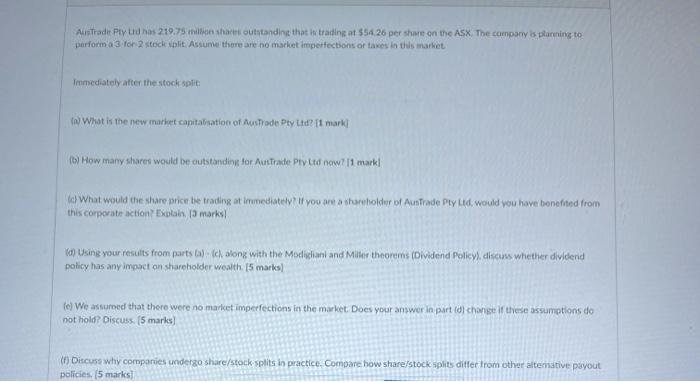

Austrade Pay das 210.75 million shoes outstanding that in trading at $54.26 per share on the ASX. The company is planning to perform a 3 for 2 stock split. Assume there are no market imperfections of taxes in this market immediately after the stock split (a) What is the new market capitalisation of Austrade Pty Ltd? [1 mark! (b) How many shares would be outstanding for A Trade Pty Ltd now? 11 mark) to What would the share price be trading at immediately if you are a stareholder of Austrade Pty Ltd, would you have benefited from this corporate action plan 3 marks! (d) Using your results from parts along with the Modician and Miller theorems (Dividend policy discs whether dividend policy has any impact on shareholder wealth 15 marks) fel We assumed that there were no market imperfections in the market. Does your answer in partid change in these assumptions de not hold? Discuss. 15 marks) (1) Discuss why companies undergo share/stock splits in practice. Compare how share/stock splits differ from other alternative payout policies, (5 marks Austrade Pay das 210.75 million shoes outstanding that in trading at $54.26 per share on the ASX. The company is planning to perform a 3 for 2 stock split. Assume there are no market imperfections of taxes in this market immediately after the stock split (a) What is the new market capitalisation of Austrade Pty Ltd? [1 mark! (b) How many shares would be outstanding for A Trade Pty Ltd now? 11 mark) to What would the share price be trading at immediately if you are a stareholder of Austrade Pty Ltd, would you have benefited from this corporate action plan 3 marks! (d) Using your results from parts along with the Modician and Miller theorems (Dividend policy discs whether dividend policy has any impact on shareholder wealth 15 marks) fel We assumed that there were no market imperfections in the market. Does your answer in partid change in these assumptions de not hold? Discuss. 15 marks) (1) Discuss why companies undergo share/stock splits in practice. Compare how share/stock splits differ from other alternative payout policies, (5 marks