Australian Taxation law question.

Rate should be take from Australia Website

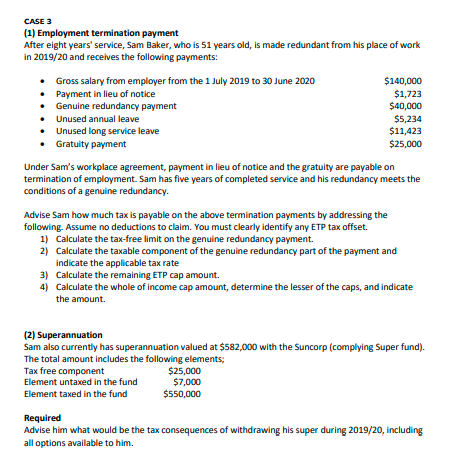

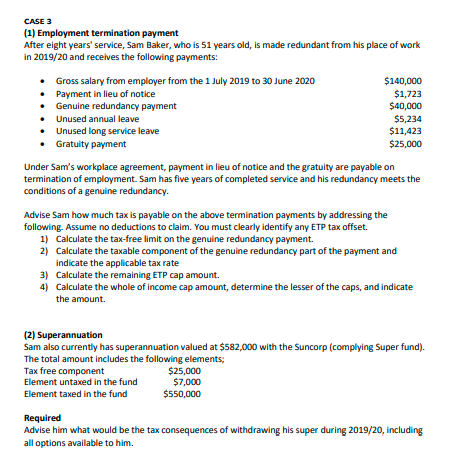

CASE 3 (1) Employment termination payment After eight years' service, Sam Baker, who is 51 years old, is made redundant from his place of work in 2019/20 and receives the following payments: Gross salary from employer from the 1 July 2019 to 30 June 2020 Payment in lieu of notice Genuine redundancy payment Unused annual leave Unused long service leave Gratuity payment $140,000 $1,723 $40,000 $5,234 $11,423 $25,000 Under Sam's workplace agreement, payment in lieu of notice and the gratuity are payable on termination of employment. Sam has five years of completed service and his redundancy meets the conditions of a genuine redundancy. Advise Sam how much tax is payable on the above termination payments by addressing the following. Assume no deductions to claim. You must clearly identify any ETP tax offset. 1) Calculate the tax-free limit on the genuine redundancy payment. 2) Calculate the taxable component of the genuine redundancy part of the payment and indicate the applicable tax rate 3) Calculate the remaining ETP cap amount. 4) Calculate the whole of income cap amount, determine the lesser of the caps, and indicate the amount. (2) Superannuation Sam also currently has superannuation valued at $582,000 with the Suncorp (complying Super fund). The total amount includes the following elements, Tax free component $25,000 Element untaxed in the fund $7,000 Element taxed in the fund $550,000 Required Advise him what would be the tax consequences of withdrawing his super during 2019/20, including all options available to him. CASE 3 (1) Employment termination payment After eight years' service, Sam Baker, who is 51 years old, is made redundant from his place of work in 2019/20 and receives the following payments: Gross salary from employer from the 1 July 2019 to 30 June 2020 Payment in lieu of notice Genuine redundancy payment Unused annual leave Unused long service leave Gratuity payment $140,000 $1,723 $40,000 $5,234 $11,423 $25,000 Under Sam's workplace agreement, payment in lieu of notice and the gratuity are payable on termination of employment. Sam has five years of completed service and his redundancy meets the conditions of a genuine redundancy. Advise Sam how much tax is payable on the above termination payments by addressing the following. Assume no deductions to claim. You must clearly identify any ETP tax offset. 1) Calculate the tax-free limit on the genuine redundancy payment. 2) Calculate the taxable component of the genuine redundancy part of the payment and indicate the applicable tax rate 3) Calculate the remaining ETP cap amount. 4) Calculate the whole of income cap amount, determine the lesser of the caps, and indicate the amount. (2) Superannuation Sam also currently has superannuation valued at $582,000 with the Suncorp (complying Super fund). The total amount includes the following elements, Tax free component $25,000 Element untaxed in the fund $7,000 Element taxed in the fund $550,000 Required Advise him what would be the tax consequences of withdrawing his super during 2019/20, including all options available to him