Answered step by step

Verified Expert Solution

Question

1 Approved Answer

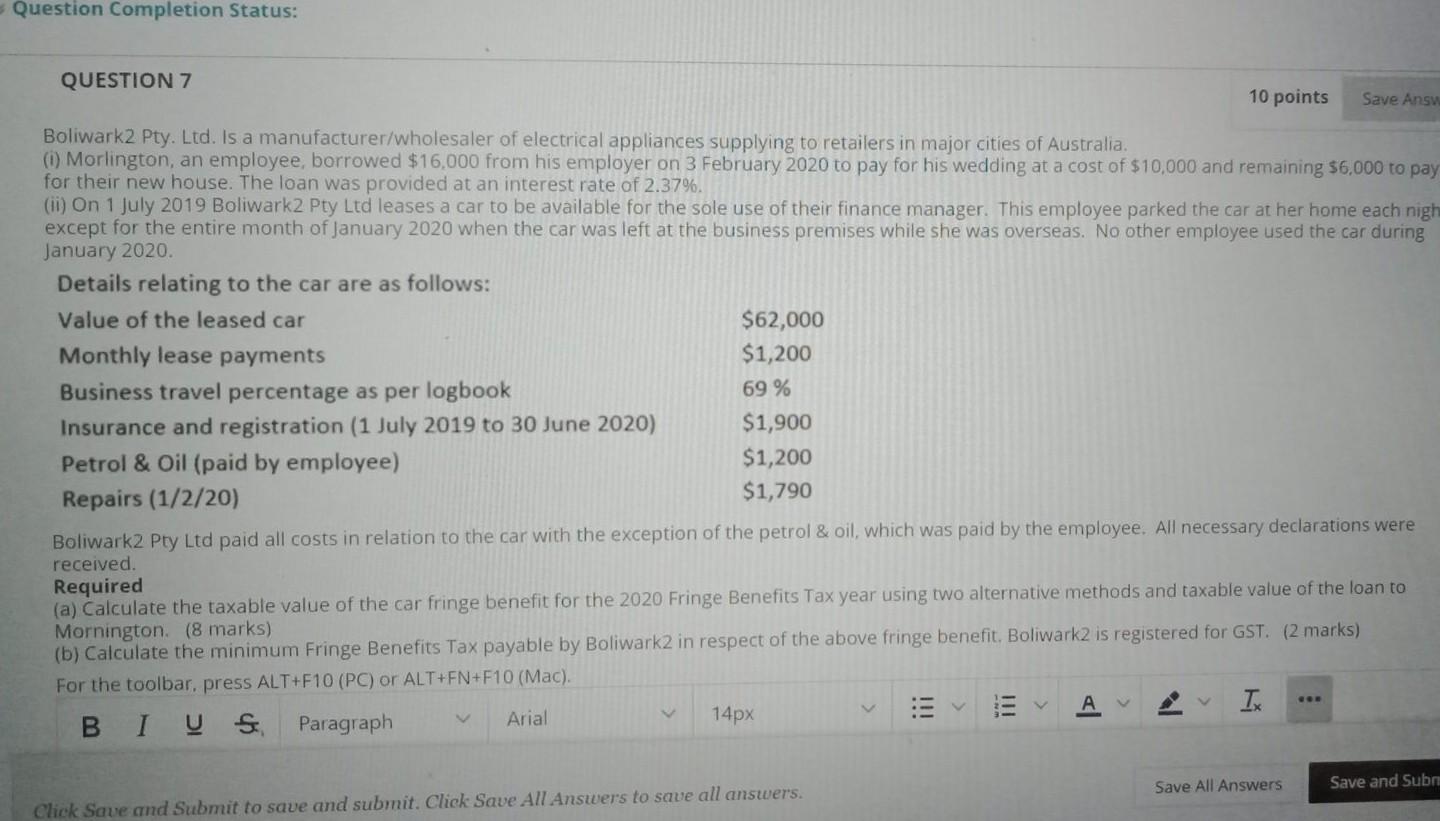

Australia tax Question Completion Status: QUESTION 7 10 points Save Answ Boliwark2 Pty. Ltd. is a manufacturer/wholesaler of electrical appliances supplying to retailers in major

Australia tax

Question Completion Status: QUESTION 7 10 points Save Answ Boliwark2 Pty. Ltd. is a manufacturer/wholesaler of electrical appliances supplying to retailers in major cities of Australia, (0) Morlington, an employee, borrowed $16,000 from his employer on 3 February 2020 to pay for his wedding at a cost of $10,000 and remaining $6,000 to pay for their new house. The loan was provided at an interest rate of 2.37%. (ii) On 1 July 2019 Boliwark2 Pty Ltd leases a car to be available for the sole use of their finance manager. This employee parked the car at her home each nigh except for the entire month of January 2020 when the car was left at the business premises while she was overseas. No other employee used the car during January 2020. Details relating to the car are as follows: Value of the leased car $62,000 Monthly lease payments $1,200 Business travel percentage as per logbook 69% Insurance and registration (1 July 2019 to 30 June 2020) $1,900 Petrol Oil (paid by employee) $1,200 Repairs (1/2/20) $1,790 Boliwark2 Pty Ltd paid all costs in relation to the car with the exception of the petrol & oil, which was paid by the employee. All necessary declarations were received Required (a) Calculate the taxable value of the car fringe benefit for the 2020 Fringe Benefits Tax year using two alternative methods and taxable value of the loan to Mornington. (8 marks) (b) Calculate the minimum Fringe Benefits Tax payable by Boliwark2 in respect of the above fringe benefit. Boliwark2 is registered for GST. (2 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). IX BI U S Paragraph Arial 14px CO Save All Answers Save and Sub Click Save and Submit to save and submit. Click Save All Answers to save all answers. Question Completion Status: QUESTION 7 10 points Save Answ Boliwark2 Pty. Ltd. is a manufacturer/wholesaler of electrical appliances supplying to retailers in major cities of Australia, (0) Morlington, an employee, borrowed $16,000 from his employer on 3 February 2020 to pay for his wedding at a cost of $10,000 and remaining $6,000 to pay for their new house. The loan was provided at an interest rate of 2.37%. (ii) On 1 July 2019 Boliwark2 Pty Ltd leases a car to be available for the sole use of their finance manager. This employee parked the car at her home each nigh except for the entire month of January 2020 when the car was left at the business premises while she was overseas. No other employee used the car during January 2020. Details relating to the car are as follows: Value of the leased car $62,000 Monthly lease payments $1,200 Business travel percentage as per logbook 69% Insurance and registration (1 July 2019 to 30 June 2020) $1,900 Petrol Oil (paid by employee) $1,200 Repairs (1/2/20) $1,790 Boliwark2 Pty Ltd paid all costs in relation to the car with the exception of the petrol & oil, which was paid by the employee. All necessary declarations were received Required (a) Calculate the taxable value of the car fringe benefit for the 2020 Fringe Benefits Tax year using two alternative methods and taxable value of the loan to Mornington. (8 marks) (b) Calculate the minimum Fringe Benefits Tax payable by Boliwark2 in respect of the above fringe benefit. Boliwark2 is registered for GST. (2 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). IX BI U S Paragraph Arial 14px CO Save All Answers Save and Sub Click Save and Submit to save and submit. Click Save All Answers to save all answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started