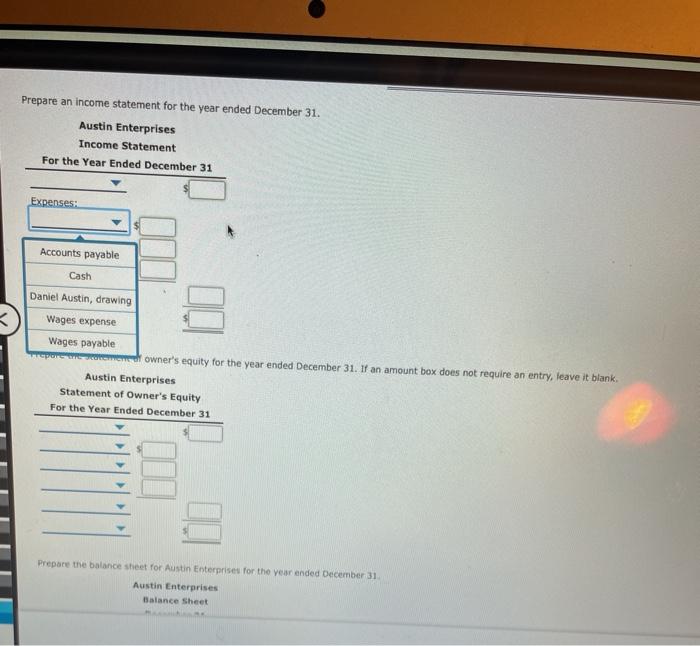

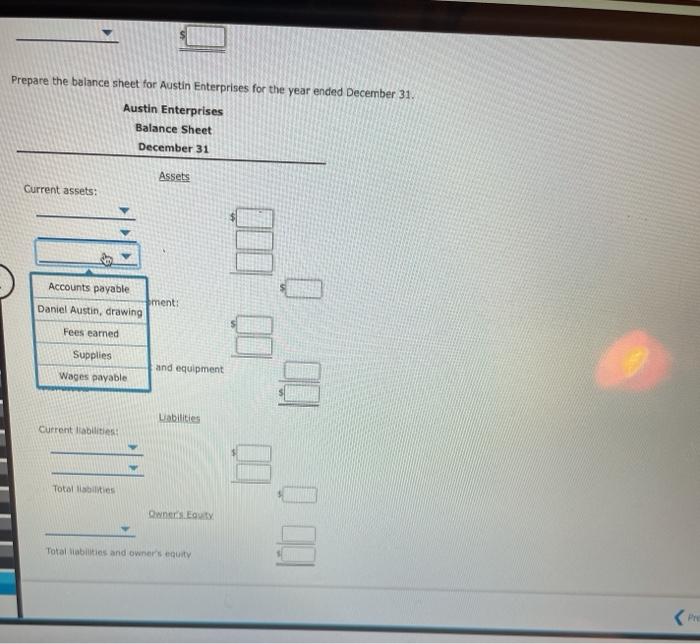

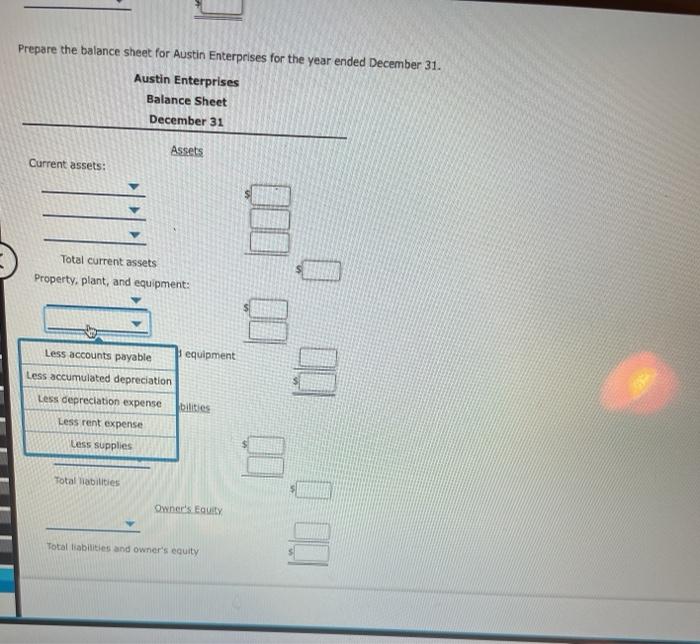

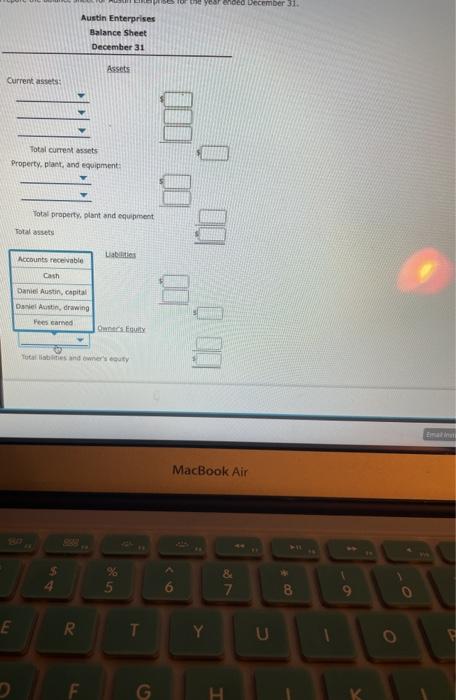

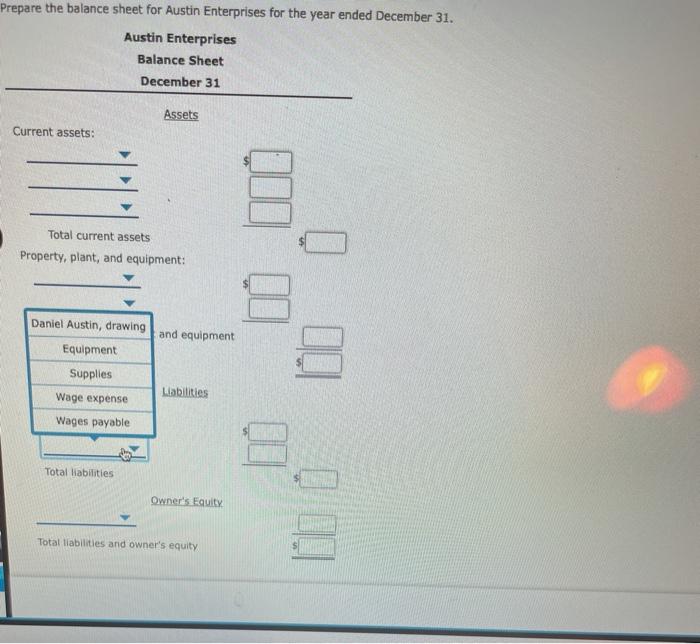

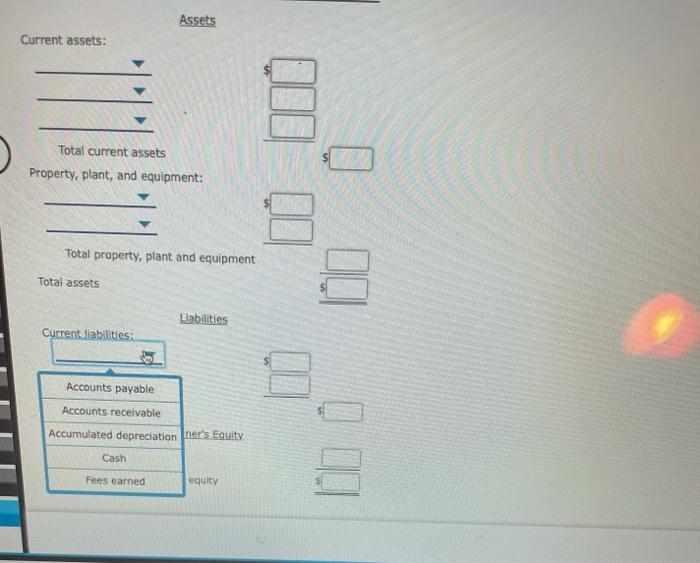

Austin Enterprises was started by Daniel Austin. During the current year, Daniel Austin invested $8,000 in the business. Based on the following end-of-period spreadsheet: Austin Enterprises End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Income Statement Dr. Cr. Dr. Cr. 26,500 7,000 Account Title Balance Sheet Dr. Cr. 1,000 26,500 7.000 1,000 18,500 18,500 Cash Accounts Receivable Supplies Equipment Accumulated Depr.-Equip Accounts Payable Wages Payable Daniel Austin, Capital Daniel Austin, Drawing Fees Earned Wages Expense Rent Expense Depreciation Expense 5,000 11,000 1,000 5,000 11,000 1,000 8,000 8,000 2,000 2,000 59,500 59,500 19,000 7,000 19,000 7.000 3.500 3,500 84,500 84,500 29.500 59,500 55.000 Net income 30,000 59,500 25,000 30,000 $5,000 59.500 55,000 Prepare an income statement for the year ended December 31 Austin Enterprises Prepare an income statement for the year ended December 31. Austin Enterprises Income Statement For the Year Ended December 31 Expenses: Total expenses 00 Daniel Austin, capit r owner's equity for the year ended December 31.1 an amount box does not require an entry, leave it blank. Equipment erprises Net Income wner's Equity Net loss d December 31 Rent expense Prepare the balance sheet for Austin Enterprises for the year ended December 31 Austin Enterprises Balance Sheet Prepare an income statement for the year ended December 31. Austin Enterprises Income Statement For the Year Ended December 31 Expenses: Accounts payable Cash Daniel Austin, drawing Wages expense Wages payable owner's equity for the year ended December 31. If an amount box does not require an entry, leave it blank. Austin Enterprises Statement of Owner's Equity For the Year Ended December 31 Prepare the balance sheet for Austin Enterprises for the year ended December 31 Austin Enterprises Balance Sheet Prepare the balance sheet for Austin Enterprises for the year ended December 31. Austin Enterprises Balance Sheet December 31 Assets Current assets: O Accounts payable ment: Daniel Austin, drawing Fees earned Supplies and equipment Wages payable Liabilities Current abilities Total abilities Owners Equity Total abilities and owners equity Prepare the balance sheet for Austin Enterprises for the year ended December 31. Austin Enterprises Balance Sheet December 31 Assets Current assets: Total current assets Property, plant, and equipment: 0 0 O Less accounts payable equipment Less accumulated depreciation Less depreciation expense bilities Less rent expense Less supplies Total abilities Owner's Equity Total liabilities and owner's equity unded December 31 Austin Enterprises Balance Sheet December 31 Assets Ourrent asset Total current assets Property, plant, and equipment: O 00 Total property, plant and equipment Total assets Accounts receivable Lates Cash 10 Daniel Austin, capital Dane Austin, drawing rees earned Equity Tobies and we's outy MacBook Air 4 5 6 & 7 8 9 R Y U G Prepare the balance sheet for Austin Enterprises for the year ended December 31. Austin Enterprises Balance Sheet December 31 Assets Current assets: Total current assets Property, plant, and equipment: and equipment Daniel Austin, drawing Equipment Supplies Wage expense Wages payable Liabilities I Total liabilities Owner's Equity Total liabilities and owner's equity Assets Current assets: Total current assets Property, plant, and equipment: Total property, plant and equipment Total assets Labilities Current liabilities: Accounts payable Accounts receivable Accumulated depreciation ner's Equity Cash Fees earned equity