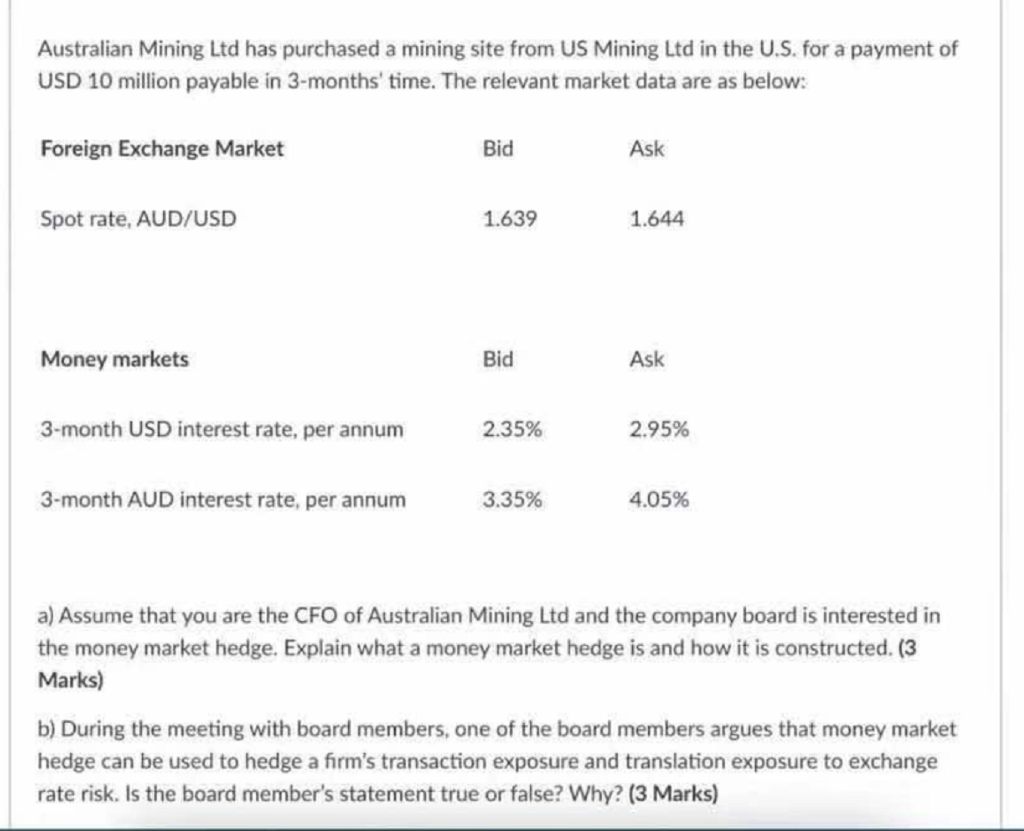

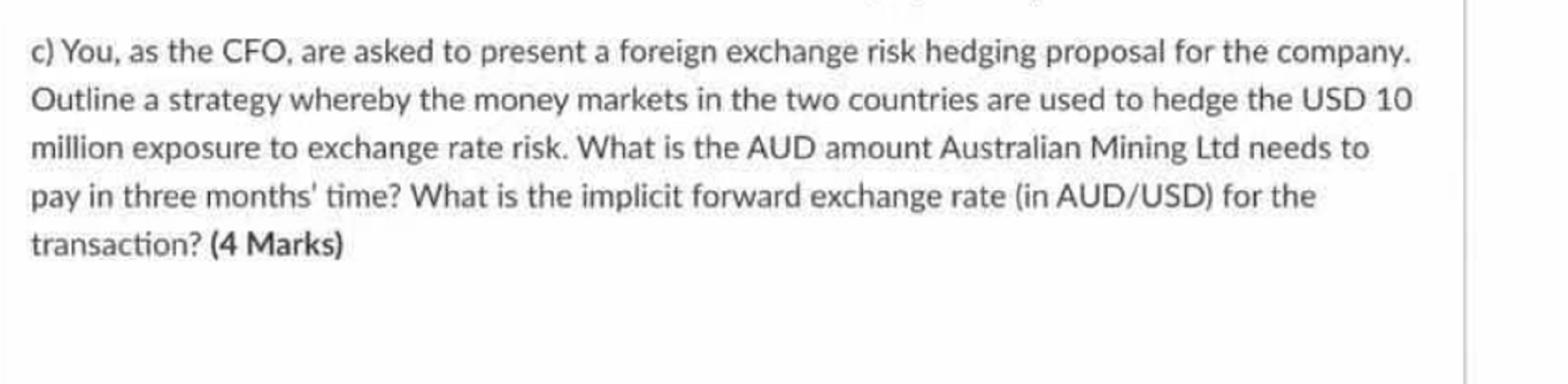

Australian Mining Ltd has purchased a mining site from US Mining Ltd in the U.S. for a payment of USD 10 million payable in 3-months' time. The relevant market data are as below: Foreign Exchange Market Bid Ask Spot rate, AUD/USD 1.639 1.644 Money markets Bid Ask 3-month USD interest rate, per annum 2.35% 2.95% 3-month AUD interest rate, per annum 3.35% 4.05% a) Assume that you are the CFO of Australian Mining Ltd and the company board is interested in the money market hedge. Explain what a money market hedge is and how it is constructed. (3 Marks) b) During the meeting with board members, one of the board members argues that money market hedge can be used to hedge a firm's transaction exposure and translation exposure to exchange rate risk. Is the board member's statement true or false? Why? (3 Marks) c) You, as the CFO, are asked to present a foreign exchange risk hedging proposal for the company. Outline a strategy whereby the money markets in the two countries are used to hedge the USD 10 million exposure to exchange rate risk. What is the AUD amount Australian Mining Ltd needs to pay in three months' time? What is the implicit forward exchange rate (in AUD/USD) for the transaction? (4 Marks) Australian Mining Ltd has purchased a mining site from US Mining Ltd in the U.S. for a payment of USD 10 million payable in 3-months' time. The relevant market data are as below: Foreign Exchange Market Bid Ask Spot rate, AUD/USD 1.639 1.644 Money markets Bid Ask 3-month USD interest rate, per annum 2.35% 2.95% 3-month AUD interest rate, per annum 3.35% 4.05% a) Assume that you are the CFO of Australian Mining Ltd and the company board is interested in the money market hedge. Explain what a money market hedge is and how it is constructed. (3 Marks) b) During the meeting with board members, one of the board members argues that money market hedge can be used to hedge a firm's transaction exposure and translation exposure to exchange rate risk. Is the board member's statement true or false? Why? (3 Marks) c) You, as the CFO, are asked to present a foreign exchange risk hedging proposal for the company. Outline a strategy whereby the money markets in the two countries are used to hedge the USD 10 million exposure to exchange rate risk. What is the AUD amount Australian Mining Ltd needs to pay in three months' time? What is the implicit forward exchange rate (in AUD/USD) for the transaction? (4 Marks)